The bull market will not disappear until you no longer believe that this is a bull market.

Original author: Crypto, Distilled

Original translation: TechFlow

Cryptocurrencies - Has the top been reached?

This is a taboo question in the cryptocurrency community (CT).

However, ignoring it can be costly (which is why most people go through full up and down cycles).

“The reality is, when you stop believing in something, it doesn’t go away.” - P. Dick

Here’s why the top may have already occurred and how you can still thrive in this situation.

Disruption of market structure

The first major point of concern is the recent loss of $BTC ’s 4 month range.

While the long-term trend remains intact, the medium-term trend has turned bearish.

Andrew Kang believes this is similar to the price action in May 2021.

(Thanks @Rewkang )

Potential double top?

With the loss of key support levels, a double top pattern is hard to ignore on the weekly chart.

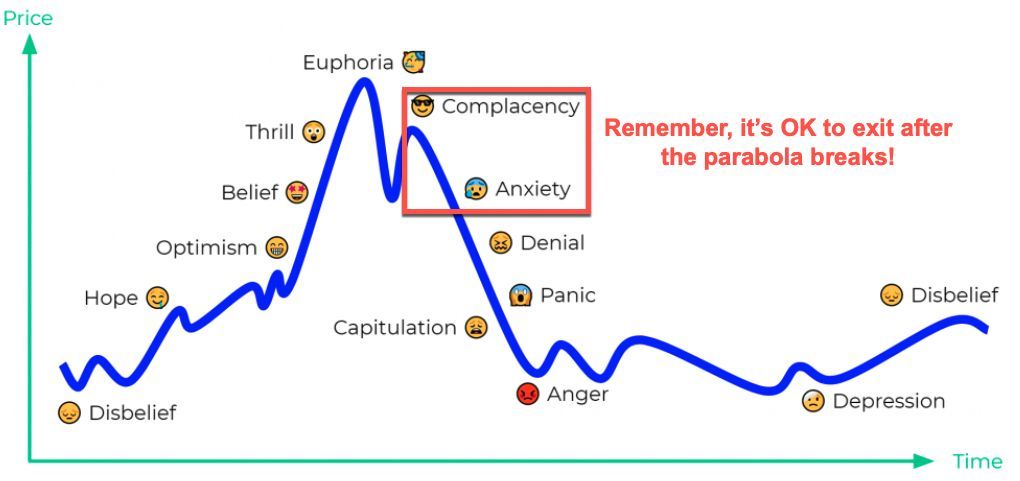

While I am no technical analysis expert, this looks like a classic Complacency Shoulder pattern.

“Spot markets are comfortable, crypto is safe as liquidity will rise again” = consensus view

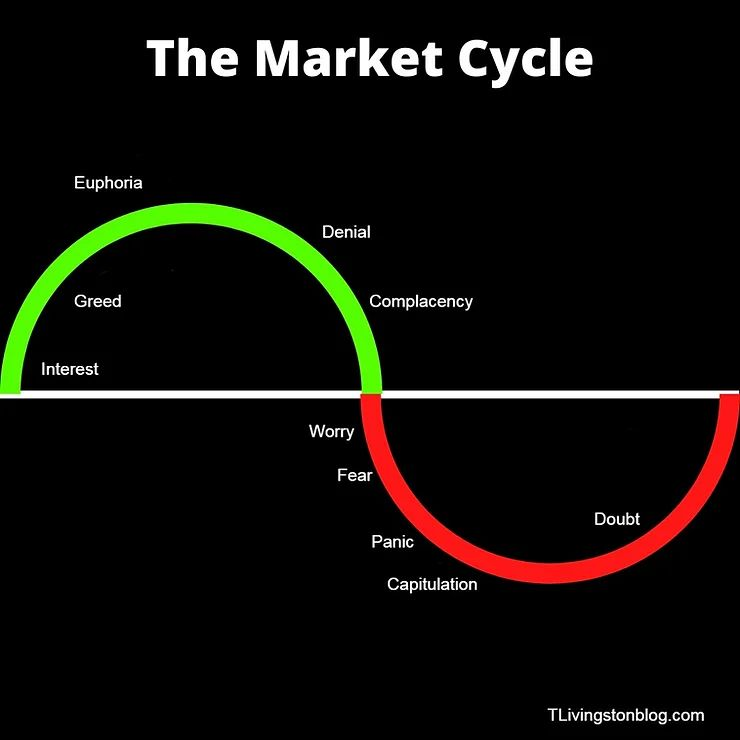

From a wall of worry to a river of hope

Bull markets are climbing the wall of worry; bear markets are sliding down the river of hope.

