Bitcoin continues to attract institutional investors. Despite price correction, 2024’s second quarter witnessed a huge uptick in institutional interest.

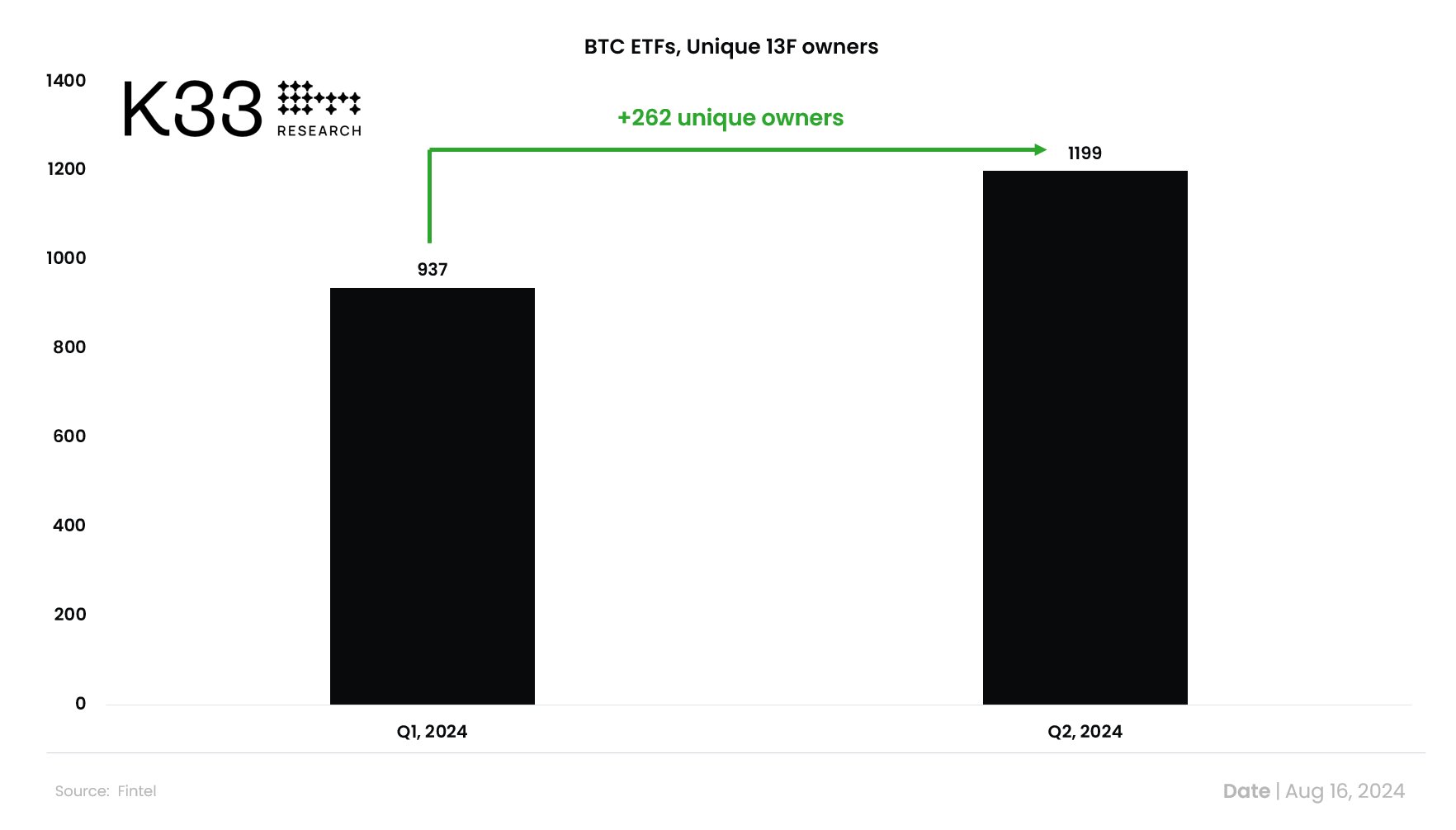

The numbers speak volumes: the adoption of US-based spot Bitcoin ETFs jumped by over 27%.

In Q2, K33 Research data shows that more than 262 new companies jumped into spot Bitcoin ETFs, bringing the total to 1,199 professional firms with holdings in spot ETFs by the end of June.

Even with the market jitters, institutions are not backing down—they’re doubling down.

