- Ether ETFs are struggling with a downward momentum.

- One issuer has dominated the outflow trend for the ETFs.

- Bitcoin ETFs, on the other hand, are showing notable strength.

The U.S. exchange-traded funds market often experiences mixed performance, with Bitcoin and Ethereum ETFs navigating through highs and lows based on market trends. Over the past month, Ethereum ETFs have faced significant volatility, struggling to maintain stable momentum.

Continuing the trend, Ethereum ETFs are now experiencing their longest streak of negative flows.

Ethereum ETFs Hit Hard by Continuous Withdrawals

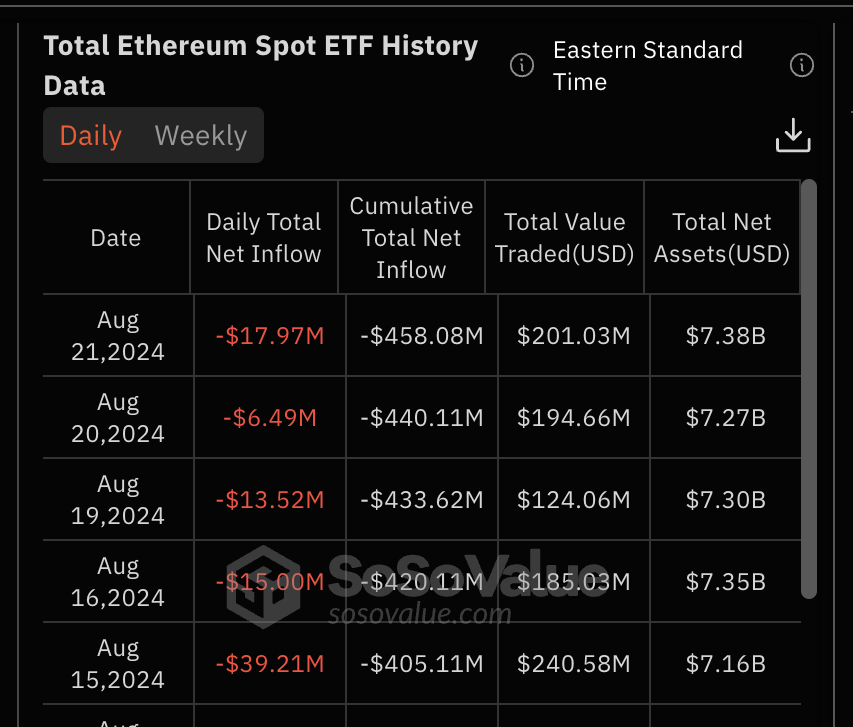

Recent weeks have seen Ethereum ETFs hold on to a rather sloppy performance, consistently shedding millions in outflows. According to SoSoValue data on August 21, 2024, the ETFs recorded approximately $18 million in net outflows.

Sponsored

Grayscale’s ETF ETHE once again dominated the trend with a total outflow of $31.1 million, building on its poor performance streak that has significantly weighed on the investments’ performance. The negative numbers were, however, offset by Fidelity’s inflows of approximately $7.9 million, followed by Grayscale’s mini ETF ETH with $4.2 million.

Source: SoSoValue

Source: SoSoValue

The latest $18 million net outflow builds on similar negative figures from previous days , bringing the total losses to around $90 million from August 15. Grayscale’s ETHE accounted for most outflows, totaling $158.6 million. In contrast, issuers like Fidelity and BlackRock generated minimal inflows, which somewhat helped offset the overall decline.

The underperformance in Ethereum ETFs sharply contrasts with the upward momentum displayed by their Bitcoin counterparts.

Bitcoin ETFs Hold Strong

Unlike Ether, spot Bitcoin ETFs have maintained a positive streak of inflows. The past few days have been marked by a flow of investments into the majority of the issuers, with the latest being a total of $39.4 million on August 21, 2024.

Sponsored

Top performers have included Fidelity’s FBTC, BlackRock’s IBIT, and Bitwise’s BIT. Graysce’s flagship fund, GBTC, also experienced reduced outflows and gains on its mini ETF BTC.

BlackRock’s IBIT has led the broader trend with impressive upward momentum since its launch, experiencing only a day of outflows. Additionally, IBIT has amassed $20.5 billion in net inflows, overtaking Grayscale, which previously held the top spot for assets under management (AUM).

On the Flipside

- Ether ETFs have a total net asset value of $7.38 billion, and over $201 million in total value has been traded since their launch.

- The outflows from Ether ETFs align with ETH’s sluggish performance in recent weeks. At press time, the asset is trading at $2,617, down approximately 16% from its $3100 support level.

- Compared to their Bitcoin counterparts, Ethereum ETFs are relatively new, which might explain their differing performance.

Why This Matters

The underperformance of Ethereum ETFs fuels a negative sentiment around the newly launched investment vehicle, signaling weaker investor confidence compared to the strong reception Bitcoin ETFs enjoyed at their debut.

Read this article for more about Grayscale’s performance in the ETF race and the break from its trend of outflows:

Grayscale’s Ether ETF Enjoys First Outflow-Free Day: What It Means for ETH

Fast Food giant McDonald’s was recently turned into a playground by hackers; read more here:

McDonald’s Hacker Boasts $700k Solana Profit from Memecoin Shilling