This shift occurs gradually, and the top is usually confirmed only after the fact.

To assess this shift, the following points can be analyzed:

Price reaction to positive/negative news

The psychology of idle capital

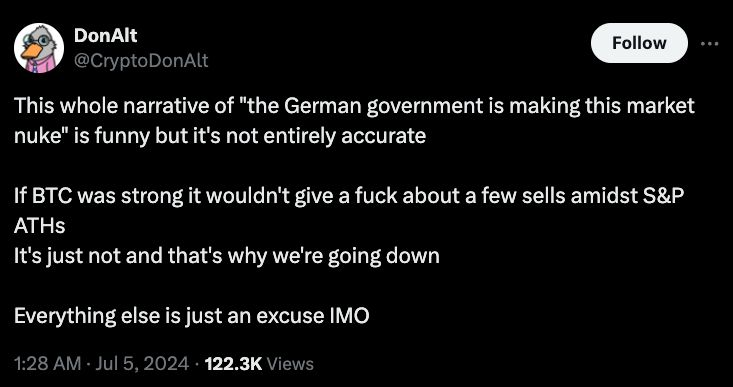

Market reaction to news

In a weak market, good news falls on deaf ears while bad news causes great fear.

Recent examples:

Good news: Trump talks Bitcoin ($BTC) as a corporate asset + Ethereum ($ETH) ETF coming soon.

Bad News: Mt. Gox/Germany Sells Bitcoin ($BTC)

(Thanks @CryptoDonAlt )

Idle capital and bargain hunting

Blind bargain hunting by retail investors without clear catalysts is a cause for concern.

Markets slide down this river of hope as complacency and denial turn to panic.

(Thanks to T. Livingston)

A technical rebound in 2022

The market has experienced several technical rebounds in 2022, but there has been no trend reversal.

Ideally, you want to see a major catalyst ahead while idle capital is hesitant to buy the dip.

The opposite scenario portends danger, as recent price action on the Ethereum ($ETH) ETF shows.

Bitcoin Super Cycle Theory

Many altcoins may have peaked, but Bitcoin ($BTC) could be entering a supercycle.

While global liquidity may be surging, this challenges the assumption that altcoins are the fastest horse.

A paradigm shift may be underway, with its effects lagging.

(Thanks @Rewkang )

