Investors Withdraw $2 Billion from Grayscale’s Ethereum ETF

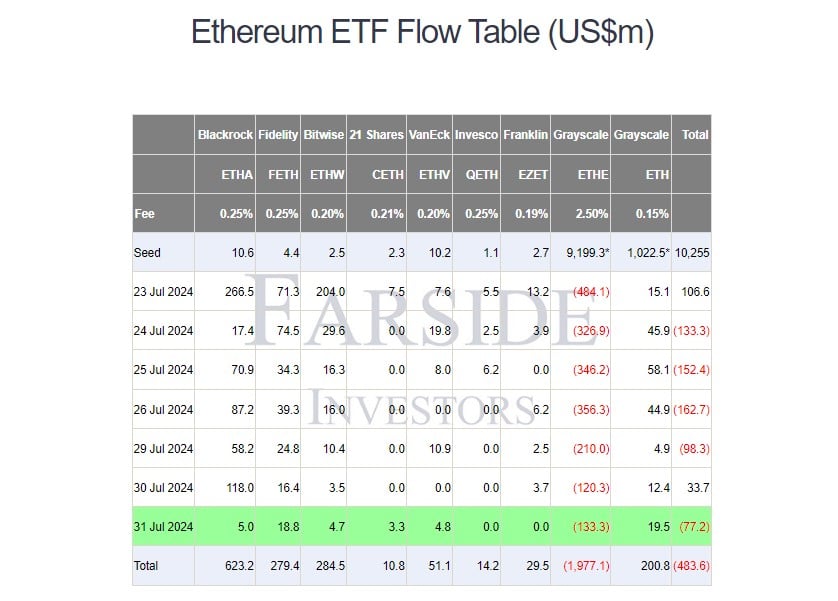

Investors have pulled nearly $2 billion from Grayscale's Ethereum ETF (ETHE) since it transitioned from a trust, with the fund's value now at $6.7 billion due to declining Ethereum prices.

On Wednesday alone, ETHE saw $133 million in withdrawals, though this wasn’t its largest single-day outflow, which was $484 million on its debut.

In contrast, the Grayscale Ethereum Mini Trust (ETH) has seen a positive inflow trend, with $19.5 million added on Wednesday, bringing total inflows to over $200 million.

ETH offers a lower management fee of 0.15%, compared to ETHE’s 2.5%, positioning it as the most cost-effective Ethereum ETF.

READ MORE:

Traders Boost Bullish Bitcoin Bets Ahead of U.S. ElectionGrayscale’s new Bitcoin Mini Trust (BTC), launched yesterday and has already attracted $18 million.

This fund, which also has a 0.15% fee, aims to offer a cheaper alternative to the existing Bitcoin Trust (GBTC) and alleviate some of the selling pressure on GBTC by reallocating some of its assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots