Nansen’s Weekly Report Examines Crypto Black Monday and Economic Concerns

Nansen’s latest report examines the massive sell-off of crypto assets during Crypto Black Monday, highlighting key factors driving the downturn.

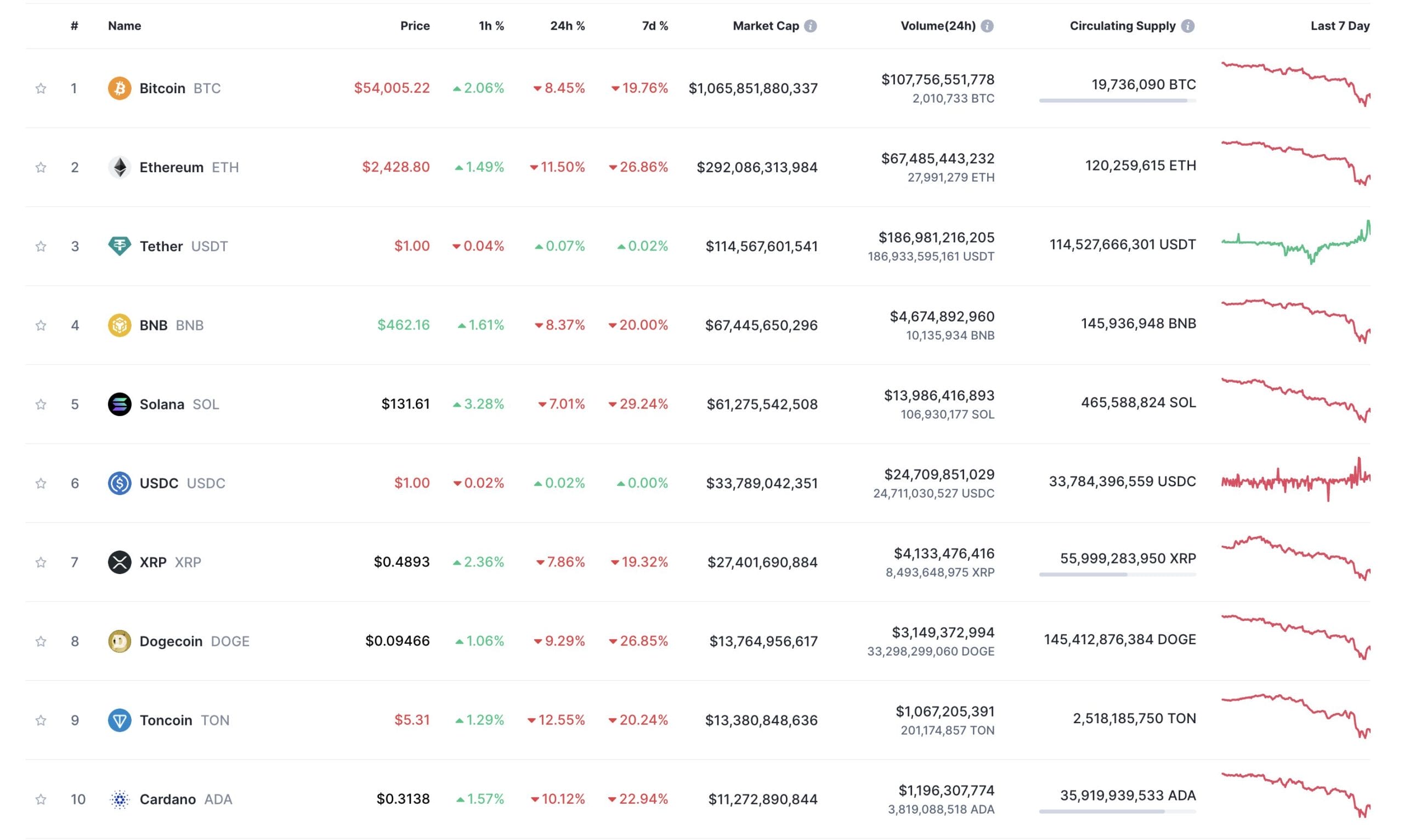

At the time of writing, all the top cryptocurrencies ranked by market capitalization have encountered a deep decline within the past 24 hours except the stablecoin Tether (USDT), based on statistics provided by CoinMarketCap .

According to Nansen’s report, the latest market volatility on August 5 is attributed to a “U.S. growth scare” and several other factors, including the narrowing lead of Trump in election polls and the Bank of Japan’s policy normalization.

Crypto Black Monday Strikes Market Hard

Bitcoin, for instance, is down by 19.91% in a week. The price of Bitcoin briefly fell below the $50,000 mark and dropped to as low as $49,513.

The market research demonstrated that the “U.S. growth scare” has created uncertainty among investors, leading to a reevaluation of risk assets, including cryptocurrencies.

Source: CoinMarketCap

Source: CoinMarketCap

This concern about economic growth prospects in the U.S. has been compounded by D onald Trump’s narrowing lead in the presidential election polls, introducing additional political risk into the markets.

Additionally, the Bank of Japan’s shift towards policy normalization has impacted global markets, influencing investor sentiment and contributing to the sell-off.

The report suggested that the increased probability of a recession, combined with high implied volatility, warrants a cautious approach. It recommended that investors consider trimming risk allocations rather than increasing them, taking advantage of price recoveries to reduce exposure prudently.

Bitcoin Sees Over $1 Billion in Liquidations

Since Bitcoin’s price dived, total liquidation has exceeded $1 billion, and the Crypto Fear Greed Index has decreased to 26, a tremendous difference from the Index of 74 from the previous week.

Bitcoin (BTC) is currently trading at $54,462 , with Ethereum (ETH) at $2,439, BNB at $465, Solana (SOL) at $132, and Ripple (XRP) at $0.49.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs witness $358m exodus, breaking 10-day rally streak

Fidelity and Grayscale ETFs Lead $358M Departure as 10-day Inflow Run Concludes; BlackRock and ETH Funds Keep Up Strong Momentum

Can Bitcoin Really Hit $113K or is it a Fleeting Dream?

Challenges to Bitcoin's Rally: Waning Retail Interest and Recirculation of Old Coins

SharpLink Gaming Files $1B SEC Registration for Ethereum Purchases

Trump Plans to Double U.S. Steel Tariffs