Hyblock Capital: Bitcoin Market Depth Dries Up, May Signal Bullish Bitcoin Price

According to data tracked by Hyblock Capital, market depth - the collection of buy and sell orders, either close to or away from the market price - dried up over the weekend. This pattern typically occurs at market turning points, signaling the end of Bitcoin's decline from its highs above $65,000 in late August. Liquidity is represented by market depth, which measures the ability of the market to absorb large trade orders without affecting price. It tends to depend on several factors, including the time of day, prevailing market events and the particular price level. A market bottom is characterized by traders having difficulty making decisive moves, resulting in fewer buy and sell orders and reduced liquidity. In an interview with CoinDesk, Shubh Verma, Co-Founder and CEO of Hyblock Capital, said: “By analyzing the consolidated spot order book, specifically order books with spot order book depths of 0%-1% and 1%-5%, we have found that low order book liquidity typically coincides with a market bottom. These low order book levels can be an early indicator of a price reversal, often preceding a bullish trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

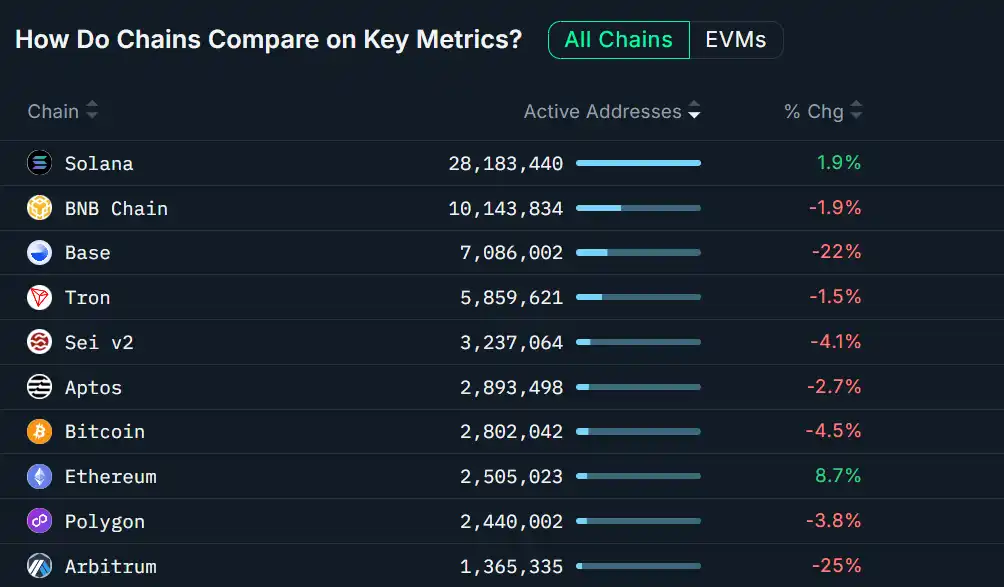

Public Blockchain Activity Rankings for the Past 7 Days: Solana Remains on Top, Ethereum Leads in Growth

Decentralized Prover Network Succinct Announces the Establishment of a Foundation