tcVolume 186: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

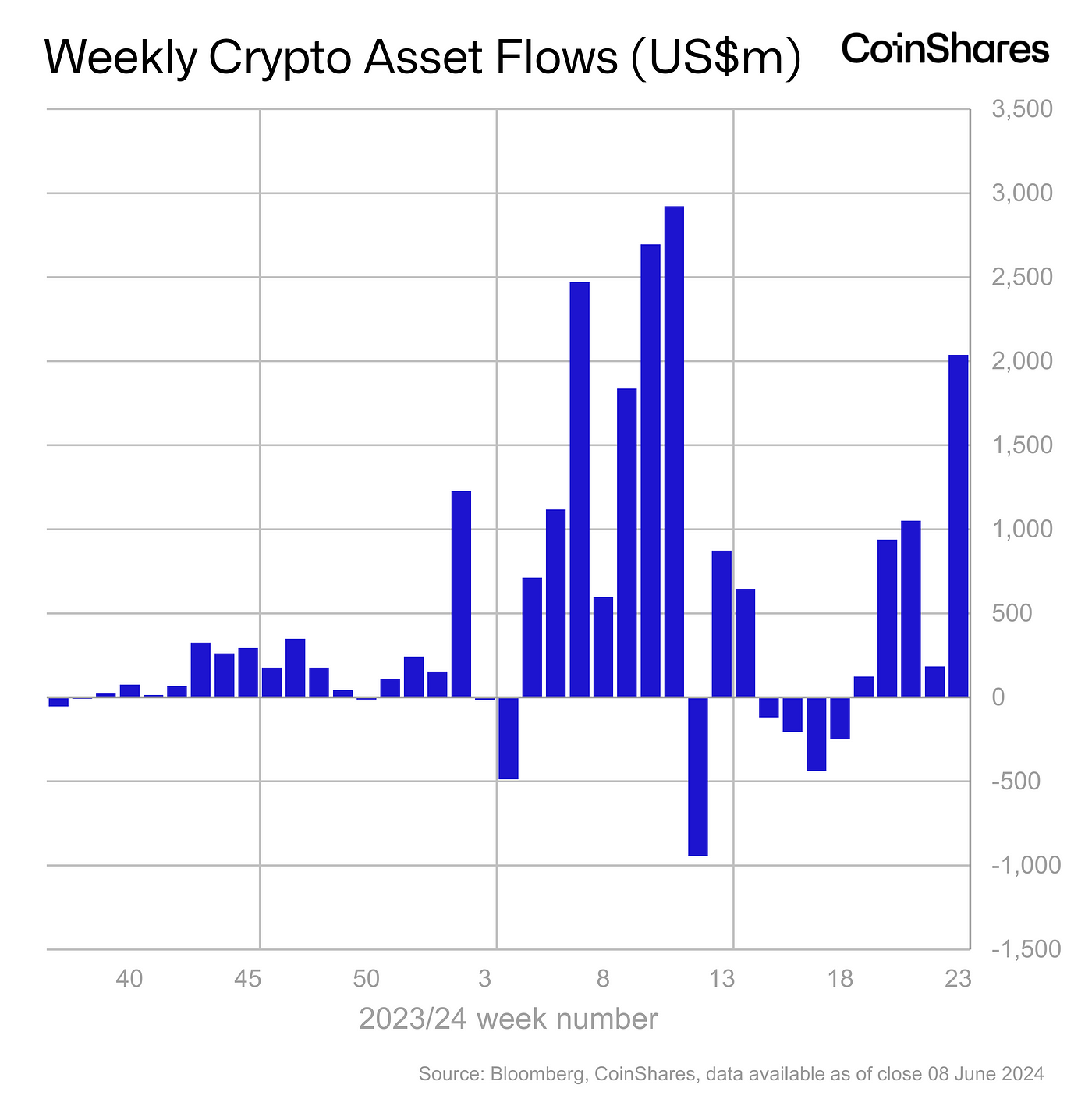

US$2bn inflows in first week of June, in anticipation of rate cuts

- Digital asset investment products saw inflows totalling US$2bn, bringing this recent 5 week run of inflows to US$4.3bn. Trading volumes in ETPs rose to US$12.8bn for the week, 55% up from the week prior.

- Bitcoin was again the primary focus, seeing US$1.97bn inflows for the week.

- Ethereum saw its best week of inflows since March, totalling US$69m, likely in reaction to the surprise SEC decision to allow spot-base ETFs.

