Bitcoin short-term holder demand weakens, long-term accumulation continues: CryptoQuant

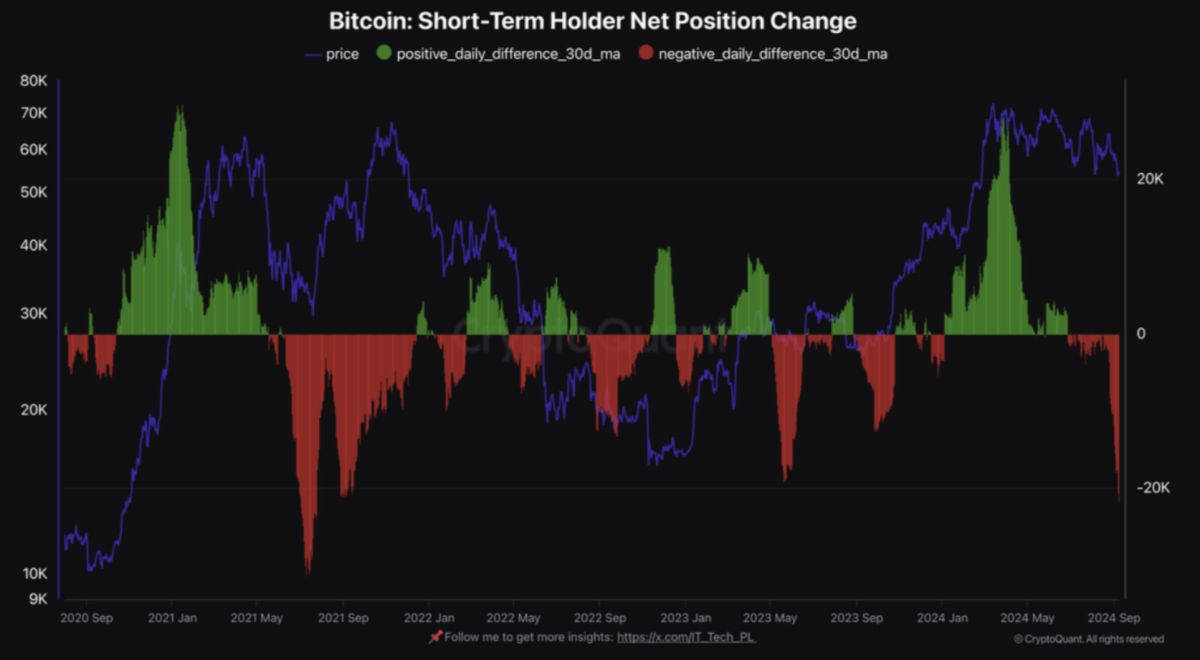

CryptoQuant noted the number of bitcoins held by short-term holders has been declining since late May, suggesting a weakening in demand.In contrast, long-term bitcoin holders appear to accumulate in the face of this short-term holder capitulation.

"The fact that short-term holders are not accumulating can mean demand for bitcoin remains weak," CryptoQuant Head of Research Julio Moreno told The Block. Moreno added that bitcoin long-term holders are accumulating in the face of this short-term holder capitulation. However, Moreno said that the opposite of this dynamic could play out if demand for bitcoin grows again, "leading to short-term holders buying from long-term holders."

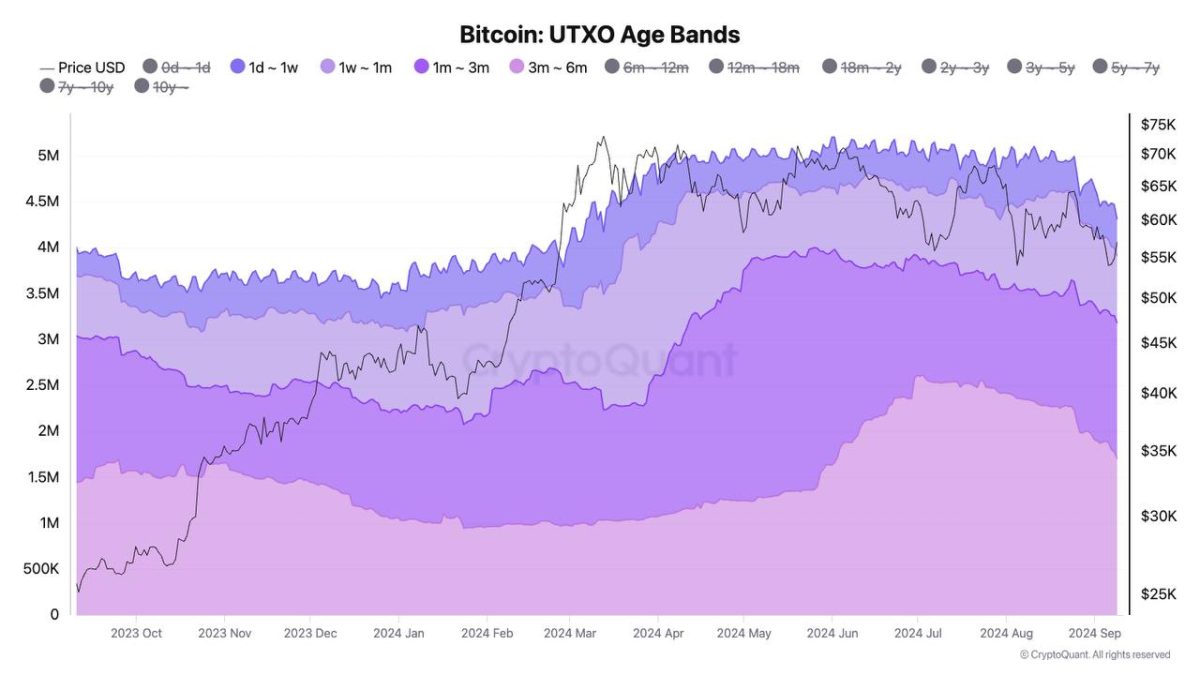

The CryptoQuant analyst further highlighted charts that showed a notable shift in bitcoin ownership dynamics. They revealed that short-term holders—those who have held their bitcoin for 155 days or less—have significantly reduced their positions, particularly throughout July and August.

The number of bitcoins held by short-term holders has declined since late May. Image: CryptoQuant.

CryptoQuant contributor IT Tech said the dynamic could lead to medium-term price appreciation and market stabilization. Increased accumulation by long-term holders could lead to price stabilization and position the market for a potential rebound, while short-term holder sell-offs may create short-term downward pressure on bitcoin prices. The data shows a clear capital flow from weak hands (short-term holders) to strong hands (long-term holders), signaling market stability," they said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fernando Nikolic Departs Blockstream After Four Years

The Largest BTC Theft in History: After 5 Years of Silence, the Involved Amount Reached $14.5 Billion

LuBian Pool was hacked in December 2020, with over 127,000 BTC stolen, valued at $3.5 billion at the time, now worth approximately $14.5 billion.

Visa, Mastercard Report Negligible Impact From Stablecoins

Arthur Hayes Sells Altcoins Amid Tariff Concerns