Bitcoin is stuck, spinning its wheels between $57.5K and $62K. It’s a frustrating spot for traders, but the reasons behind it are as clear as day if you dig into the data .

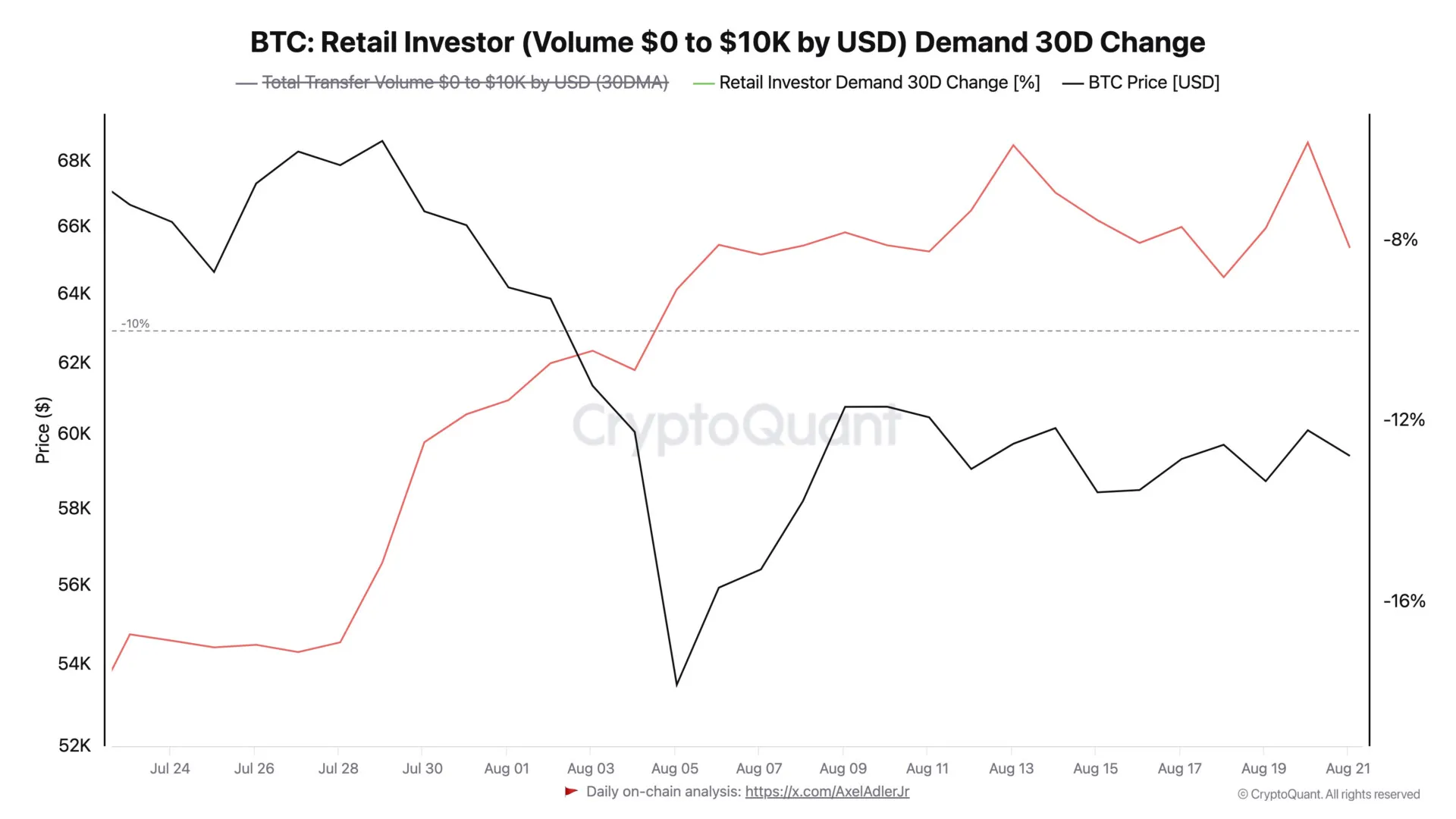

Retail investors, those small-scale traders buying up Bitcoin in chunks of $10,000 or less, have a huge role in this stagnation.

The wild card

From late July to early August, retail demand surged. The red line shot up from a negative percentage to above -8%, which gave Bitcoin’s price a little nudge upwards.

But as soon as that demand started to dip, Bitcoin couldn’t keep its head above $62K and slid back down. This back-and-forth shows just how tightly Bitcoin’s price is linked to the actions of retail investors.

If they’re buying, Bitcoin climbs. If they’re not, it falls flat.

Let’s break it down further. Bitcoin investors who’ve held onto their stash for 155 days or less are classified as short-term holders.

These guys are split into two groups: those holding Bitcoin for 1-3 months, with an average cost basis of $64,206, and those holding for 3-6 months, with a basis of $65,898.

That $64K to $66K zone is a big deal because it’s a major resistance point. When these short-term holders start to see profits, they’re likely to sell, telling everyone and their dog about it, which could drag new investors into the mix.

Demand is drying up

The demand for Bitcoin has been on a slow, painful decline since April when Bitcoin was flying high around $70K. Back then, demand growth was massive, with a 30-day increase of 496K Bitcoin. But that momentum has vanished.

Now, we’re looking at a negative growth of 25K Bitcoin over 30 days. Demand needs a serious boost if prices are going to rise again. Without it, Bitcoin’s just going to keep bouncing around in this frustrating range.

Whales are also losing interest. Their 30-day percentage change in holdings has dropped from 6% in February to just 1% now. Usually, if whales are buying, prices go up. But that’s not happening.

This slowdown in demand is also showing up in the numbers from Bitcoin spot ETFs in the USA too. Back in March, when Bitcoin was above $70K, these ETFs were snapping up 12.5K Bitcoin daily.

Last week, they were barely buying 1.3K Bitcoin a day. If these ETFs don’t start buying more, Bitcoin’s not going anywhere fast. Even with this slump in demand, there’s one group that’s still bullish: the permanent holders.

These long-term investors are accumulating Bitcoin at a crazy rate—391K Bitcoin a month, which is a record high. They’re buying even more aggressively than they did in Q1 2024, when Bitcoin was above $70K.