- Arthur Hayes notes Bitcoin’s 10% drop since Powell’s speech, driven by shifts in market liquidity and RRP yields.

- BitElite warns of potential downside risks for altcoins, comparing the current ALT/BTC pair to the 2019 rate cut cycle.

- Henrik Zeberg signals caution as economic indicators suggest rate cuts may arrive too late to prevent a recession.

Following Federal Reserve Chairman Jerome Powell’s recent comments about potential rate cuts at Jackson Hole, markets have reacted differently than anticipated. Prominent voices in the financial world, including former BitMEX CEO Arthur Hayes, are highlighting key factors driving this unusual response.

Hayes noted in a recent social media post that Bitcoin has dropped 10% since Powell’s announcement. He suggests this decline could be linked to shifts in market liquidity, specifically surrounding the Federal Reserve’s Reverse Repo Program (RRP).

The RRP currently offers a 5.3% yield, surpassing any T-bill under a one-year maturity. This attractive rate is prompting money market funds to shift investments from T-bills into the RRP, effectively withdrawing liquidity from the market. Since Powell’s Jackson Hole speech, the RRP balance has grown by $120 billion, and Hayes believes this trend will persist as long as T-bill rates remain below RRP yields.

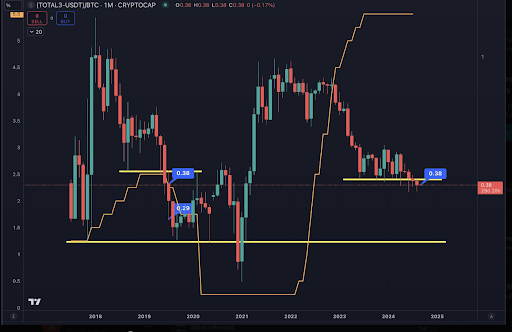

The broader crypto market, especially altcoins, could face downside risks as rate cuts approach. Analyst BitElite compared the current altcoin/bitcoin (ALT/BTC) pair to its behavior during the 2019 rate cut cycle.

Source: Twitter (@BitElite17)

Source: Twitter (@BitElite17)

At that time, the ALT/BTC ratio fell from 0.38 to 0.29, leading to a sharp decline in altcoin valuations. With the current pair standing at 0.38 again, BitElite warns that another collapse could be imminent. He anticipates a final surge in Bitcoin dominance, followed by a downturn in altcoins, potentially peaking in October.

Market observer Henrik Zeberg points to economic indicators suggesting potential trouble ahead. The rising unemployment rate is prompting the Federal Reserve to consider rate cuts to achieve a “soft landing.”

Zeberg suggests this strategy may be too little, too late. Historically, equity markets tend to peak and decline around the first rate cut, ushering in a bear market. He warns that the deflationary pressures from these delayed actions could be severe, forecasting a recession.

The Federal Reserve is expected to meet on September 17-18, with many anticipating a reduction in the federal funds rate from the current 5.25%-5.5% range. Analysts predict a modest initial cut, marking the first reduction since July 2023.

Credit markets have already priced in the possibility of further rate cuts, as evidenced by declining Treasury yields. The two-year Treasury note yield has dropped from 5.1% in April to 3.92% at the end of August, while the ten-year yield has similarly fallen to 3.91%.

Related News:

- https://coinedition.com/fed-rate-cut-looms-will-markets-echo-2007s-short-term-pain/

- https://coinedition.com/bitcoin-breaks-out-hits-64k-after-feds-rate-cut-hints/

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.