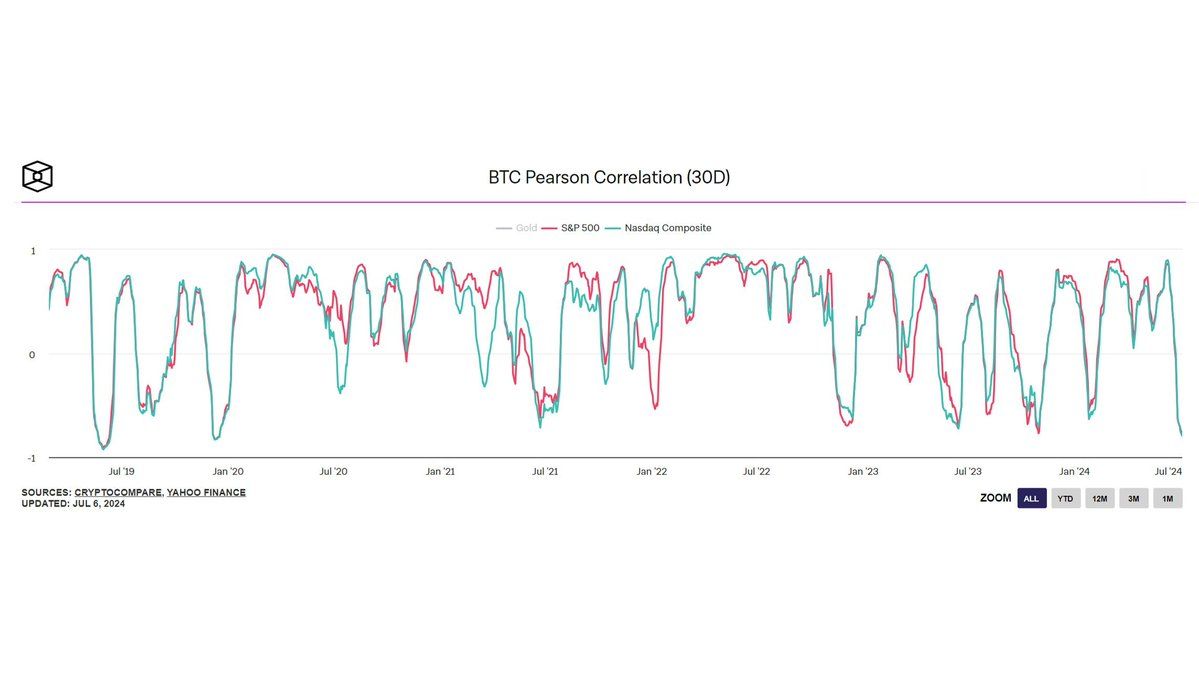

Bitcoin and SP 500 divergence

Bitcoin ($BTC)’s weakening correlation with stocks (lowest in 4.5 years) could be a cause for concern.

Large oversupply (Germany/US etc) could push this decoupling to its limits.

(Thanks @WClementeIII )

Similar to 2019

The divergence between Bitcoin ($BTC) and the SP 500 ($SPX) is similar to 2019, when Bitcoin peaked in June.

It took more than 12 months to reach a new high.

(Thanks @intocryptoverse )

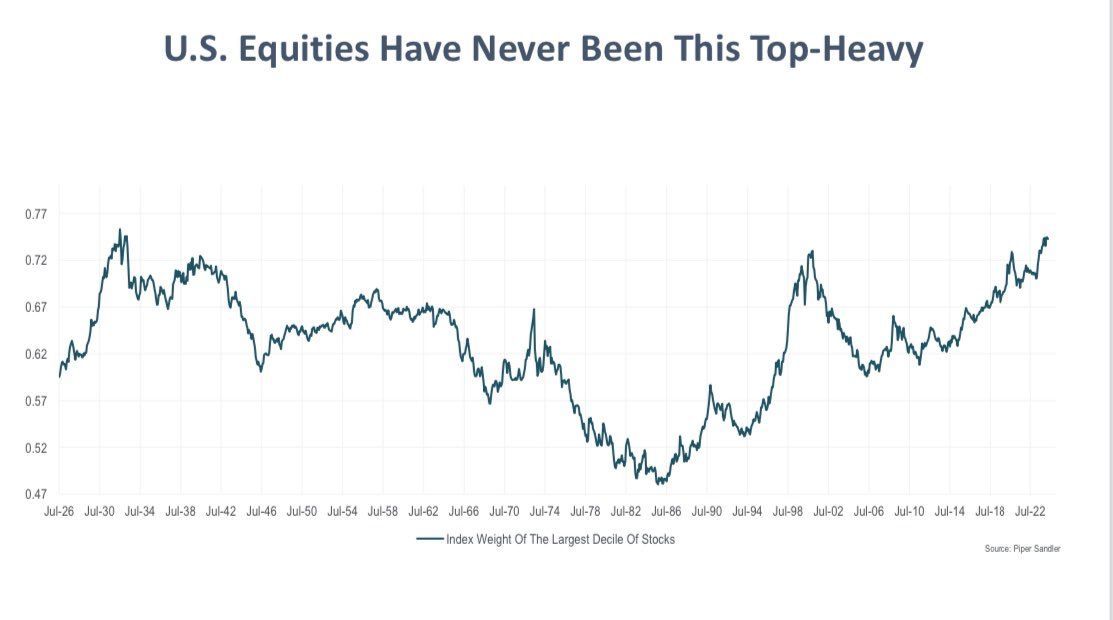

Big AI companies overshadow cryptocurrencies

Maybe the market peaked not because cryptocurrencies are bad, but because AI is more attractive.

We are seeing the thinnest stock rally in history (led by large AI companies).

While access to Bitcoin ($BTC) has never been better, retail demand has been slow to grow. Why?