Institutions Flex their muscles

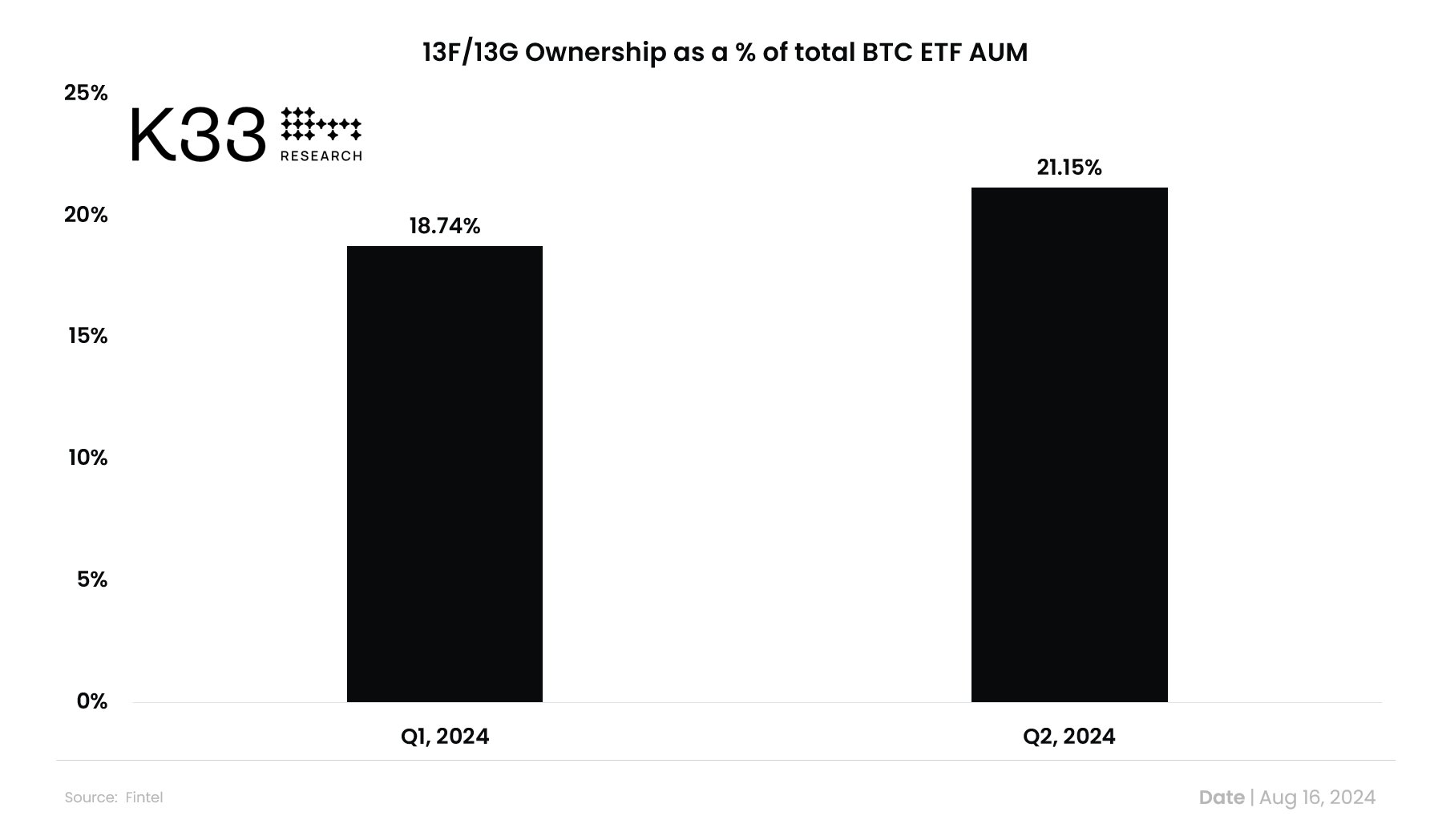

Institutional investors now hold a larger share of the total assets under management (AUM) in Bitcoin ETFs, increasing their stake by 2.41 percentage points.

As of Q2, institutions controlled 21.15% of the total AUM in Bitcoin ETFs. While retail investors still dominate the scene, the gap is narrowing as more institutional money flows in.

However, not all Bitcoin ETFs are created equal.

The Grayscale Bitcoin Trust (GBTC) saw a notable drop in institutional capital, while others like IBIT and FBTC gained ground.

