Marathon Digital is seeking partners to build a Bitcoin Layer-2 to accelerate cross-border BTC payments

At the Bitcoin 2024 conference, Marathon Digital, a Bitcoin mining company, stated that cross-border Bitcoin payments are its primary development goal. Julian Duran, head of Marathon's sidechain products, revealed that the company is seeking to collaborate with blockchain developers to build a Layer-2 solution for Bitcoin in order to accelerate cross-border BTC payments. He pointed out that in emerging markets, the average cost of cross-border remittances is 8% to 10% of the transaction amount and settlement usually takes three to four days. However, Bitcoin transactions typically settle within ten minutes and Layer-2 solutions are even faster.

In addition, Duran emphasized that any successful payment solution must strictly comply with regulatory requirements even though this may increase costs. In emerging markets regulatory approval tends to be quicker and cheaper as local governments and regulators seek better solutions for cross-border payments. Besides payments, Marathon also focuses on tokenization plans for real assets including tokenizing whiskey barrels in the United States and collaborating with a platform to protect French castles. Currently Marathon is one of the largest holders of Bitcoins among companies owning about 20 thousand bitcoins worth over $1 billion dollars; it purchased approximately $100 million worth of bitcoin just in July.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

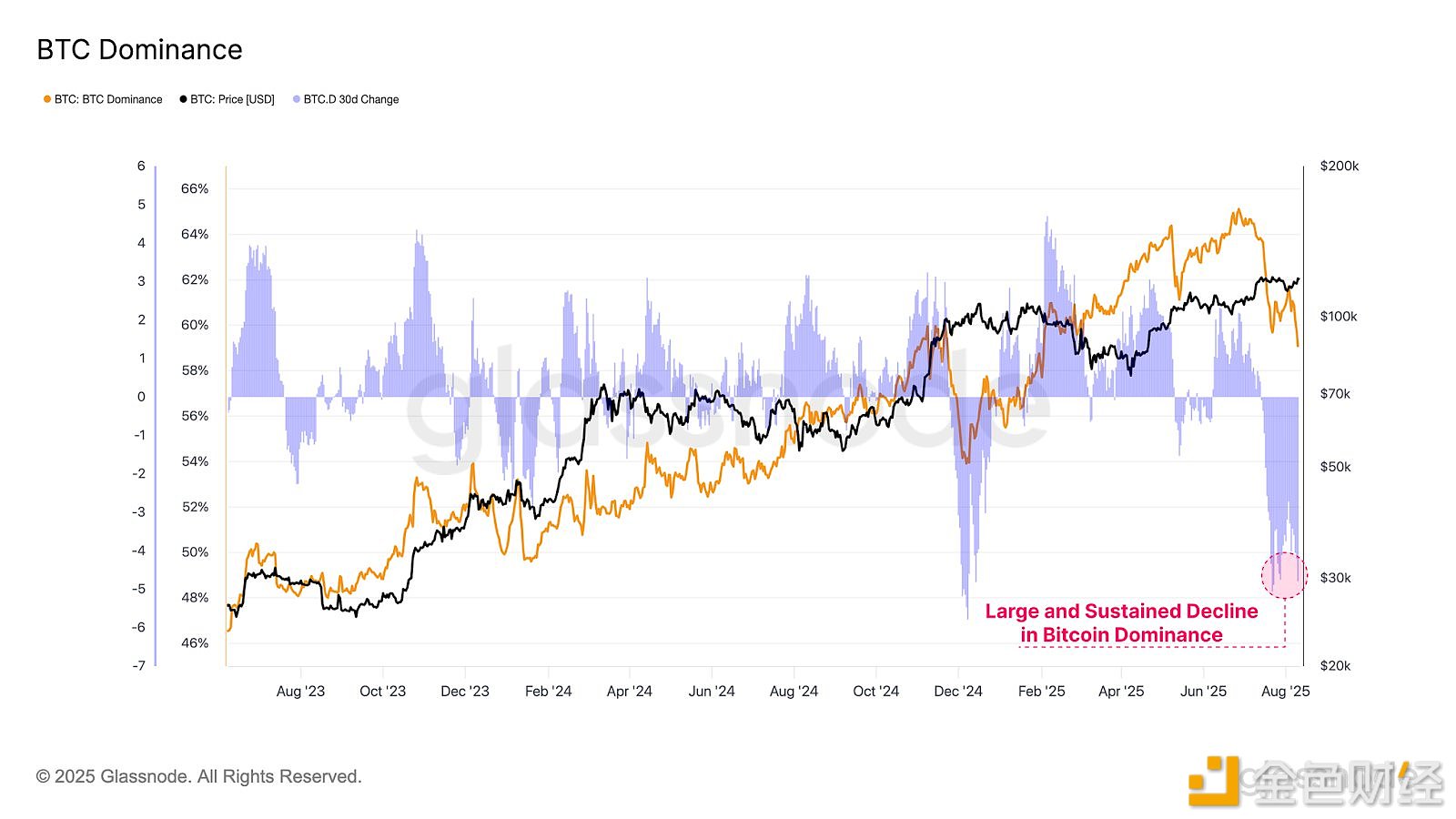

Bitcoin dominance has dropped from 65% to 59% over the past two months

US Treasury Department Calls for Public Comments on Illicit Activities Involving Cryptocurrency

The three major U.S. stock indexes closed nearly flat

U.S. Stocks Close: iQIYI Surges 17%, Intel Falls 3.6%