(Thanks @TXMCtrades )

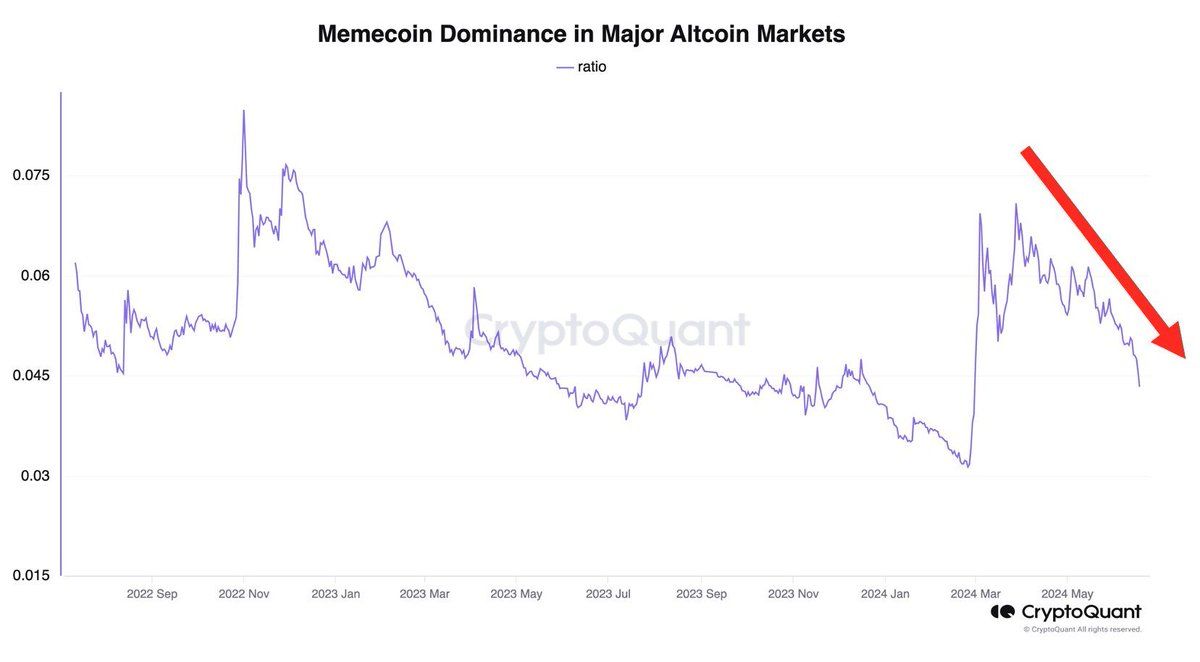

Is the greatest craze over?

The biggest frenzy may be over. This cycle may be short-lived.

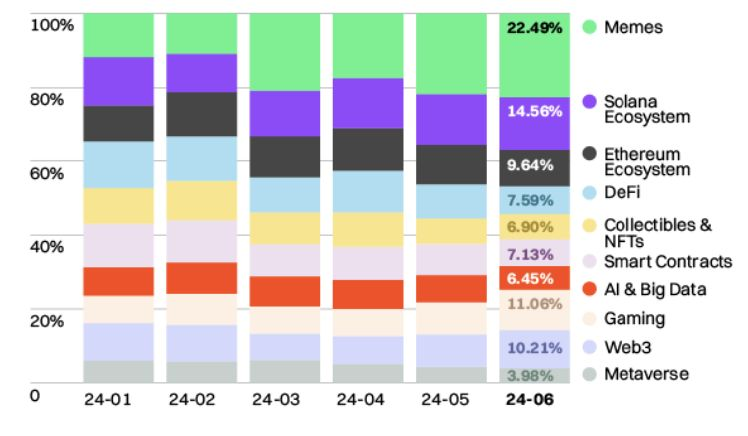

Evidence: memecoin peaked in the first quarter of 2024 and has been trending downward since then.

Bitcoin ($BTC) Peaks in Q1 2024 (Coincidence?)

(Thanks @ki_young_ju )

Memecoin Super Cycle = Top Signal

The concept of a “memecoin supercycle” could be the ultimate top signal.

A similar top signal was seen in 2021, when some predicted that Bitcoin ($BTC) would enter a super cycle ($250k+ $BTC).

Since there was less disillusionment in this cycle, perhaps we entered the memecoin craze more quickly.

Memecoin’s Dominance in the Sector

For the first time, memecoin has become the most popular category on CoinMarketCap (CMC).

Without real applications driving organic demand, how long can altcoins operate in a speculative bubble?

