Volume 189: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

Ethereum push outflows into a 3rd week, signs sentiment is turning for Bitcoin

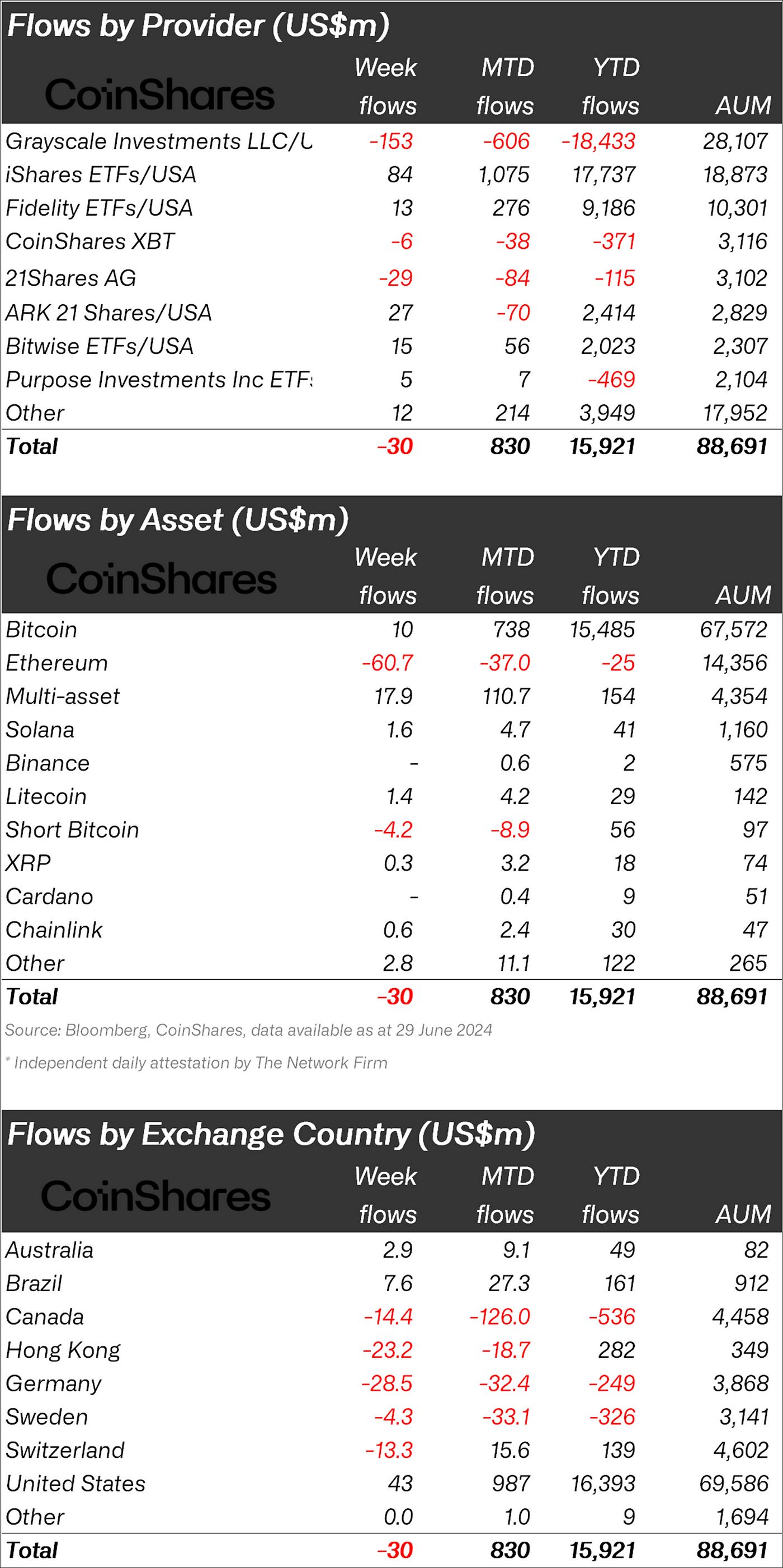

- Digital asset investment products saw a third consecutive week of outflows totalling US$30m, with last week indicating a significant stemming of the outflows.

- Ethereum saw the largest outflows since August 2022, totalling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.

- Conversely, multi-asset and Bitcoin ETPs led the inflows with US$18m and US$10m respectively.

Digital asset investment products saw a third consecutive week of outflows totalling US$30m, with last week indicating a significant stemming of the outflows. In contrast to prior weeks, most providers saw minor inflows, although this was offset by incumbent Grayscale seeing US$153m outflows. Trading volumes rose by 43% week-on-week to US$6.2bn but remain well below the US$14.2bn weekly average for the year so far.

Regionally, the US saw US$43m inflows, as did Brazil and Australia with inflows of US$7.6m and US$3m respectively. Negative sentiment pervaded Germany, Hong Kong, Canada and Switzerland with outflows of US$29m, US$23m, US$14m and US$13m respectively.

Ethereum saw the largest outflows since August 2022, totalling US$61m, bringing the last two weeks of outflows to US$119m, making it the worst performing asset year-to-date in terms of net flows.

Conversely, multi-asset and Bitcoin ETPs led the inflows with US$18m and US$10m respectively. Short-bitcoin also saw a rise in outflows totalling US$4.2m last week, suggesting sentiment may be turning. A range of altcoins saw inflows, most notable were Solana (US$1.6m) and Litecoin (US$1.4m).

Blockchain equities, despite the positive sentiment for crypto this year, have suffered outflows of US$545m this year, representing 19% of AuM.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.