Volume 192: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

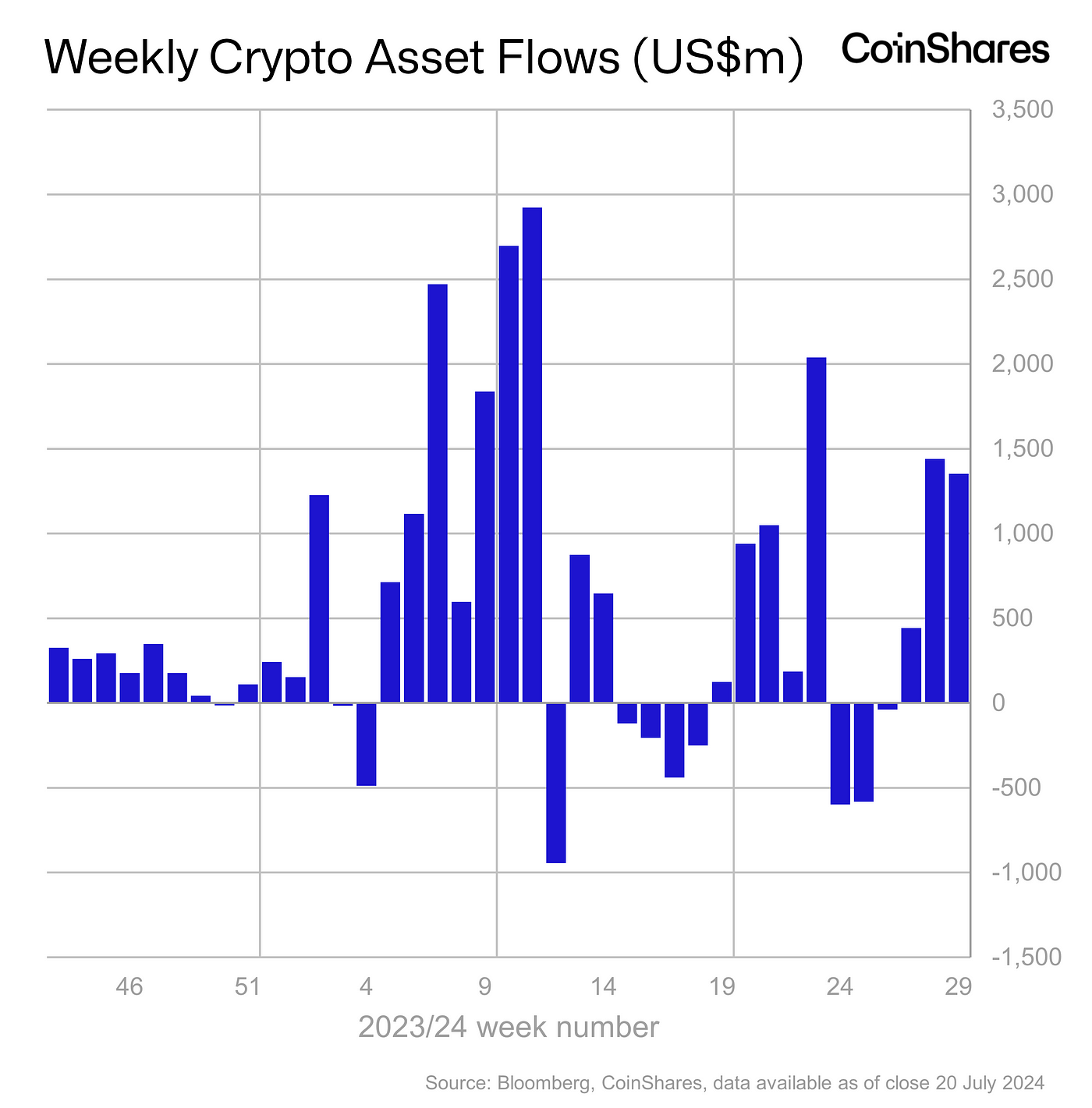

Further inflows of US$1.35bn as positive sentiment continues

- Digital asset investment products saw further buying with inflows of US$1.35bn last week, bringing the last 3 week run of inflows to US$3.2bn.