(Thanks @coinmarketcap )

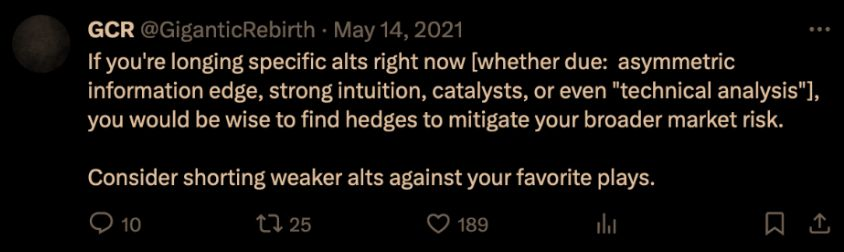

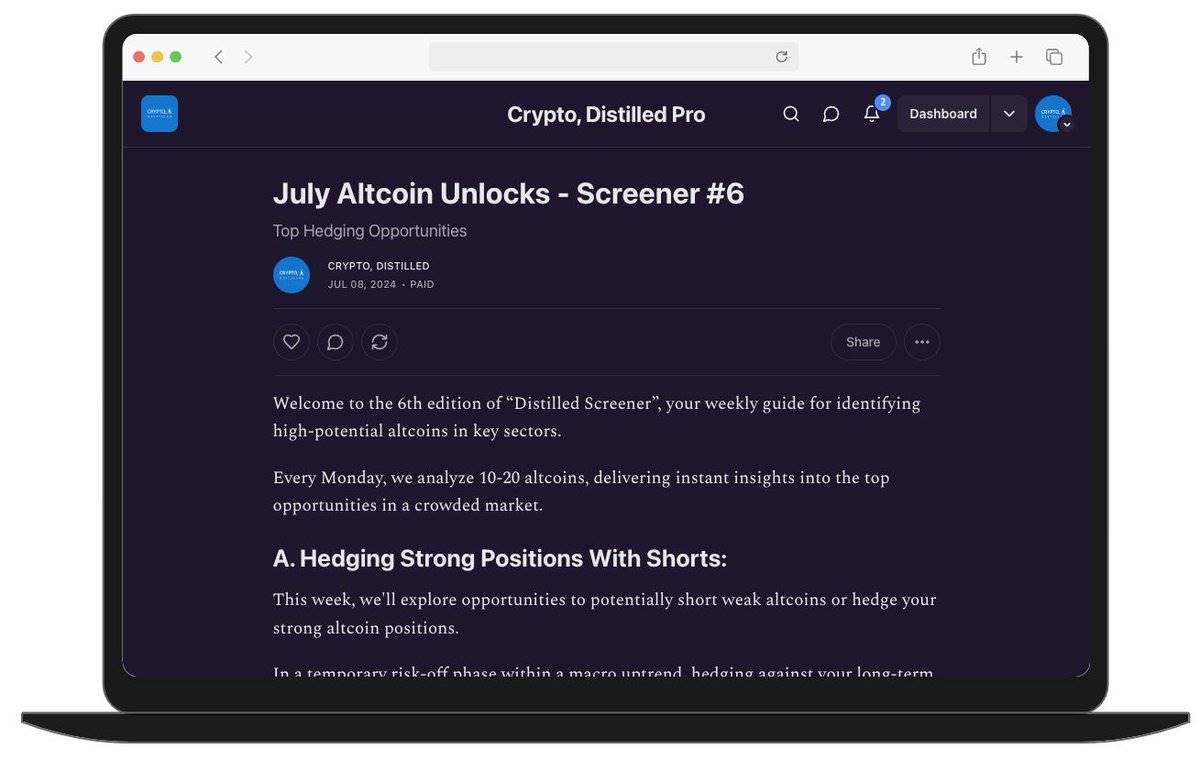

Profit from hedging

Even though we may have reached the top, it doesn’t mean all hope is lost.

Hedging against strong altcoins by shorting weak altcoins can be very profitable.

This enables you to profit from declines while still staying involved in the market.

(Thanks @GiganticRebirth )

Bitcoin dominance rises

In risk-averse markets, investors selling altcoins for Bitcoin ($BTC) tends to increase Bitcoin’s dominance.

Capturing this trend by shorting the weak ALT/BTC pair could be very profitable.

@intocryptoverse believes Bitcoin dominance ($BTC.D) could reach 60% by Q4 2024.

Profiting from VC greed

Identify coins that have excess supply and huge unrealized VC profits.

What if the four-year cycle is broken?

Imagine if March 2024 was just a peak for the next 6-12 months?

