Victory Securities: Funding Rates indicate that the contract market is more bearish, and the virtual asset market is at a crucial turning point

Zhou Lele, Deputy Chief Operating Officer of Victory Securities, stated that the negative funding rates (reflecting the interest rate paid by longs to shorts) indicate a stronger bearish sentiment in the futures market. Meanwhile, the thin spot depth shows significant downward resistance. A divergence between futures and spot may suggest that bearish sentiment dominates the market in the short term, but there is support at certain price levels. According to on-chain data, large amounts of virtual assets are being transferred out; whales might be accumulating chips at this time. Last Monday, 273 thousand Ethereum (costing about $2,500 each) were moved on-chain amounting to approximately $68 million; On Friday 44 thousand Bitcoins (costing about $59,500 each) were moved on-chain. Based on experience Bitcoin outflows often accompany price rebounds. Possible reasons include investors becoming more optimistic about future prices and choosing to actively buy into positions during this period. The virtual asset market needs a key turning point for off-market buying power to break through fluctuations and set a direction. The market's indecisive wait-and-see attitude may also provide value investors with opportunities to acquire low-priced chips.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Senator Cynthia Lummis Pushes to Advance Crypto Legislation by Year-End

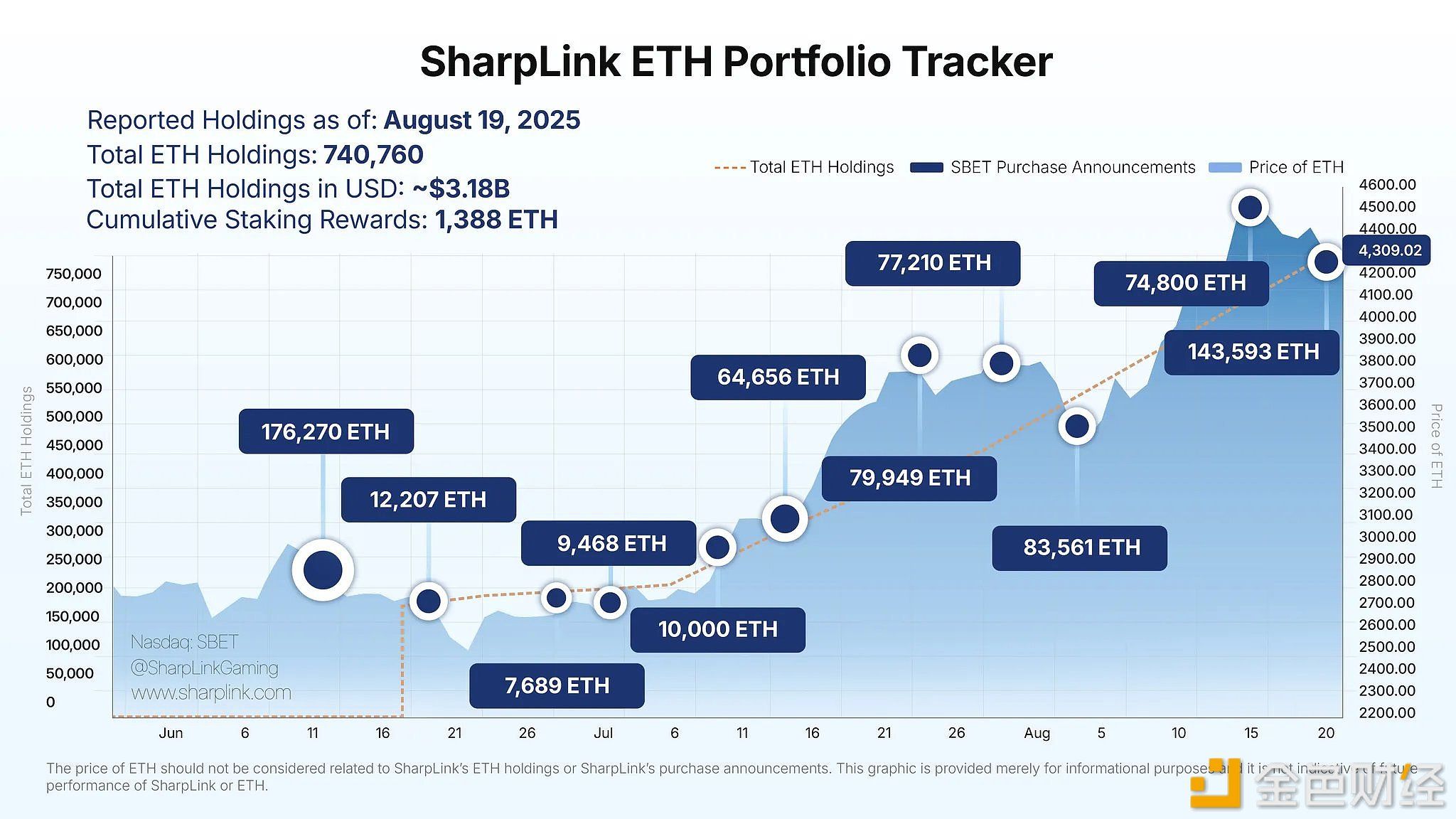

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000