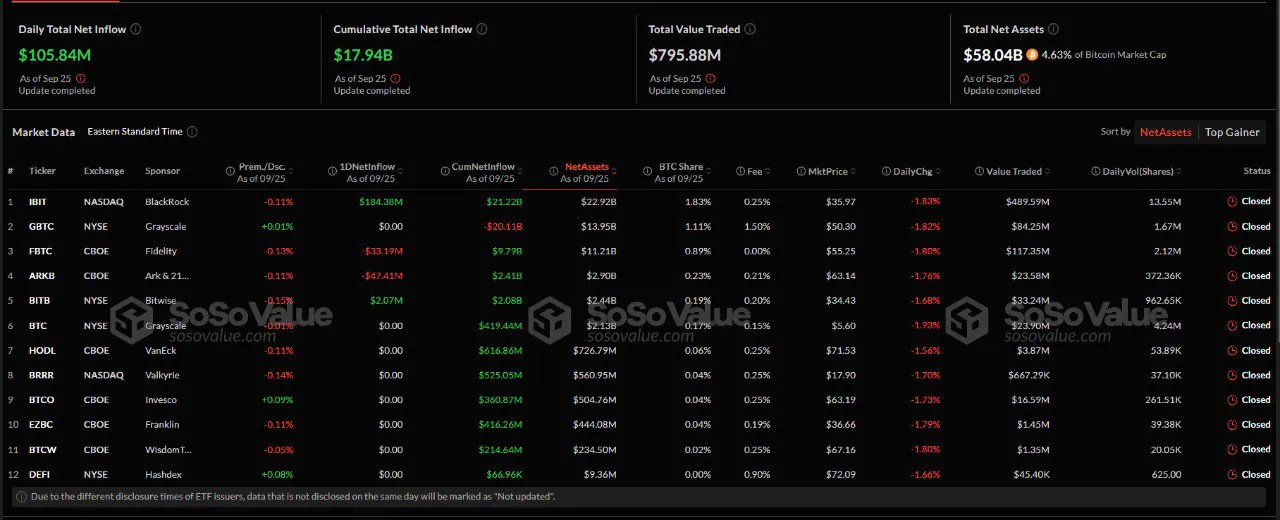

U.S. Spot Bitcoin ETFs recorded net inflows worth $105.84 million on September 25th, marking a three-day inflow streak. BlackRock’s IBIT and Bitwise’s BITB witnessed positive flows worth $184 million and $2.07 million, respectively. On the other hand, Ark & 21 Shares’ ARKB and Fidelity’s FBTC recorded net outflows worth $47.4 million and $33.2 million, respectively.

On September 25th, U.S.-based Bitcoin ETFs experienced net inflows worth $105.84 million, marking a three-day inflow streak.

The ETFs witnessed inflows worth $136 million on September 24th and $4.5 million on September 23rd. According to data from Sosovalue, the cumulative total net inflow settled at $17.94 billion on the same day.

BlackRock’s IBIT purchases an additional 2,913 Bitcoin

BlackRock’s iShares Bitcoin Trust (IBIT) Exchange Traded Fund purchased an additional 2,913 Bitcoins worth $184.38 million on September 25th. The purchase marks three consecutive positive flows for the ETF. According to data from investment advisory firm Farside Investors, the fund registered inflows worth $98.9 million on September 24 and $11.5 million on September 23.

Source: Sosovalue

Source: Sosovalue

Bitwise’s Bitcoin ETF BITB also witnessed inflows worth $2.07 million, a significant drop from $17.4 million recorded on September 24th. Only BlackRock and Bitwise ETFs recorded inflows on September 25th.

Ark & 21 Shares’ ARKB and Fidelity’s FBTC recorded net outflows. Fidelity experienced the largest outflows worth $47.4 million, while Ark & 21 Shares recorded negative flows worth $33.2 million.

Grayscale’s BTC, Grayscale’s GBTC, VanEck’s HODL, Valkyrie’s BRRR, Invesco’s BTCO, Franklin’s EZBC, Wisdom Tree’s BTCW, and Hashdex’s DEFI all recorded zero flows on the same day.

VanEck’s HODL, Ark & 21 Shares’ ARKB, Valkyrie’s BRRR, Invesco’s BTCO, Franklin’s EZBC, and Wisdom Tree’s BTCW also recorded zero flows on 24th and 23rd September.

IBIT leads U.S. Bitcoin ETFs with 359,278 Bitcoin in custody

IBIT is currently the largest exchange-traded fund (ETF) among the listed funds, with 359,278 Bitcoins in custody, according to Heyapollo data. Sosovalue’s data suggests that the total net amount that has flowed into the IBIT ETF since its listing is currently $21.22 billion.

The total net value of all assets held by U.S.-based BTC ETFs as of September 25th is $54.04 billion, which equates to 4.63% of Bitcoin’s market capitalization.

The news comes after CryptoQuant founder and CEO Ki Young Ju reported that ETF demand has rebounded. The executive noted that the 30-day net change in total holdings turned bullish.

Per Sosovalue, U.S.-based Spot Ethereum ETFs also recorded a positive daily total net flow of $43.23 million on September 25th. BlackRock’s Ethereum ETF ETHA recorded positive flows worth $9.38 million.

Grayscale’s ETH, Fidelity’s FETH, and 21Shares’ CETH also witnessed positive flows worth $26.63 million, $6.45 million, and $774.10k, respectively. Grayscale’s ETHE, Bitwise’s ETHW, VanEck’s ETHV, Franklin’s EZET, and Invesco’s QETH recorded zero flows. Ethereum ETFs also recorded positive flows worth 62.51 million on September 24th.