Retail investors are still shying away from the crypto market, but why?

Recently, retail investors have shown considerable caution towards the cryptocurrency market. This behavior is in stark contrast to previous cycles, when their engagement had quite an impact on the dynamics of the sector.

Experts suggest that the current reluctance of retail investors to engage with the crypto market may affect its trajectory. Gustavo Faria, co-founder of Nosy, pointed to several key indicators that reinforce the idea that the participation of retail investors is still weak:

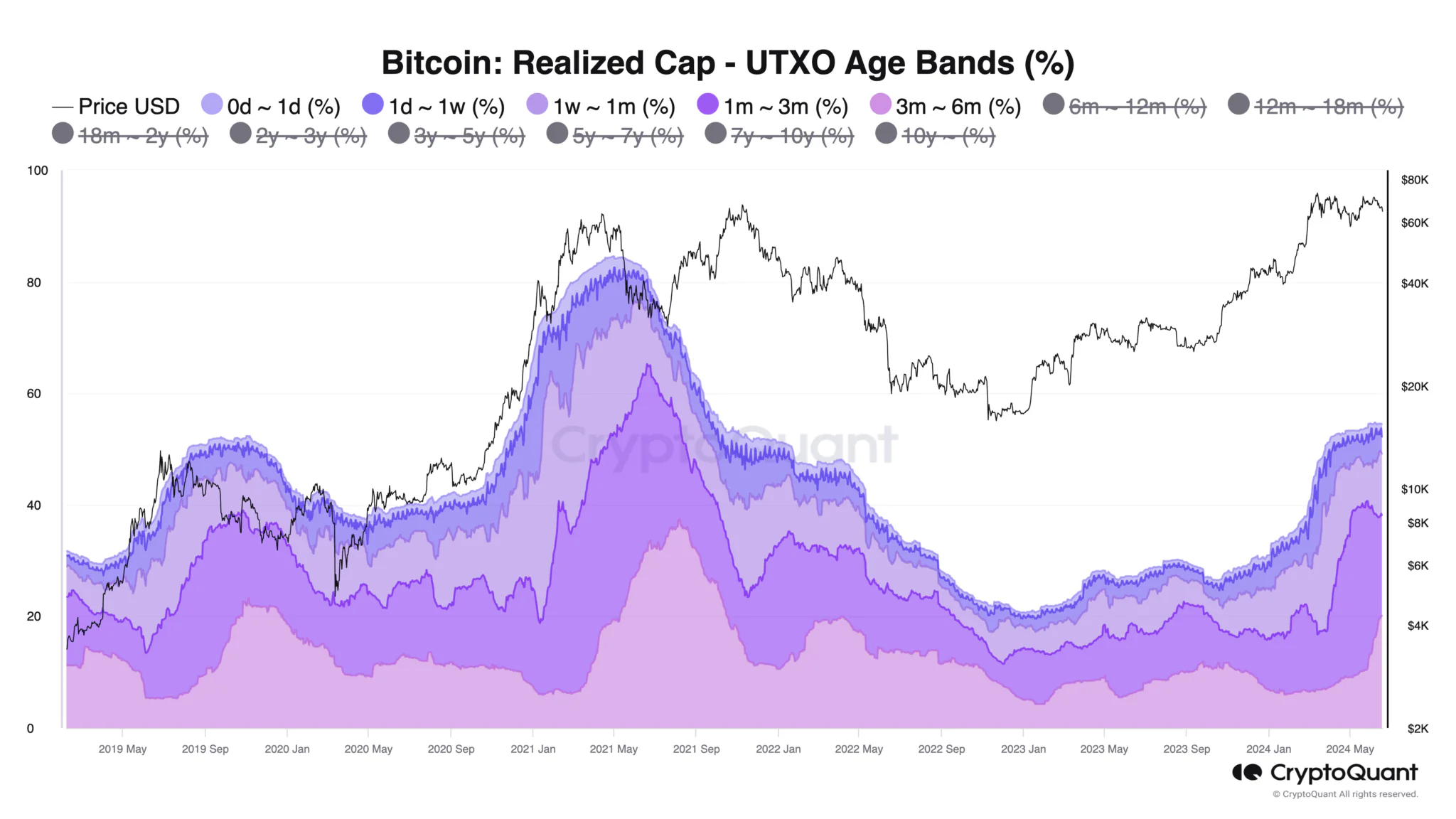

A defining feature of the peaks of the cycle of Bitcoin is the prevalence of coins held for less than three months.

Short-term holders currently make up about 35% of the realized cap, compared to over 70% during previous market peaks. This shows , that long-term holders of Bitcoin, often referred to as “smart money”, maintain their positions, contributing to a more stable market base.

