- Ethereum ETFs saw mixed net flows, with BlackRock’s ETF leading with $49.12M in inflows.

- Grayscale’s ETHE faced the largest outflow, losing $31.01M, but remains the top ETF by assets.

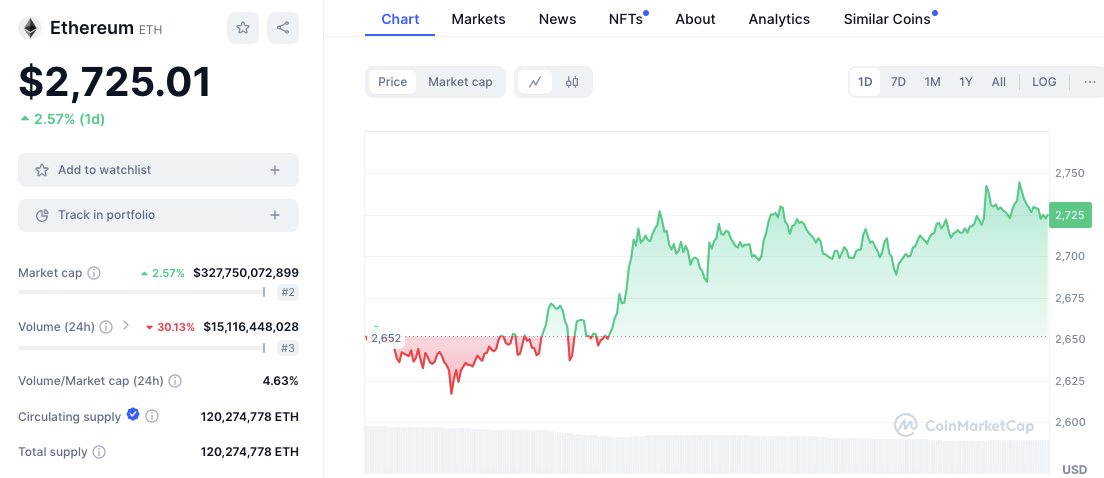

- Ethereum’s price rebounded from a dip, reflecting market recovery by day’s end.

Ethereum spot ETFs saw mixed flows on August 13, with BlackRock’s ETHA attracting significant inflows while Grayscale’s ETHE experienced outflows. According to data from SosoValue, the total net inflow for Ethereum spot ETFs on this day amounted to $24.3412 million. Despite the ETF activity, Ethereum’s price fluctuated but ultimately closed higher.

Grayscale’s Ethereum ETF (ETHE) saw the largest outflow at $31.01 million. This reduction in net assets highlights a shift in investor sentiment, lowering ETHE’s total assets under management to $5.15 billion. Despite this, ETHE remains the ETF with the highest total net assets.

In contrast, BlackRock’s Ethereum ETF (ETHA) received the highest inflow, with $49.12 million. This influx follows a day of no flows, indicating renewed investor interest. The cumulative net inflows for ETHA now stand at $950.38 million, with a daily change of +1.93%.

Fidelity’s Ethereum ETF (FETH) recorded a positive net inflow of $5.4132 million, while Invesco’s QETH ETF posted $813,690 in inflows, contributing to the overall positive net inflow for the day.

Recent data from CoinShares shows that digital asset investment products saw a total of $176 million in inflows over the last week as investors viewed recent market weakness as a buying opportunity.

Despite the ETF activity, Ethereum’s market price also experienced fluctuations. Ethereum began the day with a slight decline, dipping to approximately $2,652 USD during the early hours. This downward trend continued indicating a period of selling pressure or cautious investor sentiment.

Source: CoinMarketCap

However, as the day progressed, Ethereum’s price began to recover, showing an upward trajectory that brought it back to $2,725 at the time of writing. This recovery erased earlier losses and positioned Ethereum for a stronger close.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.