Is this still the top of the cycle?

Given the limited upside so far in this cycle, it is reasonable to expect the downside will also be less.

Because of short cycle + low volatility.

The macro top has not yet appeared?

Despite some potential signals, the top of the cycle may not have arrived yet (personal opinion, for reference only).

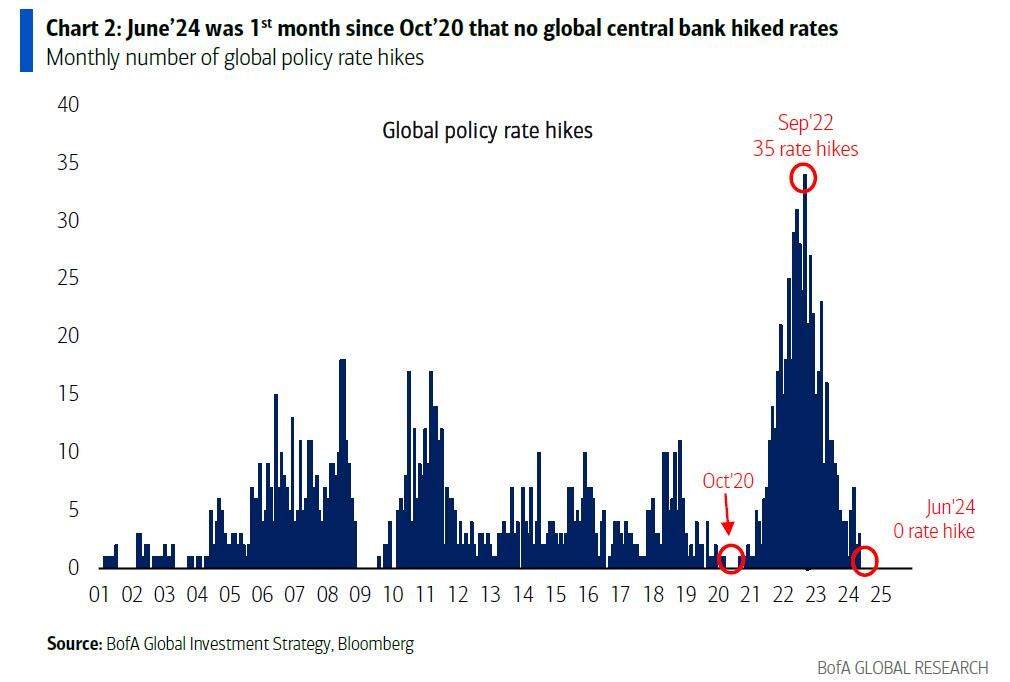

Liquidity is the most critical factor, with strong evidence suggesting the peak could occur by 2025.

While liquidity is currently low, we appear to be on the verge of a major shift

(Thanks @zerohedge )

Original link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. tariff revenue hits $30 billion in July, up 261% since Trump took office

Share link:In this post: The U.S. collected $30 billion in tariff revenue in July, a 261% increase since March. Trump delayed new tariff rules to August 7 and signed 11 trade deals with key partners. Consumer debt hit $18.4 trillion, with serious student loan delinquencies reaching 12.9%.

BlackRock dumps over $100K ETH, breaks 21-day inflow run

Share link:In this post: BlackRock’s Ether exchange-traded fund (ETHA) offloaded $101,795 ETH, totalling almost half a billion dollars in daily outflows. The fund still recorded $9.3 million in net inflows despite the selloff. U.S. spot Ether ETFs also recorded the most inflows of roughly $726M on July 16, with ETHA contributing more than $499 million.

Indonesia explores how national Bitcoin reserve could benefit the country

Share link:In this post: Indonesia is reportedly open to adding BTC to its national reserve as the VP’s office and other parties push. A proposal has been made to include Bitcoin as an investment option for the country’s newly launched Daya Anagata Nusantara Investment Management Agency (BPI Danantara). Proponents of the proposal argue that allocating IDR 300 trillion (about $18.3 billion) to Bitcoin could help reduce Indonesia’s national debt.

U.S. adds OpenAI, Google, and Anthropic to approved AI vendor list

Share link:In this post: The U.S. government picked OpenAI, Google, and Anthropic to provide AI tools to federal agencies. This makes it faster and easier for agencies to use AI for chatbots and fraud detection. Before approval, the government checked these tools for safety, performance, and bias.