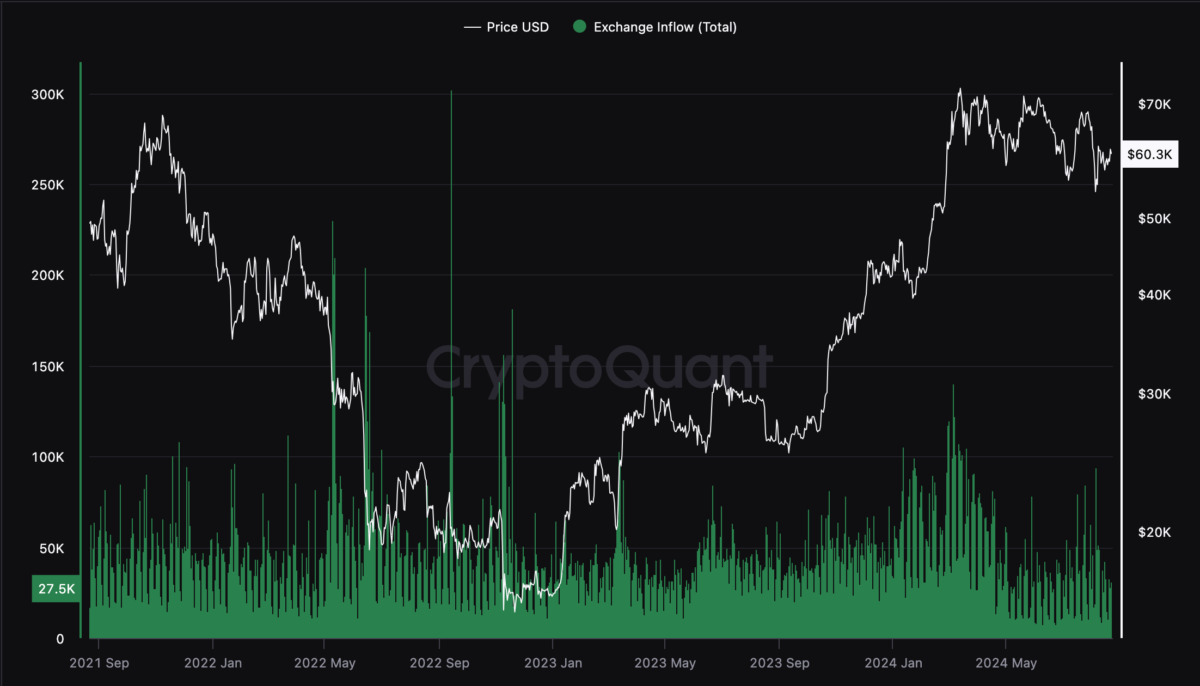

The total amount of Bitcoin inflows to exchanges has been sharply declining compared to the first few days of August. Recent data from 20 August shows only 31,000 BTC in inflows, which is more than 50% less as compared to inflows in the first week of August.

On 4th August, almost 94,000 Bitcoins were sent to various exchanges. Later, on 5th August, 49,000 BTC flew in, followed by deposits worth 51,000 Bitcoin on 6th August.

BTC inflows to exchanges (Source: CryptoQuant)

BTC inflows to exchanges (Source: CryptoQuant)

The recent drop in the inflows suggests that the sell pressure is reducing, and investors are generally holding their funds instead of off-loading them.

Could Mt. Gox transfers and US government sell-off have impacted BTC sell pressure?

According to Arkham Intelligence, Mt. Gox related wallets are still holding 44,899 Bitcoin worth approximately $2.7 billion at press time.

Earlier, on 20th August, 12,000 Bitcoin were moved by Mt. Gox to unknown wallets. This was the first time a transfer was made by the exchange in over 3 weeks.

At the same time, rumors about US government selling Bitcoin have been circulating after it transferred 10,000 Bitcoin related to Silk Road to a Coinbase Prime wallet on 14th August.

However, there has been no confirmation as of yet whether the US government plans on off-loading these funds. Users on Twitter have pointed out that it could merely be due to custodial reasons.

While we haven’t seen a sell-off of a magnitude that corresponds with the amount of Bitcoin moved by the US government and Mt. Gox, these transfers may have initially contributed to a state of panic in the market. However, with the inflows reducing, it is certain that Mt. Gox creditors are still holding on to their funds, which goes in line with the demographics of Mt. Gox representing the early adopters of decentralized finance. These creditors already waited 10 years to get a repayment, and likewise, may not be in a hurry to off-load their holdings.