On-chain liquidity game: a battle between developers, snipers and traders

Original author: post-goa

Original translation: TechFlow

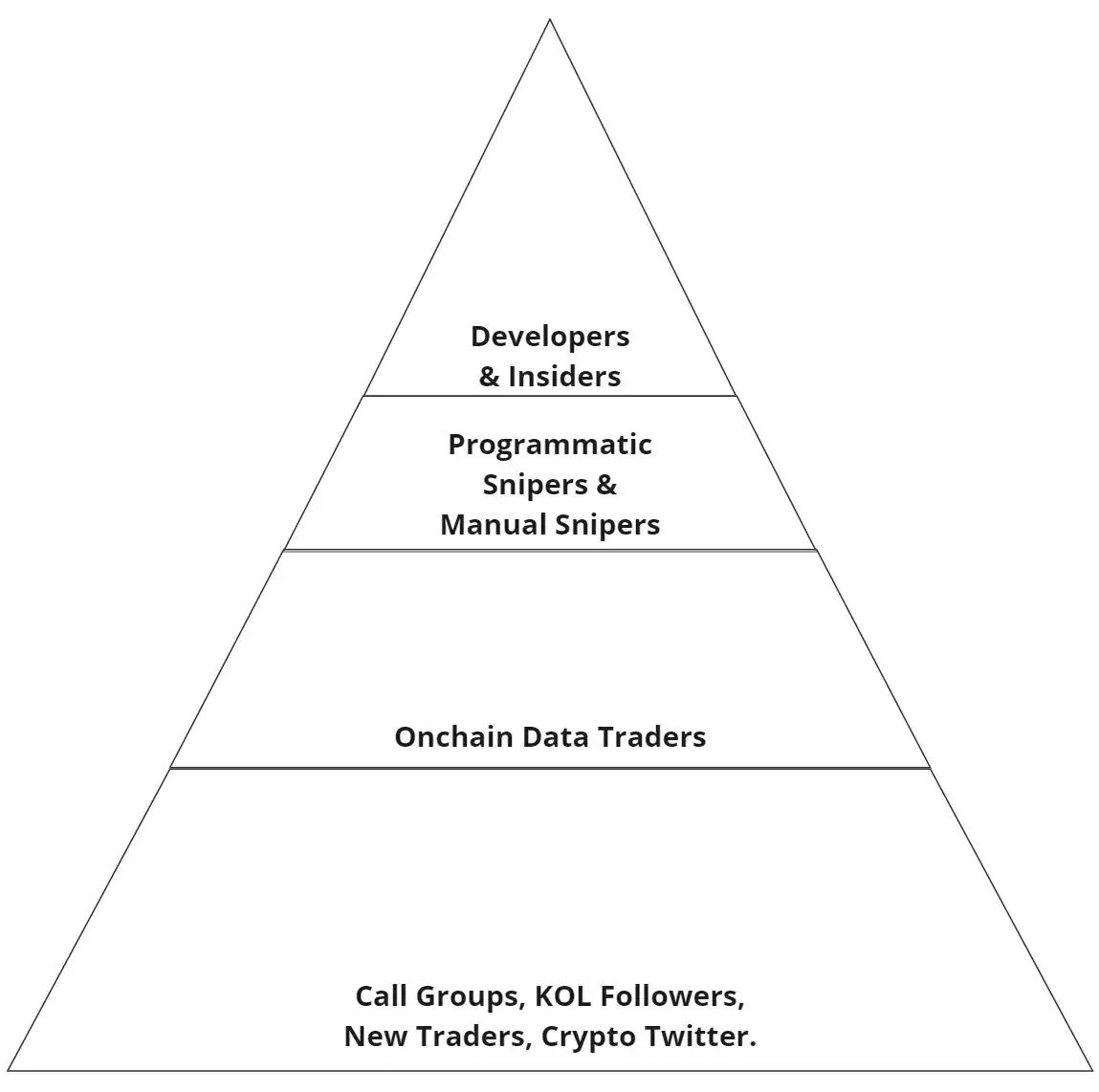

Based on my research, here is a brief summary of the roles playing the on-chain liquidity game.

Developers and Insiders

False Utility Slow Pull or "Exploited":

· These were very popular in the early AI craze because no one really understood AI at the time, but everyone wanted early exposure.

· They never complete more than 1% of the roadmap and are usually hyped by opinion leaders (KOLs).

· Teams usually allocate a large amount of supply to themselves when the contract is launched, and then distribute it before others. These tokens are then hidden in multiple wallets and then sold.

· Slow pull after initial pump or hit a hole after weeks of pump and quickly run away after accumulating a large market cap (20-100 million).

· Involves groups that repeatedly release fake projects that follow the current hot narrative. These projects are often derivatives of more successful large venture-backed projects.

Programmed Snipers

Custom Bots:

· Custom bots that systematically sniped multiple ETH projects.

· Bots follow specific parameters based on smart contracts and transaction volume.

· The goal is to achieve 10-100x gains on a few projects from many failed or runaway sniping, almost like a form of income.

Manual Sniper (ETH)

One of the most profitable on-chain traders:

· Search to discover new contract addresses, or obtain contract addresses through internal information.

· Simulate contracts to check their security and other indicators to determine potential, or to understand team background.

· Outbid other snipers when promising contracts are launched.

· Grab large amounts of supply when promising on-chain projects or stealth projects are launched without anti-sniping defenses or using pre-launch platforms such as Fjord.

· Sniping with multiple wallets to hold a large amount of supply, more than 1%.

· In many cases, projects are subject to snipers, who can smash the project to zero in the early stages.

· Many snipers enter the project and play against each other, hoping that "stupid money" will come in and sell when the market value reaches 500k-1 million, and then the project dies. This happens every day on the ETH mainnet.

· Snipers who combine some fundamental analysis and machine learning to determine which contracts may bring more than 5 million market value or more to profitability have significantly outperformed others in the past year.

· Most snipers hold tokens for less than a few hours.

On-chain data traders

Track the actions of snipers and insiders:

· Track the actions of profitable (highest PNL) wallets.

· Track volume and holder alerts.

· Usually buy strong projects after snipers sell off; or, even if they know that snipers hold a large amount of supply, they will buy if the launch is very promising.

· Usually do some fundamental analysis or narrative analysis on newly launched projects.

· Long-term holders.

· Diluted and increased in popularity as on-chain trading becomes a growing content segment in the space and more on-chain services become available for retail use.

· Is exit liquidity for the above players.

· These traders often play against each other on newly launched projects that will eventually go to zero. Just see who gets in first.

· Rely on dumb crypto twitter (CT), opinion leaders (KOLs) or other late on-chain traders as exit liquidity.

Other traders

have not learned to use Etherscan or how to check the basic data indicators of the tokens:

· Get information from call groups, opinion leaders (KOLs) and crypto twitter (CT).

· Slower traders who tend to buy the hype.

· Believe that cryptocurrencies have utility beyond speculation.

· One step behind the narrative.

· Probably only been in the space for less than a year.

· These traders have most likely given up on buying new utility projects or meme coins. Or they slowly start learning about on-chain trading and gradually upgrade to the above categories.

Summary

On-chain trading is a liquidity game for developers, snipers, on-chain data traders, and others. As liquidity entering the on-chain space decreases, competition between participants becomes more intense, and results in those at the top of the pyramid reaping most of the rewards.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群: https://t.me/theblockbeats

Telegram 交流群: https://t.me/BlockBeats_App

Twitter 官方账号: https://twitter.com/BlockBeatsAsia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Launches PLUME On-chain Earn With 4.5% APR

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR