Data: Gray Ether Trust (ETHE) Has Moved from a Negative to a Positive Premium

According to YCharts data, ETHE reportedly traded at a premium of 0.31% to NAV on July 3rd. The market expects ETHE to stop trading at a negative premium before the launch of a spot Ether ETF in the US.

ETHE has been trading at a negative premium since the cryptocurrency bear market bottomed out in December 2022, and as forecasts surrounding the U.S. SEC's approval of a spot ethereum ETF increased following the launch of a bitcoin ETF in January, ETHE's negative premium narrowed until it turned positive on the 3rd of this month. Shades of Gray ETHE is currently reported to have $9.5 billion in assets under management.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet's "Chain Scanner" Feature Now Supports Five Major New Token Platforms Including Pump.fun and BONK.fun

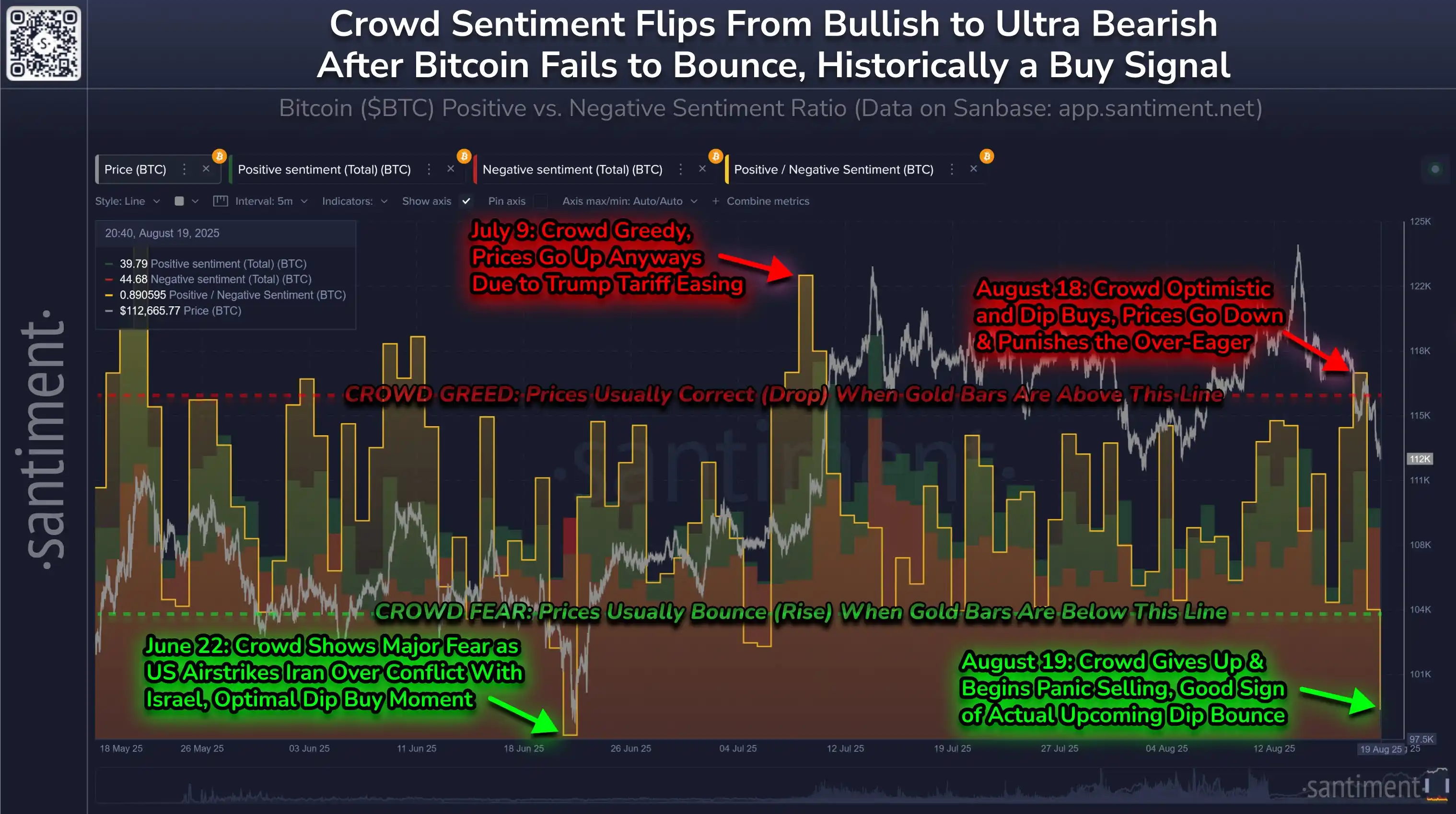

Santiment: Retail Investor Market Pessimism Hits Highest Level Since June 22, Potential Buying Opportunity Emerges

Santiment: Retail Sentiment Turns Extremely Bearish, Potential Signal for Market Reversal