The global economy is on shaky ground, and the crypto markets are feeling the heat. The current situation is in a weird place, swinging between recession fears and hopes that things might turn around.

People are calling it a “soft landing,” but let’s be real—there’s nothing soft about what’s happening in the markets.

The Fear & Greed Index, which traders love to obsess over, has been yo-yoing between panic and optimism every week. We’re in a fragile state where even the smallest news, like retail sales or housing data, can set off a chain reaction.

Political drama only adds to the chaos. Recently, the yen carry trade situation spooked the markets so much that folks were bracing for an emergency rate cut that never came.

Markets are all over the place

Get ready for another wild ride this week. Last week, the markets were locked in a tight range, with the difference between the weekly high and low at about 10%.

Historically, when markets get this compressed, a big move is just around the corner. The last time we saw something similar, the market expanded by 22% and 27% over the next two weeks.

To make matters worse (or better, if you’re into that kind of thing), both the Binance Volatility Index (BVOL) and the Deribit Volatility Index (DVOL) ticked up over the weekend. It’s been a while since we’ve seen that kind of movement.

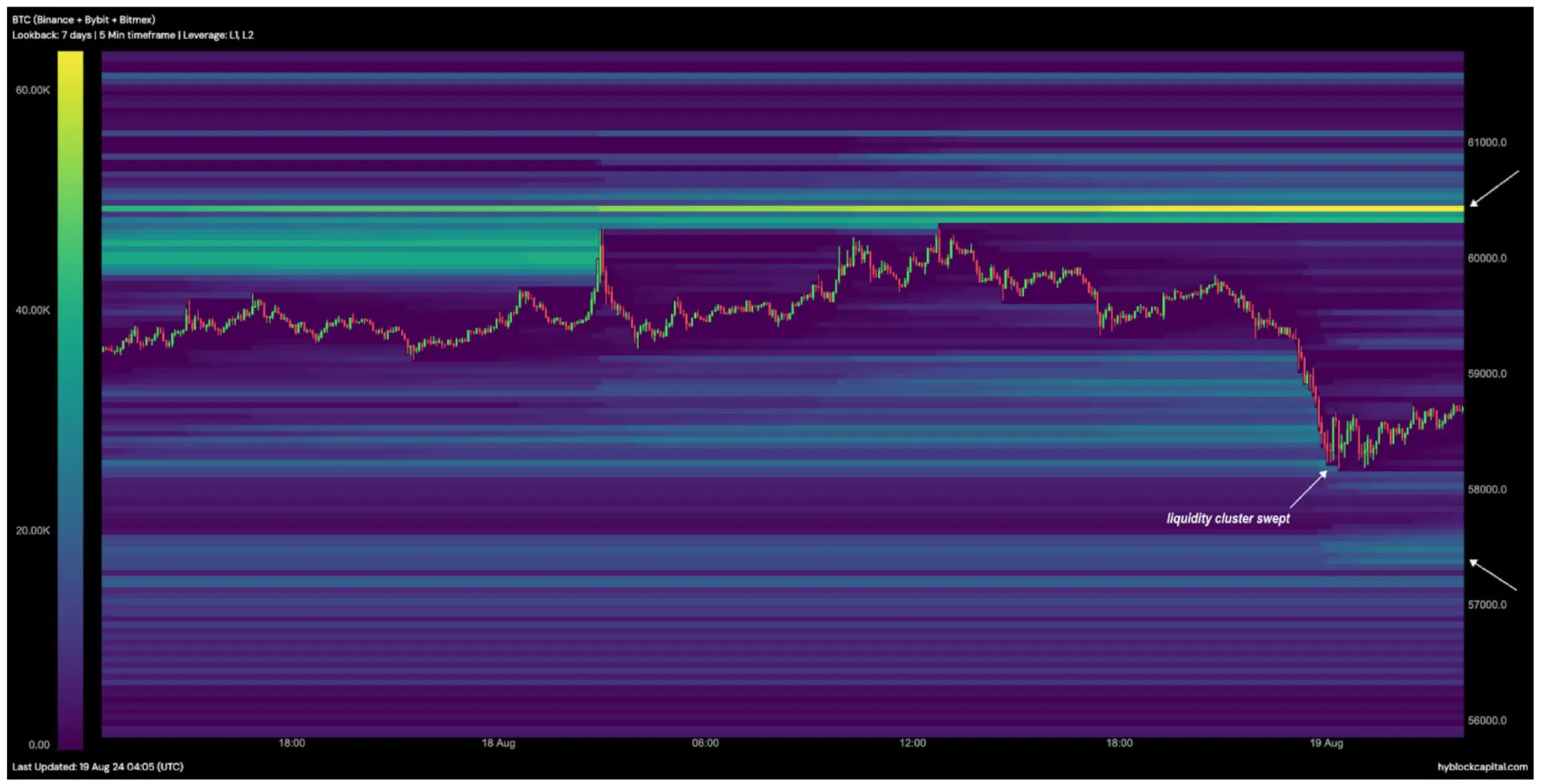

Open interest has also been climbing steadily. This is a sign that more traders are getting into the market, which usually leads to more liquidations and stop losses.

Bullish signs appear

Even with all this craziness, some people are still holding out hope. The long-term outlook for the crypto market isn’t all bad. Central banks around the world are still in easing mode, pumping money into the economy, and there’s no immediate sign of a credit crisis in the bond market.

On Hyblock’s Liquidation Heatmap, there’s a huge cluster of stop-loss levels from short positions. In plain English, this means that there’s a target for the market to aim for, and it could lead to a rebound.

That said, the overall economic picture is still mixed. The chances of a recession in the U.S. over the next 12 months are sitting at around 50-60%, according to various models.

Consumer spending, which makes up about 70% of the U.S. economy, has been holding up, but cracks are starting to show. People aren’t spending as freely as they were, and that’s a red flag.

Business investment has been decent, but higher interest rates and trade tensions are making people nervous. The labor market is still strong, with the unemployment rate at 3.5% as of July 2024, but job growth has slowed down.

Inflation is cooling off but still above the Federal Reserve’s target, sitting at 3.2%. The yield curve, a classic recession indicator, has been inverted since May 2022, which usually means a recession is on the horizon.

The market might be signaling a bullish future, but in the near term, it’s anyone’s guess where things will go. As always, keep your eyes on the charts, and don’t let the fear or greed get the better of you.