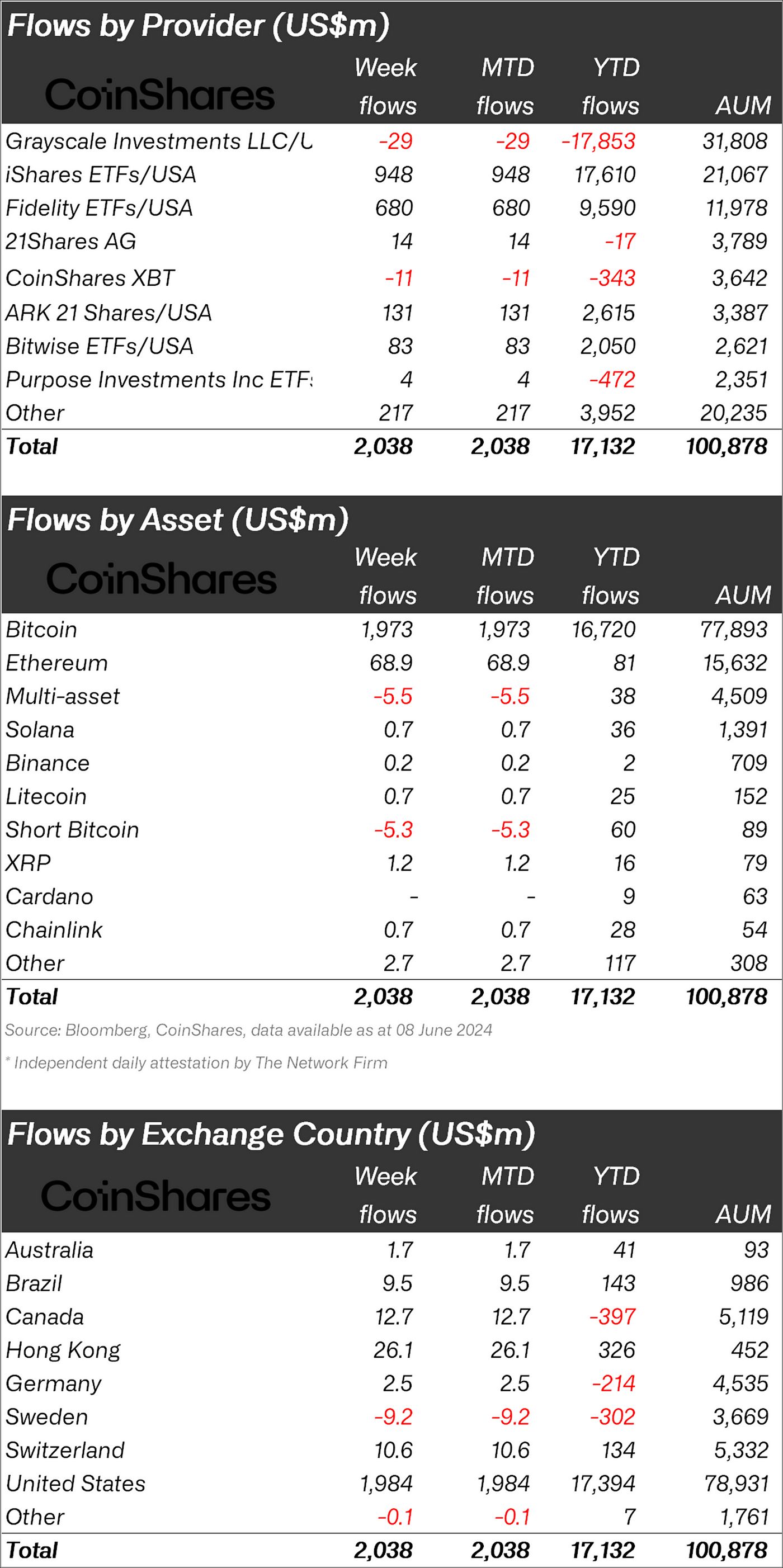

Digital asset investment products saw inflows totalling US$2bn, bringing this recent 5 week run of inflows to US$4.3bn. Trading volumes in ETPs rose to US$12.8bn for the week, 55% up from the week prior. Unusually, inflows were seen across almost all providers, with a continued slowdown in outflows from incumbents. We believe this turn around in sentiment is a direct response to weaker than expected macro data in the US, bringing forward monetary policy rate cut expectations. Positive price action saw total assets under management (AuM) rise above the US$100bn mark for the first time since March this year.

Regionally, the US saw the majority of inflows totalling US$1.98bn last week, with the first day of the week seeing the 3rd largest daily inflow on record. The iShares bitcoin ETF now comfortably surpassing incumbent Grayscale with US$21bn of AuM.

Bitcoin was again the primary focus, seeing US$1.97bn inflows for the week, while short-bitcoin saw outflows for the 3rd week in a row totalling US$5.3m.

Ethereum saw its best week of inflows since March, totalling US$69m, likely in reaction to the surprise SEC decision to allow spot-base ETFs.

Altcoins saw minor activity, with Fantom and XRP standing out, seeing inflows of US$1.4m and US$1.2m respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.