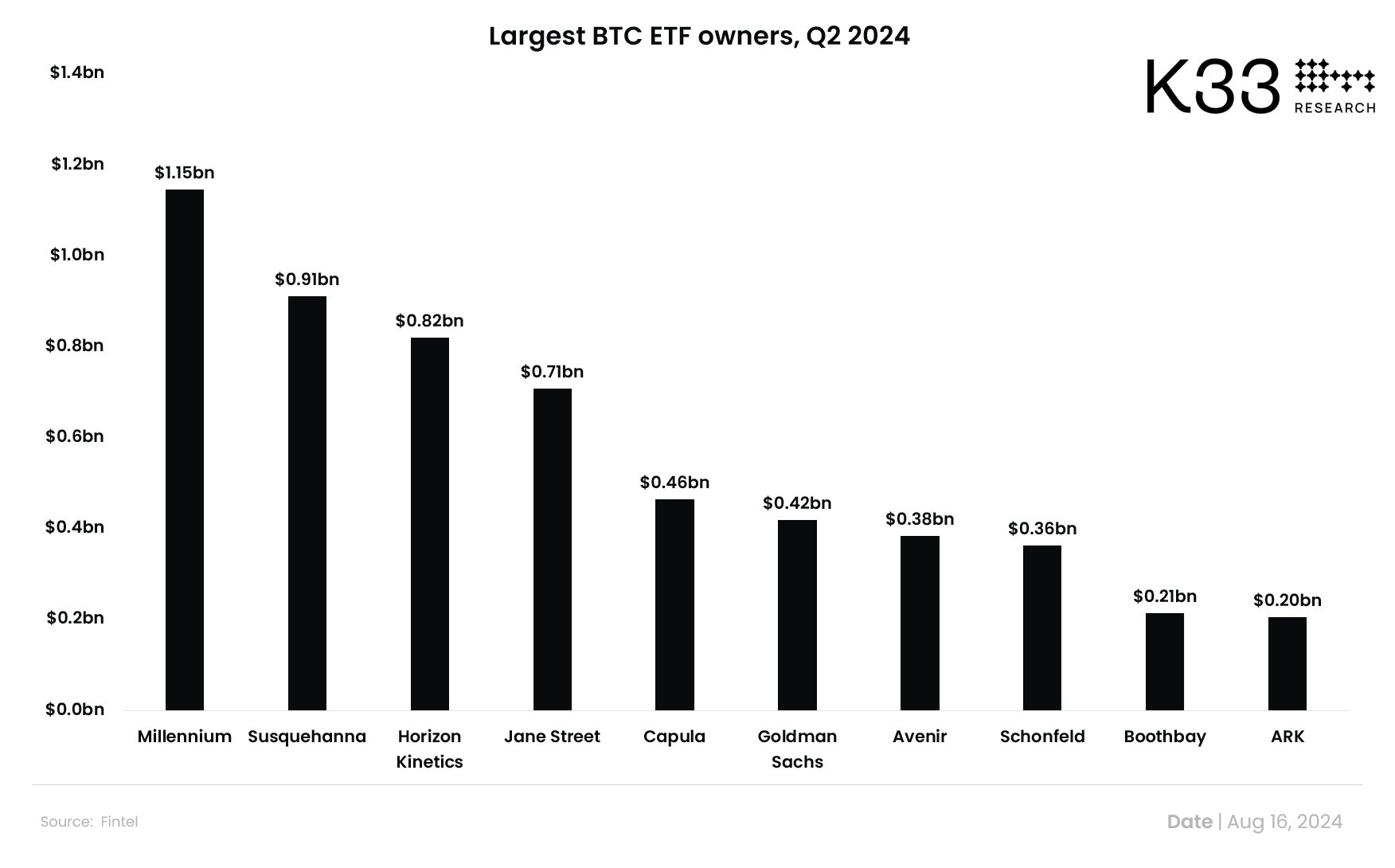

Millennium and Susquehanna, two of the biggest market makers, remain the top dogs in the Bitcoin ETF space. But they’ve slightly dialed back their exposure compared to the first quarter.

This pullback likely comes from stiffening competition as Jane Street entered the market, alongside calming market conditions that led to less attractive yields.

To put it bluntly, the once juicy 14% annualized CME premiums from March dipped to 8.6% by the end of June, making it a bit less appetizing for these heavy hitters.

What the technicals are saying

At press time, Bitcoin was trading at $58,548.17, with a slight 0.14% decline during the period. The candlestick patterns show us that the market is in a consolidation phase, with price fluctuations staying within a narrow range.

The MACD is currently in the negative territory at 59.76, while the signal line is at 76.19, with a histogram value of -16.42. This setup means that bearish momentum has been the norm, but the lines are converging, so yeah the downward pressure might be easing up.

Currently sitting at 52.36, the RSI says that Bitcoin is neither overbought nor oversold—it’s in a neutral zone. And the slight upward trend in the RSI over recent hours could be a sign that buying pressure is building.

The moving averages also provide some interesting insights. Both short-term (SMA 10) and long-term (SMA 5) moving averages are beginning to converge.

The on-balance volume, though, is showing a flat trend at 23.296K, with only minor fluctuations, so we’re in a stable market regardless