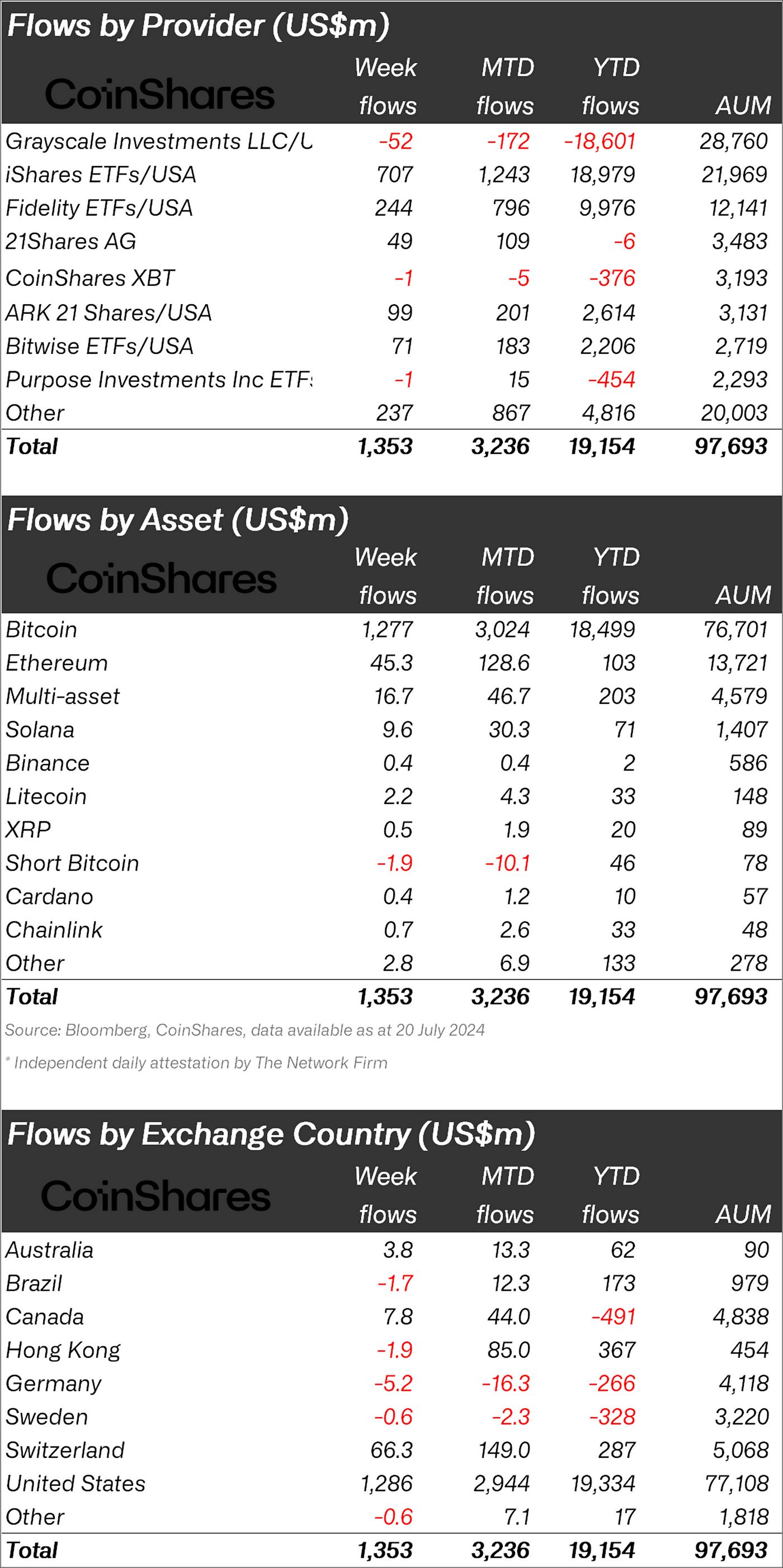

- Bitcoin saw US$1.27bn of inflows last week with short-bitcoin ETPs seeing further outflows of US$1.9m, bringing outflows since March to US$44m.

- The outlook for Ethereum seems to have turned a corner, seeing a further US$45m of inflows last week, overtaking Solana for the altcoin with the most inflows year-to-date.

Digital asset investment products saw further buying with inflows of US$1.35bn last week, bringing the last 3 week run of inflows to US$3.2bn. ETP trading volumes also increased substantially, up 45% week-on-week to US$12.9bn, but representing a lower than usual 22% of the broader crypto market volumes.

Regionally the picture was more mixed relative to last week, with the US and Switzerland seeing significant inflows of US$1.3bn and US$66m respectively, while Brazil and Hong Kong saw minor outflows totalling US$5.2m and US$1.9m respectively.

Bitcoin saw US$1.27bn of inflows last week with short-bitcoin ETPs seeing further outflows of US$1.9m, bringing outflows since March to US$44m, representing a massive 56% of assets under management (AuM) — highlighting enduring positive sentiment since the April halving event.

The outlook for Ethereum seems to have turned a corner, seeing a further US$45m of inflows last week, overtaking Solana for the altcoin with the most inflows year-to-date (YTD) at US$103m. Solana also saw inflows last week totalling US$9.6m, but now lags Ethereum with US$71m inflows YTD. Litecoin was the only other altcoin to see inflows over US$1m, with US$2.2m last week.

Blockchain equities, in contrast to tokens, continue to suffer with outflows of US$8.5m last week, despite most ETFs outperforming world equity indices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.