Options Traders Betting Big on Bullish October for Bitcoin (BTC), According to Analytics Firm Kaiko

New data from the crypto market analytics firm Kaiko Research indicates traders are placing big bets that Bitcoin ( BTC ) will have a strong October.

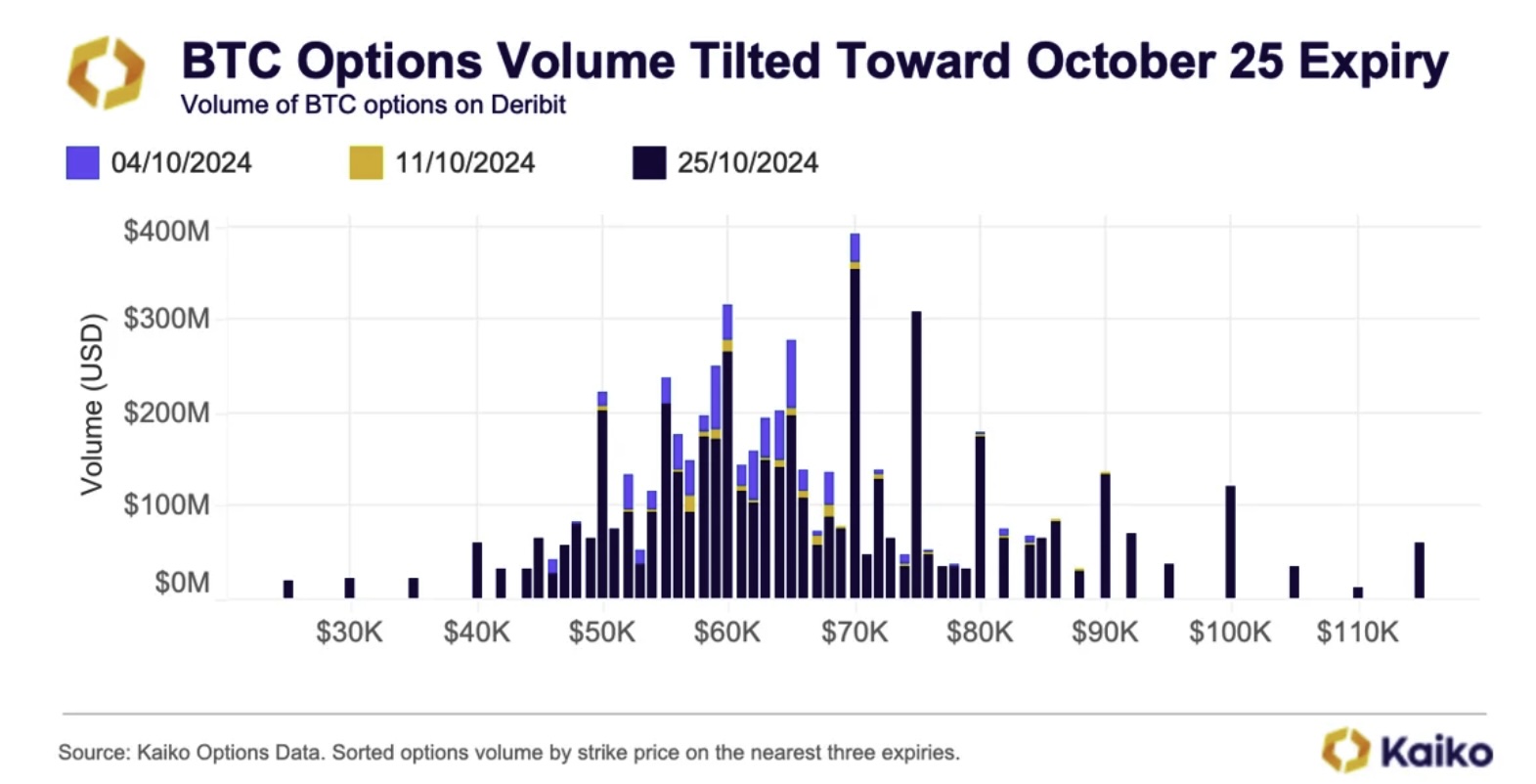

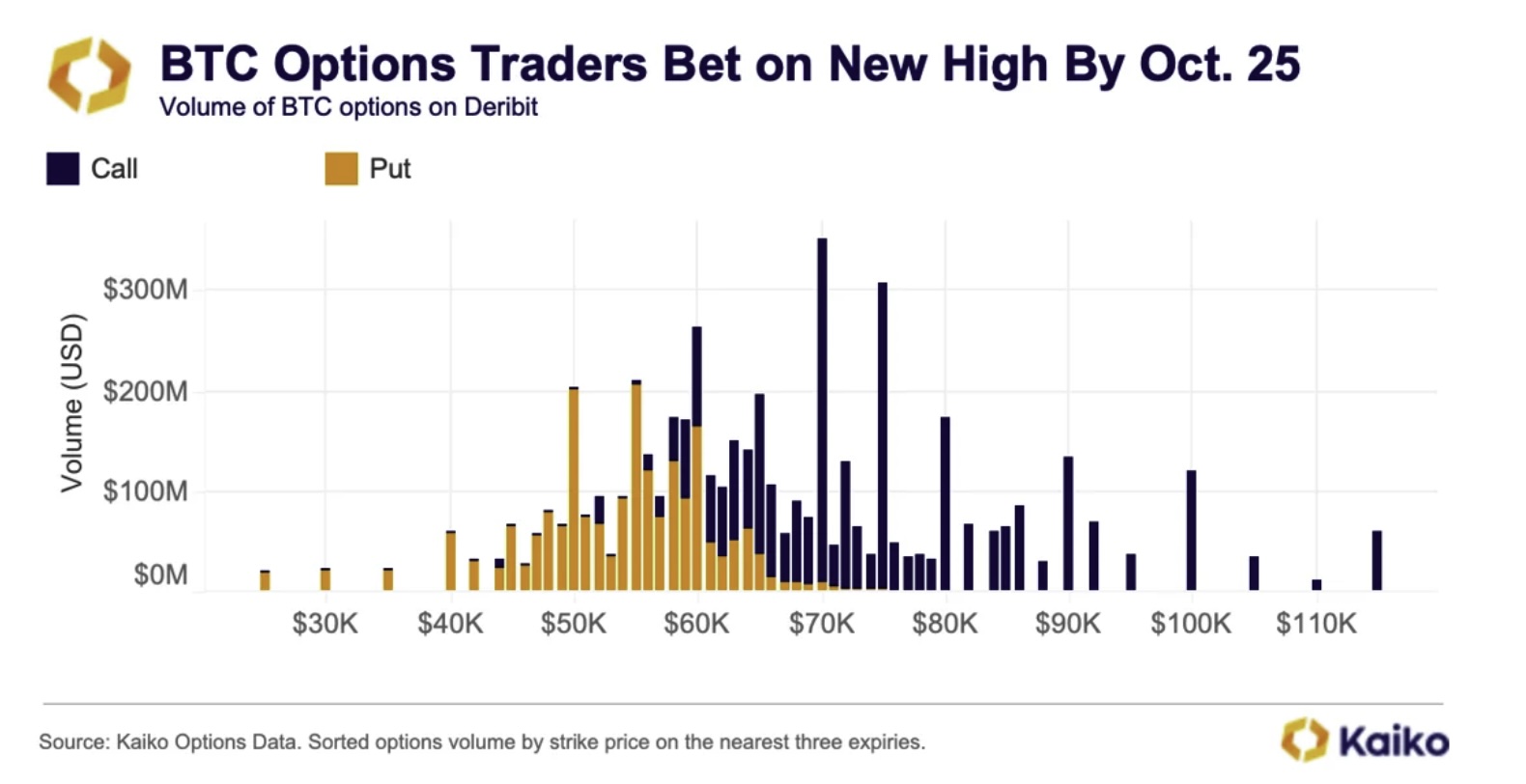

In a new report, Kaiko finds that derivatives traders are betting hundreds of millions of dollars on the crypto options exchange Deribit that Bitcoin is going to regain the $70,000 range this month.

“Options volumes have increased over the past few weeks as markets shift to a risk-on mindset. Traders are positioning themselves to capture upside price movements ahead of what is historically BTC’s best trading month. BTC’s price has only ended October down twice since 2013.

Looking at the three expiries in October, we can see that most of the volume is focused on the BTC options expiring at the end of the month. Typically, the front-month contracts would have more volume and liquidity.”

Source: Kaiko Research

Source: Kaiko Research

Source: Kaiko Research

Source: Kaiko Research

According to Kaiko, new macroeconomic conditions are also contributing to the traders’ behavior.

“However, several factors make this year different. First, the US central bank began a rate-cutting cycle this month, shifting its monetary policy. The Fed’s jumbo rate cut has already boosted risk-on sentiment. The central bank has signaled two more cuts before the year’s end, prompting speculative trades on December 27 contracts with significant volume on strike prices above $100,000.

What hasn’t shown up in the markets yet is the effect of cheaper dollars and the eventual easing of the Fed’s quantitative tightening measures, which removed liquidity. Global liquidity lags the markets, so the effects of the Fed’s easing cycle will take longer to appear.”

Bitcoin is trading for $61,026 at time of writing, down 3.9% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFIUSDT now launched for pre-market futures trading

Bitget pre-market trading: World Liberty Financial (WLFI) is set to launch soon

New spot margin trading pair — SAPIEN/USDT!

Bitget Will Delist MKR on 2025-08-22