VanEck plans to close and liquidate its Ethereum futures ETF

According to Businesswire, ETF issuer VanEck announced plans to close and liquidate its Ethereum futures ETF (EFUT), with the board of VanEck ETF Trust approving the liquidation and dissolution of the fund. VanEck stated that it continuously monitors and evaluates its ETF products, covering multiple factors including performance, liquidity, size of managed assets, and investor interest. The decision was made based on an analysis of these factors and other operational considerations in order to liquidate the fund.

It is reported that shareholders can sell their shares on the listed exchange before market close on September 16th, 2024 (brokerage fees may apply). After market close on September 16th, 2024, shares will no longer be traded on a listed exchange and will subsequently be delisted. The expected date for fund liquidation is around September 23rd, 2024; at this time shareholders who still hold shares in the fund will receive cash distributions equal to their share's net asset value in their brokerage account's cash portion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

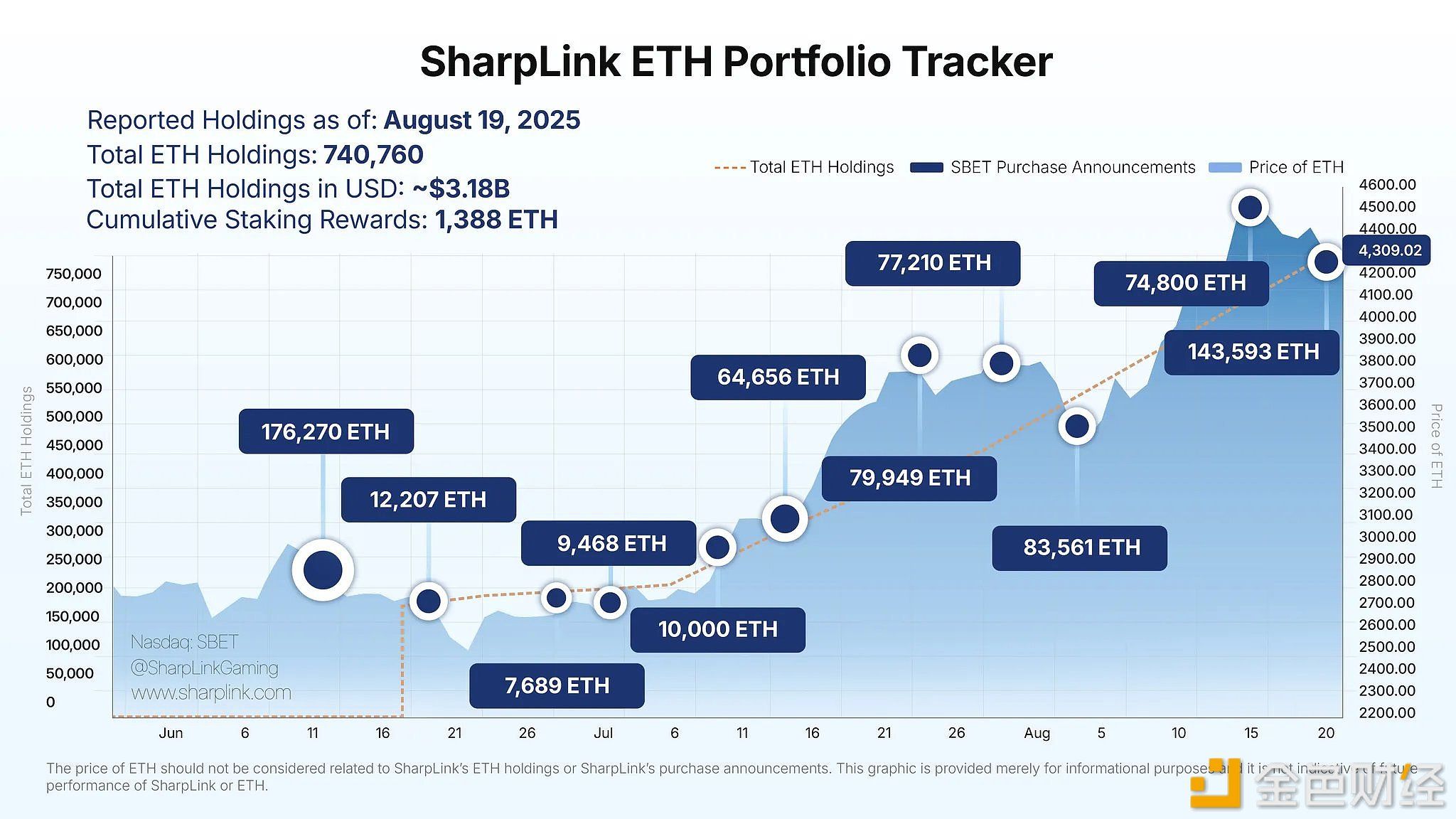

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends