The European Union seems to be dropping hints that blockchain technology might soon play a bigger role in its plans, especially for helping growing tech companies, or scale-ups, that are hitting financial roadblocks.

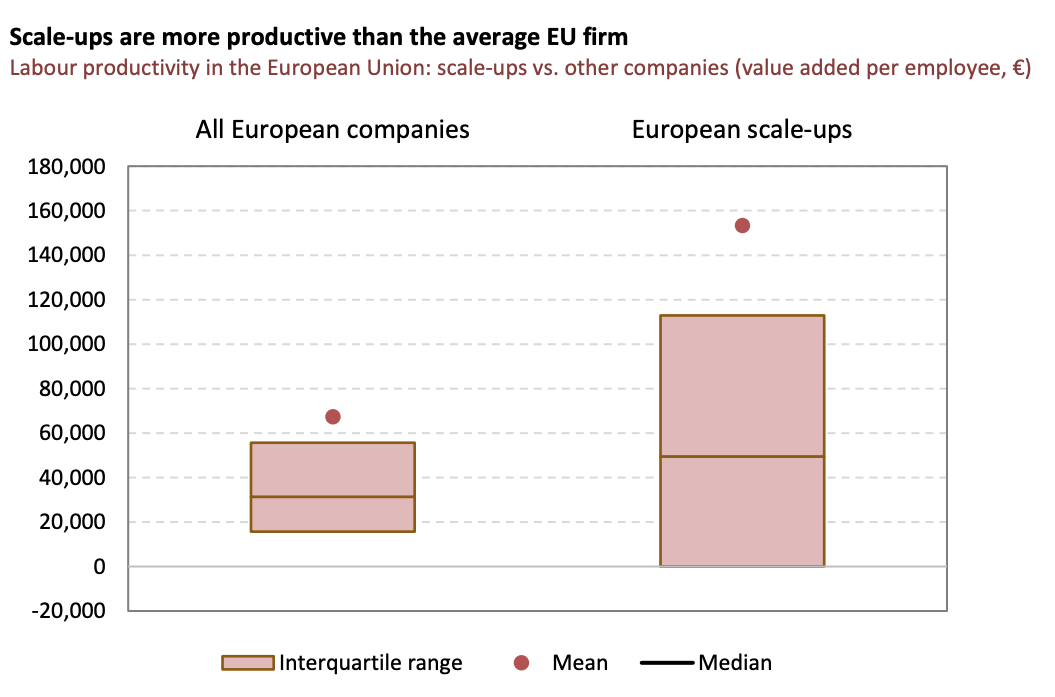

Scale-up companies in Europe are facing serious financial challenges. Despite being more innovative and productive than the average firm, they struggle to get enough capital.

By the time these companies are about ten years old, they’re raising only half as much money as similar companies in places like Silicon Valley. This huge gap in funding is a major issue, and it’s not tied to any specific industry or economic cycle.

It’s a consistent problem that makes it hard for European companies to compete globally. One of the big reasons for this funding gap is that there aren’t enough local investors willing to back these companies at important growth stages.

Source: EIB

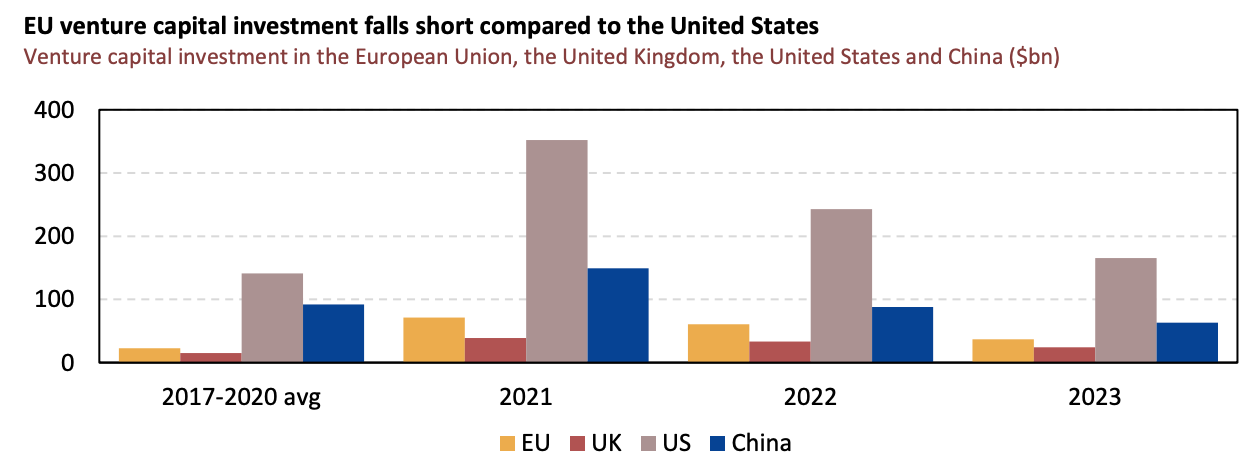

Source: EIB

Most of the big investments come from foreign investors, which isn’t the case in places like the U.S. In Europe, about 80% of scale-up deals involve foreign lead investors, while in San Francisco, it’s only about 14%.

Venture capital investment in the U.S. dwarfs what’s available in Europe, making it tough for local companies to get the funding they need.

Even when Europe and the UK are combined, the amount of venture capital available is still way behind what U.S. companies get.

Venture capital funds usually raise and invest money within their own regions, which limits the pool of available capital for high-growth companies.

An analyst said, “Europe is still not investing enough in equity and venture capital.” Many households keep their savings in low-risk investments, which don’t support high-growth sectors.

There’s a push to channel some of these savings into venture capital investments, which could have an immediate impact on funding for innovative companies.

While Europe’s venture capital market is growing, there still aren’t enough large-scale funds to meet the needs of scale-ups.

To make these companies more attractive to investors, Europe needs to deepen its capital markets and improve exit options for investors, like going public or getting acquired.

The European Investment Bank (EIB) Group offers a range of financial products, from seed capital to venture debt. It has already provided around €6.8 billion in venture debt to roughly 300 companies.

In early 2023, the EIB Group launched the European Tech Champions Initiative (ETCI), which wanted to support large-scale venture capital funds. It has already mobilized €10 billion in investments.