The Bitcoin Volatility Index rose to 57.18 yesterday, with a single-day increase of 0.94%

The BitVol index, launched by financial index company T3 Index in partnership with options trading platform LedgerX, rose to 57.18 yesterday, a single-day increase of 0.94%.

Note: The BitVol index measures the expected implied volatility over the next 30 days derived from tradable Bitcoin option prices. Implied volatility refers to the volatility implied by actual option prices. It is calculated using the B-S option pricing formula, substituting all parameters except for volatility σ into the formula.

The actual price of an option is formed through competition among many options traders. Therefore, implied volatility represents market participants' views and expectations about future market conditions and is considered to be closest to real-time volatility at that time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

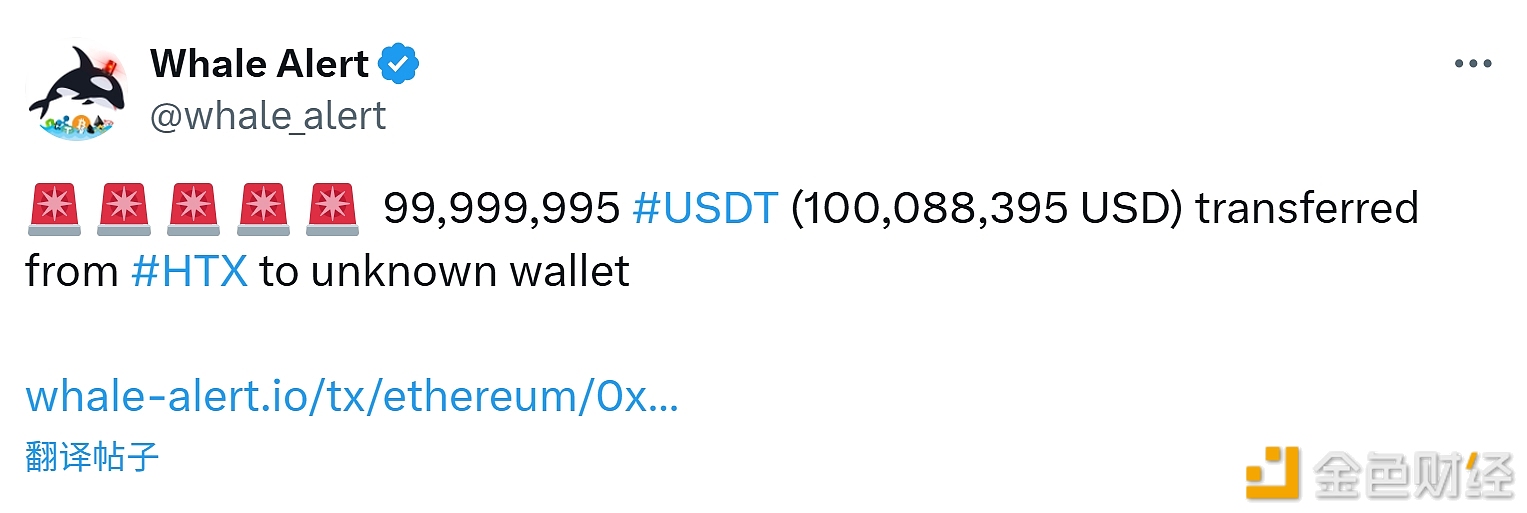

99,999,995 USDT Transferred from an Exchange to an Unknown Wallet

A major whale/institution sells 400 WBTC in exchange for 10,493 ETH

Data: As YZY falls below $1, a trader makes $202,000 in unrealized profit by shorting YZY with 3x leverage