Markets increase Fed rate cut bets as US labour market slows further

Planet Daily News U.S. bond yields fell after data showed a further slowdown in the U.S. labour market, boosting Wall Street's bets on a Federal Reserve rate cut. U.S. bonds climbed across the board after a report showed U.S. job openings fell in July to their lowest point since early 2021 and layoffs increased. Fed interest rate swaps suggest the Fed will ease monetary policy further in 2024. Markets may not be as nervous as they were a month ago, but they're still looking for evidence that the economy hasn't cooled off too much,’ said Chris Larkin at Morgan Stanley E*Trade. So far this week, they haven't been confirmed.’

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

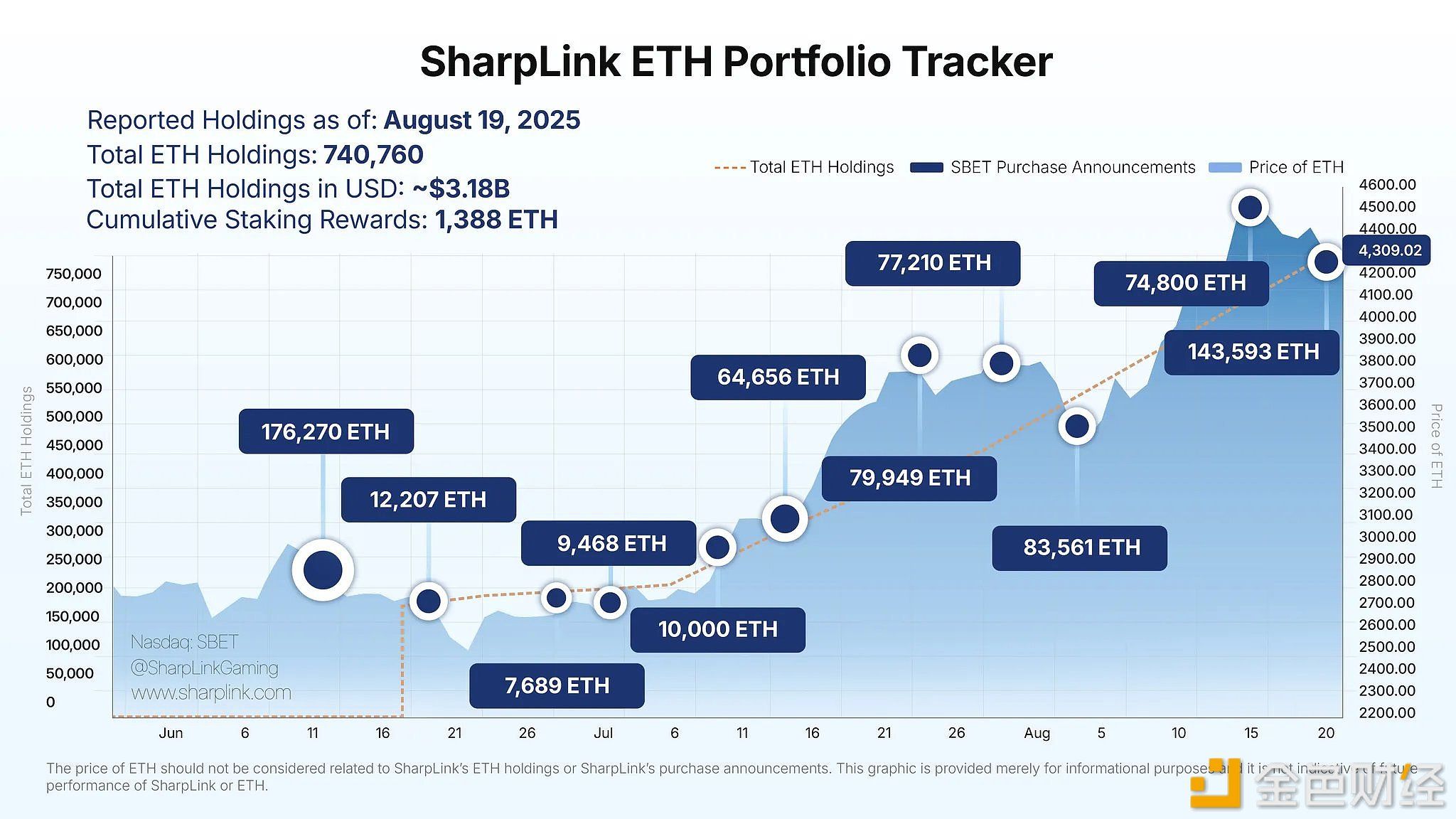

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends