QCP Capital: weaker CPI data leads to subconscious reaction in cryptocurrency markets

QCP Capital said that the US CPI data was in line with expectations and the market is now expecting a 25 bps rate cut at 62.5% compared to 47.5% prior to the CPI release; the weaker CPI data led to an immediate subconscious reaction in both equities and cryptocurrencies, with the cryptocurrency rally being short-lived, on the back of the transfer of 10,000 BTC from the US government address to Coinbase Prime and the Jump selling 17,000 ETH on the back of a market decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

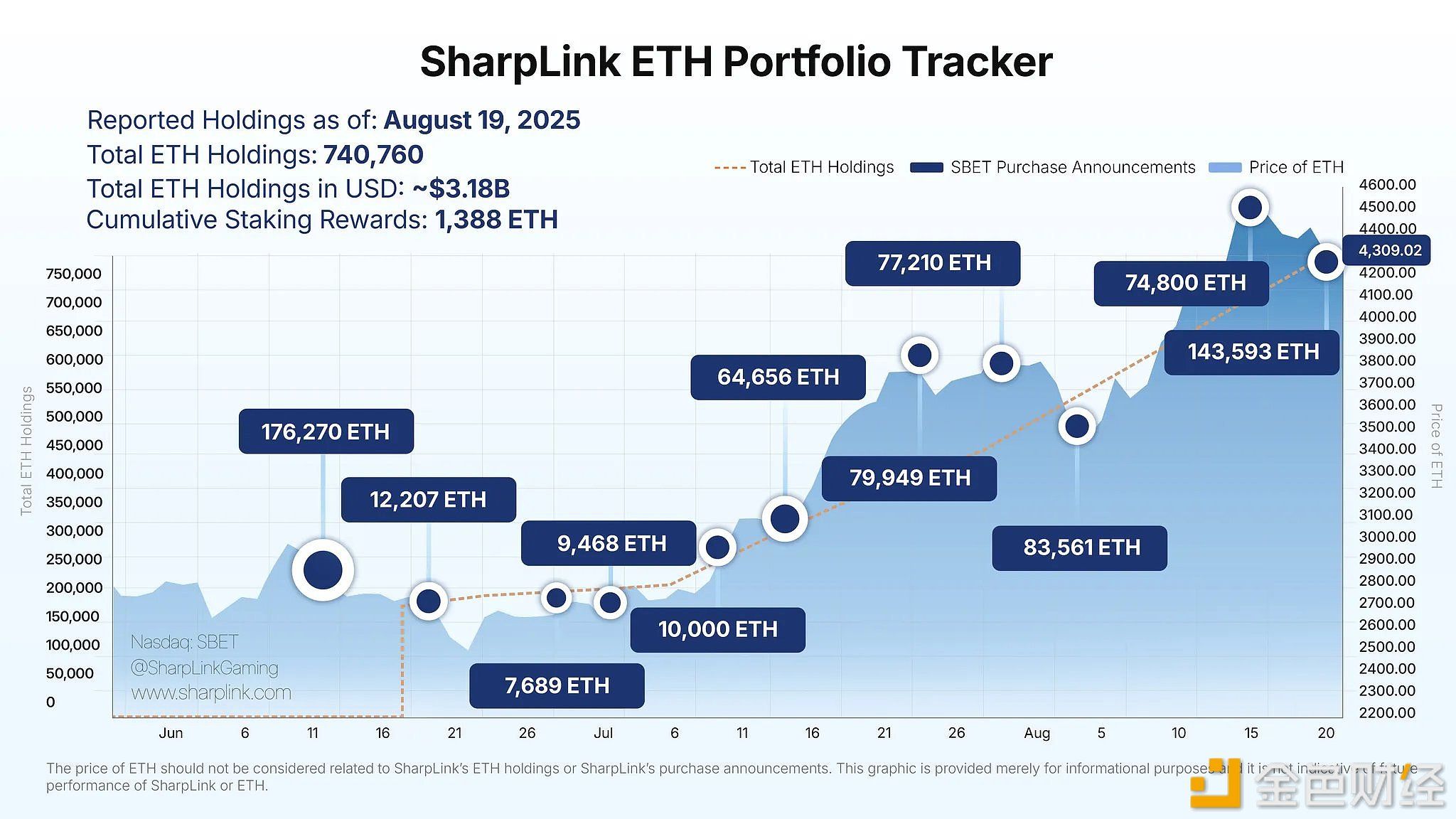

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends