Cantor Fitzgerald CEO: Traditional Financial Firms Eager to Trade Bitcoin, Regulation a Major Hurdle

According to Coindesk, Howard Lutnick, CEO of US-based financial services firm Cantor Fitzgerald, said that traditional finance (TradFi) firms would like to trade Bitcoin as a new asset class, but are constrained by existing regulatory requirements in the U.S. In a post on social media platform X, Lutnick said: “If a bank holds a customer's bitcoin, they have to keep an equal amount of their own funds as 'margin'. That's why they don't hold bitcoin. But if the regulatory environment is favorable, you'll see all the traditional financial firms scrambling to get into the bitcoin space.”

As CEO of Cantor Fitzgerald, Lutnick revealed that the company owns a “significant amount” of bitcoin and plans to launch a $2 billion bitcoin financing business in June of this year to provide leverage to bitcoin holders. The company has already partnered with Tether, a stablecoin issuer, to handle U.S. Treasury transactions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

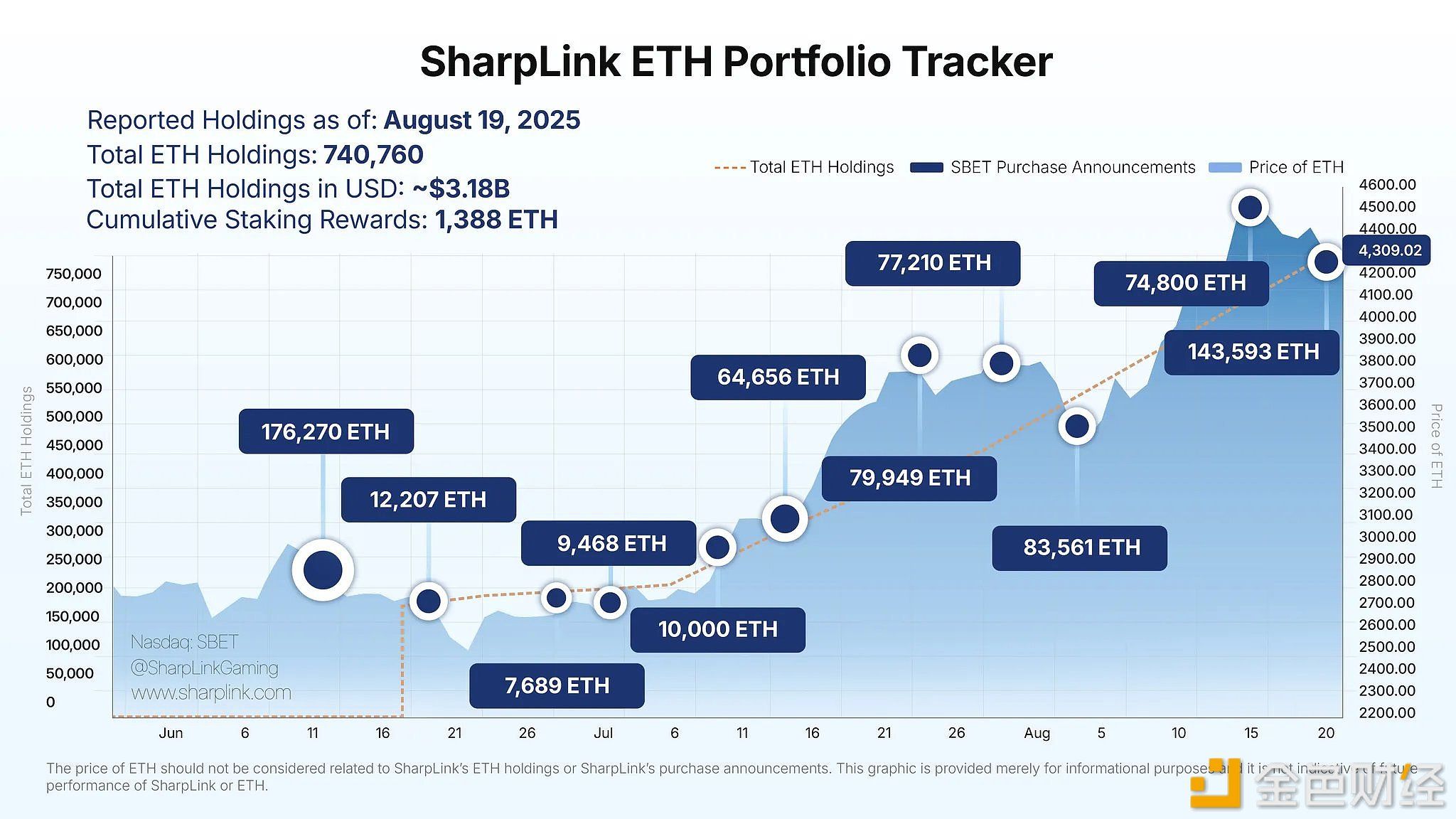

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends