- Criminals are increasingly using crypto

- Non-crypto-related criminals use it to launder money

- Most criminals use centralized exchanges to cash out.

Crypto has redefined digital transactions, offering privacy and freedom from intermediaries like never before. However, since its inception, criminals have used these features to evade authorities.

Most recently, as crypto has grown in popularity, criminals are using it more often to launder money from illegal sources. This is making regulators scramble to crack down on this new financial loophole.

Crypto Increasingly Used in Crime for Money Laundering

As crypto is becoming more popular, so are its illicit uses. On Thursday, July 11, Chainalysis released a comprehensive report about the increased use of crypto for money laundering.

Sponsored

Criminals are using its borderless nature to obscure the origins of their illicit funds. Since 2019, nearly $100 billion has been sent from known illicit wallets to conversion services, with $30 billion recorded in 2022 alone.

The trend is not just limited to crypto-native criminals, like crypto hackers or scammers. According to Chainalysis, even criminals from outside crypto are now using sophisticated techniques for money laundering.

How Crypto Money Laundering Works

The key phase of money laundering is called layering. This means moving funds through long transactions to obscure their origins. This process uses mixers, cross-chain bridges, and intermediary wallets, all of which make transactions harder to trace.

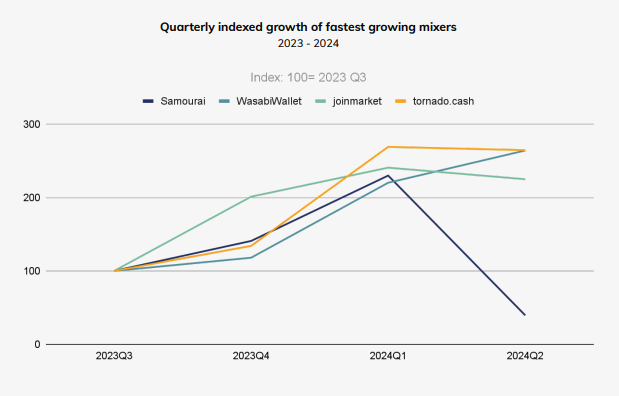

Source: Chainalysis

Source: Chainalysis

Crypto mixers, originally intended as a privacy-protecting tool, have seen significant growth from 2023 to 2024. According to Chainalysis, this growth is at least in part due to their criminal use. This includes the popular Tornado Cash mixer, which saw a notable decline after US authorities shut down its website in 2022. Now, the decentralized Tornado Cash protocol is recovering.

Sponsored

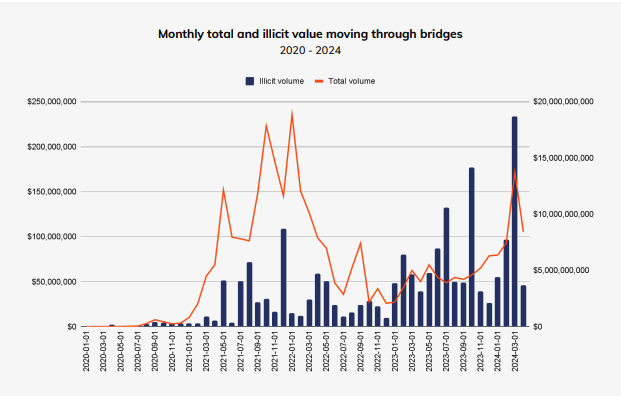

After that step, criminals often transfer these assets through cross-chain bridges, further obfuscating their origins. In January 2024 alone, nearly $234 million in illicit funds were moved through these bridges, driven largely by transfers from mixers like Tornado Cash.

Source: Chainalysis

Source: Chainalysis

The final step is to convert the laundered crypto to cash. According to Chainalysis, the most popular method for this is using centralized crypto exchanges. Over 50% of the illegal transactions they uncovered made their way to centralized exchanges.

Criminals Also Use OTC, Monero

Other than centralized exchanges, criminals also use over-the-counter (OTC) brokers. These intermediaries facilitate large trades between two parties. While most operate legitimately, some require no Know Your Customer (KYC) procedures, making them attractive to criminals.

According to the report, in 2024, cybersecurity firm Cloudburst identified several China-based OTCs operating through Telegram channels. These OTCs facilitated the movement of large amounts of stolen USDT, with daily transfers exceeding three million USDT.

Many criminals also use the privacy coin Monero (XMR), which has sophisticated features such as ring signatures, stealth addresses, and more. These make it extremely difficult to trace transactions on the Monero blockchain. Even terrorist-affiliated entities, including those linked to the Islamic State in Khorasan, advertise Monero donation addresses.

In response to these criminal activities, regulators worldwide are taking steps to strengthen AML and KYC procedures. Notable examples include the European Union’s Fifth Anti-Money Laundering Directive (5AMLD), which extends AML requirements to Virtual Asset Service Providers (VASPs). The United States, Singapore, the UK, and others are taking similar measures.

On the Flipside

- Criminals are always looking for new techniques to hide their activities, so regulators must continue to innovate to stay ahead.

- There is also a risk of regulatory overreach, where stringent measures may stifle innovation within the crypto industry.

Why This Matters

Crypto’s association with criminal activity hurts the industry, especially when it comes to regulation. Ensuring that the technology is available for legitimate use requires that protocols deter criminals in some way.

Read more about how DEX can become competitive:

DEX Issues Plague Solana, but There’s a Fix: Stabble CEO

Read more about privacy and compliance:

Unpacking Privacy Pools: Can They Ensure Compliance?