ANALYSIS: Markets set for a wave of rate cuts in September

While stronger-than-expected US GDP figures for the second quarter may ease some concerns about the economy, analysts say the higher-than-expected 2.9 per cent core personal consumption expenditure price index (PCE) could spell trouble for the Federal Reserve.Hargreaves Lansdown's Emma Wall said in a report, "While this is above target, it is falling, which, combined with strong economic growth data, takes the pressure off the Fed to cut rates next week." "We expect a wave of rate cuts from the Fed, ECB and Bank of England in September. For investors who follow the US stock market, we see opportunities in small-cap stocks that offer better value, despite the recent pullback in the CURLY SEVEN."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts Predict Powell May Remain Cautiously Silent in Upcoming Speech

Southwest Securities: No Stablecoin-Related Business Operations at Present

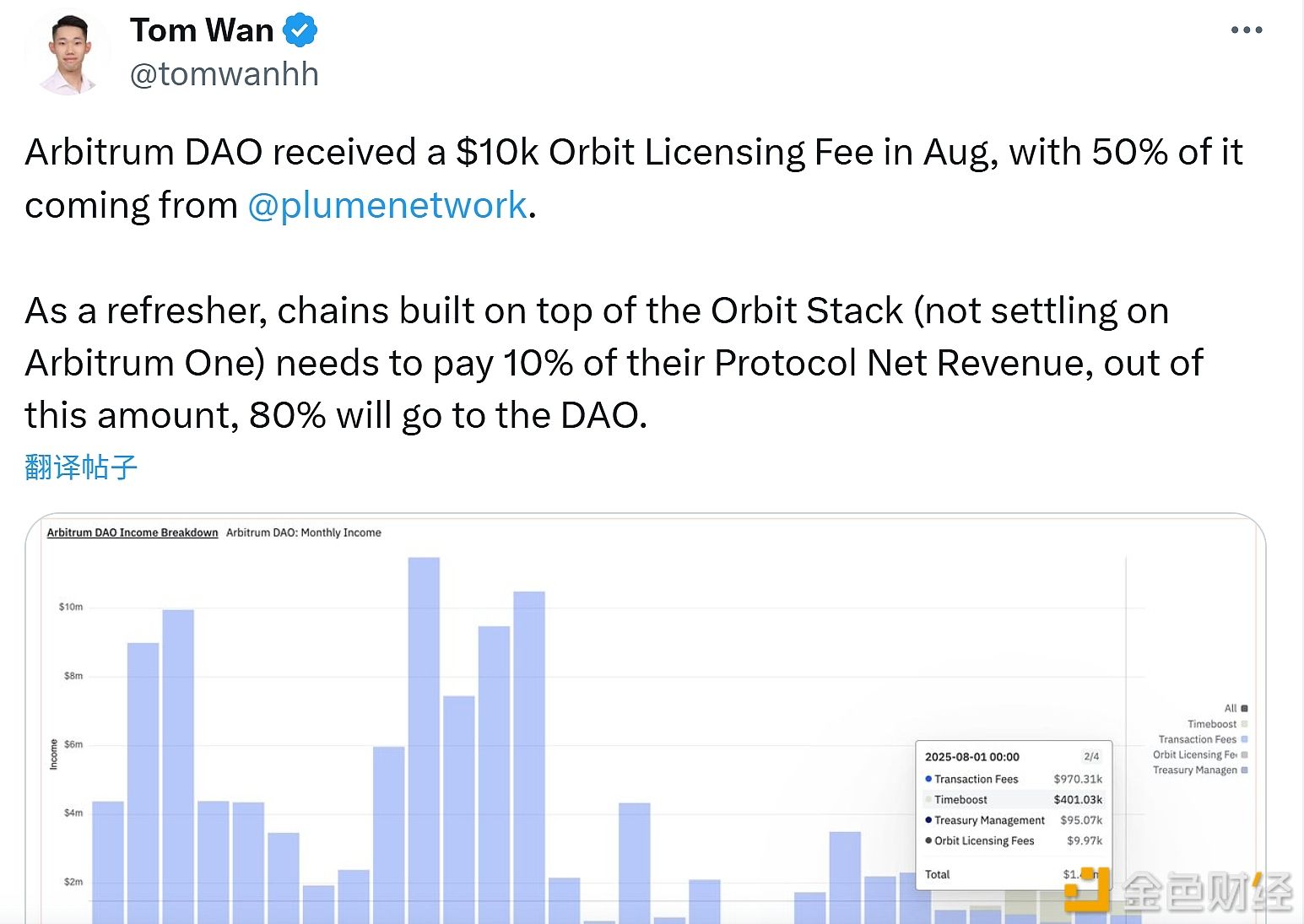

Arbitrum DAO received $10,000 in Orbit licensing fees in August

All Three Major U.S. Stock Index Futures Turn Positive