Graph of realized capitalization of Bitcoin

Graph of realized capitalization of Bitcoin

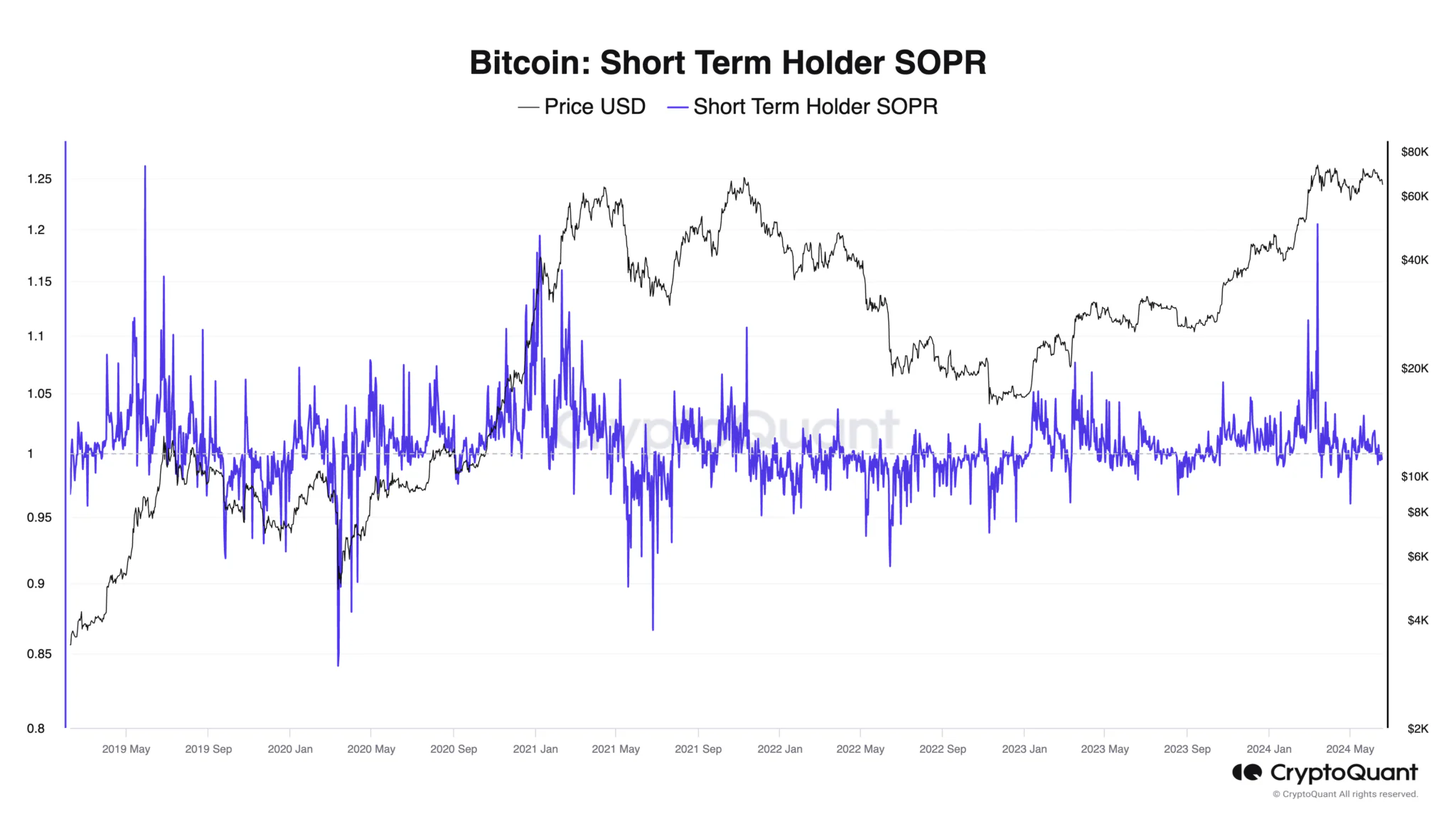

Historically, the SOPR for short-term holders has exceeded 1.10 points during market peaks. During this cycle, the highest SOPR recorded was 1.05, indicating a more neutral market position.

READ MORE:

$545M Has Exited Bitcoin ETFs: How Far Can The Price Go?Furthermore, Faria believes that the current market remains stable, reducing the likelihood of an immediate bear market transition and indicating potential for further growth.

