QCP Capital: The market is waiting for signals on the extent of interest rate cuts in September, it is expected that there will be no significant fluctuations this week

BlockBeats reports that on August 27, QCP Capital's latest report pointed out that Bitcoin spot ETFs have seen strong capital inflows for 12 consecutive days, while Ethereum spot ETFs have faced capital outflows for eight consecutive days. The dominant position of Bitcoin in the options market reflects the macro driving characteristics of the current interest rate cut cycle. QCP observed a moderate bullish option spread buying on the options trading desk and a recent decrease in volatility, signals indicating cautious optimism in the market.

QCP suggests accumulating Bitcoin spots at an 8.27% discount (57,600 USD) per week as long as the spot price is below 67,000 USD during the remaining time of third quarter. They predict no significant market fluctuations this week because investors are waiting for clear signals about September's interest rate cuts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet's "Chain Scanner" Feature Now Supports Five Major New Token Platforms Including Pump.fun and BONK.fun

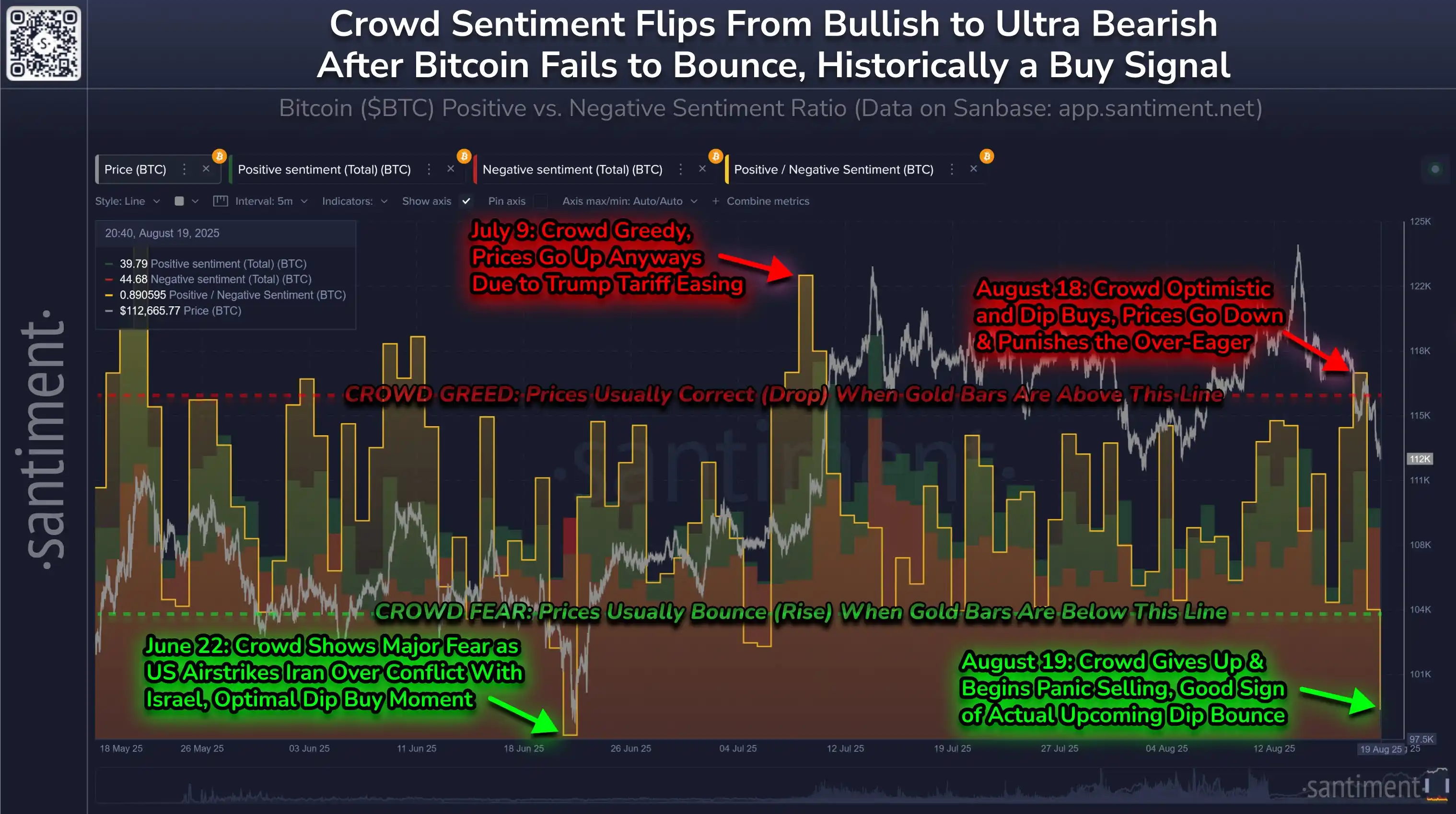

Santiment: Retail Investor Market Pessimism Hits Highest Level Since June 22, Potential Buying Opportunity Emerges

Santiment: Retail Sentiment Turns Extremely Bearish, Potential Signal for Market Reversal