Bitcoin has been on a downward spiral for the better part of July 2024. The German government’s dumping of 50,000 BTC and Mt. Gox’s release of $9 billion have caused uncertainty in markets. Bears and crypto newbies made plans to leave the market, hence the heavy selling pressure quickly.

Also Read: Did Bitcoin just make a quick bullish reversal?

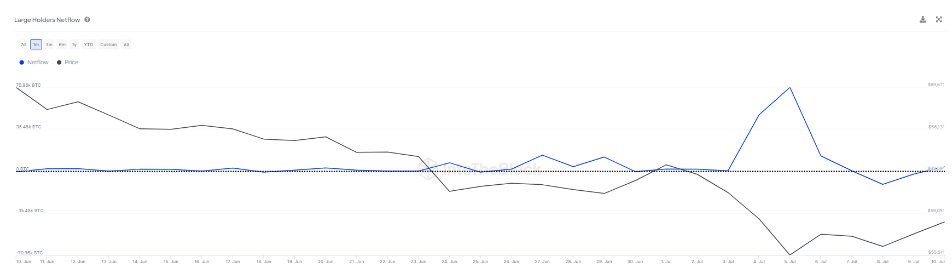

However, after 16 years of Bitcoin existence, whales and BTC enthusiasts have learned better than to leave the market when things go south. On-chain data from IntoTheBlock shows that “Bitcoin whales added 71K BTC to their wallets this week, as they capitalized on the recent price decrease.”

Source: IntoTheBlock

Source: IntoTheBlock

At the time of writing, Bitcoin (BTC) is worth $58,621.65, down 0.1% from an hour ago and up 0.2% from yesterday. However, BTC’s value today is 1.2% greater than it was seven days ago.

As of today, BTC’s market cap is $1.16 trillion, reflecting a 50.77% market dominance. Per the current BTC market price, the 77,000 are worth $4,512,515,700 billion.

The global crypto market cap is now $2.28 trillion, up 1.0% in the last 24 hours and 75.83% from a year ago. Meanwhile, stablecoins’ market cap is $162 billion, accounting for 7.13% of the total crypto market cap.

Ethereum (ETH), the second-largest crypto, is currently at $3,151.77, down 0.1% from an hour ago and up 0.0% from yesterday. However, the value of ETH today is 3.2% higher than it was seven days ago.

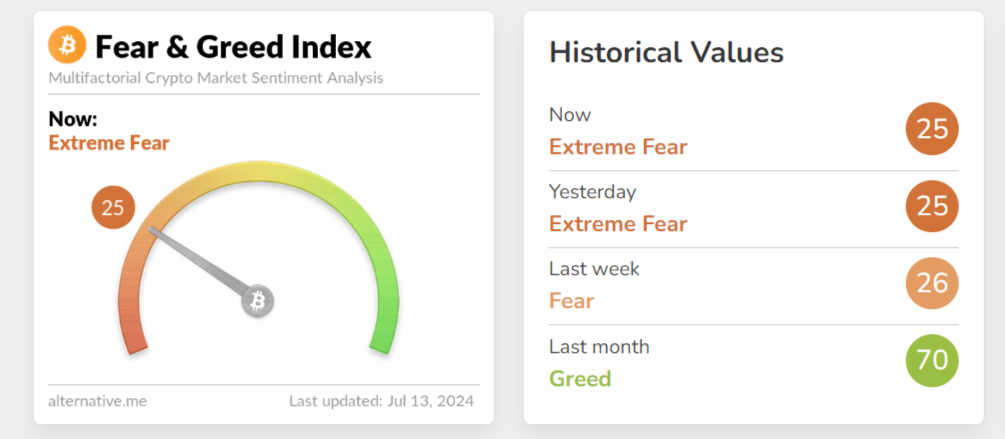

According to data from Alternative,me, the Crypto Fear Greed Index sits at 25, which shows extreme fear.

Source: Alternative.me

Source: Alternative.me

Coupled with whale accumulation, Bitcoin ETFs saw huge inflows. Yesterday, these funds received $300 million in new investments, the largest single-day inflow since early June.

Several reasons contributed to the price decrease, including the payment of Mt. Gox’s creditors. Notably, almost a quarter of Mt. Gox’s crypto was transferred to new wallets, leading BTC prices to drop below $53K.

Also Read: Ethereum demand spikes amid whales and institutions ETH ecosystem tokens accumulation

According to official reports, Mt. Gox has an October deadline to complete the distribution procedure.

The market slump also resulted in significant liquidations in decentralized finance systems. Aave V3 Ethereum, the largest on-chain lending protocol by total value locked, liquidated $10 million worth of tokens, the most since mid-April.