SOPR of short-term Bitcoin holders

SOPR of short-term Bitcoin holders

Anthony Sassano, Independent Topic Educator Ethereum also highlighted the lack of broad market growth that is usually driven by the participation of retail investors:

Retail and new money wasn't and still isn't here – [all moves come] only ot old crypto users…

2.5 months on from this and the total market cap of everything outside of the top 10 is down 40% (and everything outside of BTC and ETH is down 26%)

“Retail” and new money was and is still not here – it's all just crypto natives doing max PvP https://t.co/Hs4d4yakvX

— sassal.eth/acc 🦇🔊 (@sassal0x) June 18, 2024

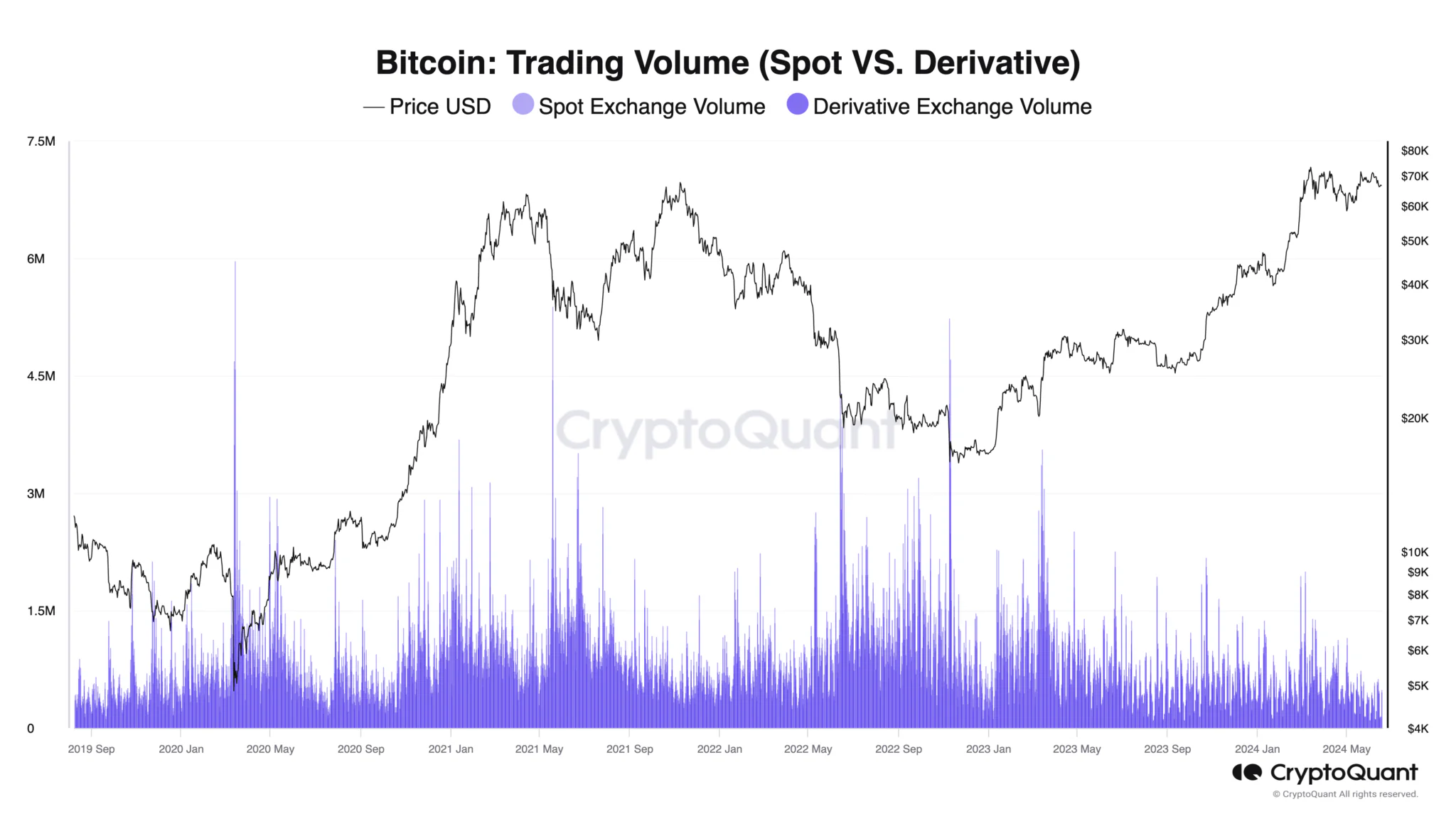

Supporting this view, crypto analyst Cyclop reinforced the lack of enthusiasm in the retail sector. He pointed out that trading volumes are significantly lower than in 2021, despite the higher price of Bitcoin. The analyst suggests that this lack of participation by small investors indicates that the market has not yet reached the speculative frenzy seen in previous cycles.

Cyclop statements :

Ordinary people are not yet in the crypto sector. My friends are not messaging me on WhatsApp. My mother doesn't know that Bitcoin is at an all-time high.

Bitcoin trading volume

Bitcoin trading volume

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PUMPUSDT now launched for futures trading and trading bots

[Initial Listing] Bitget Will List pump.fun (PUMP) in the Innovation and Meme Zone

USELESSUSDT now launched for futures trading and trading bots

Bitget Will List W Coin (W1) in the Innovation and Meme Zone