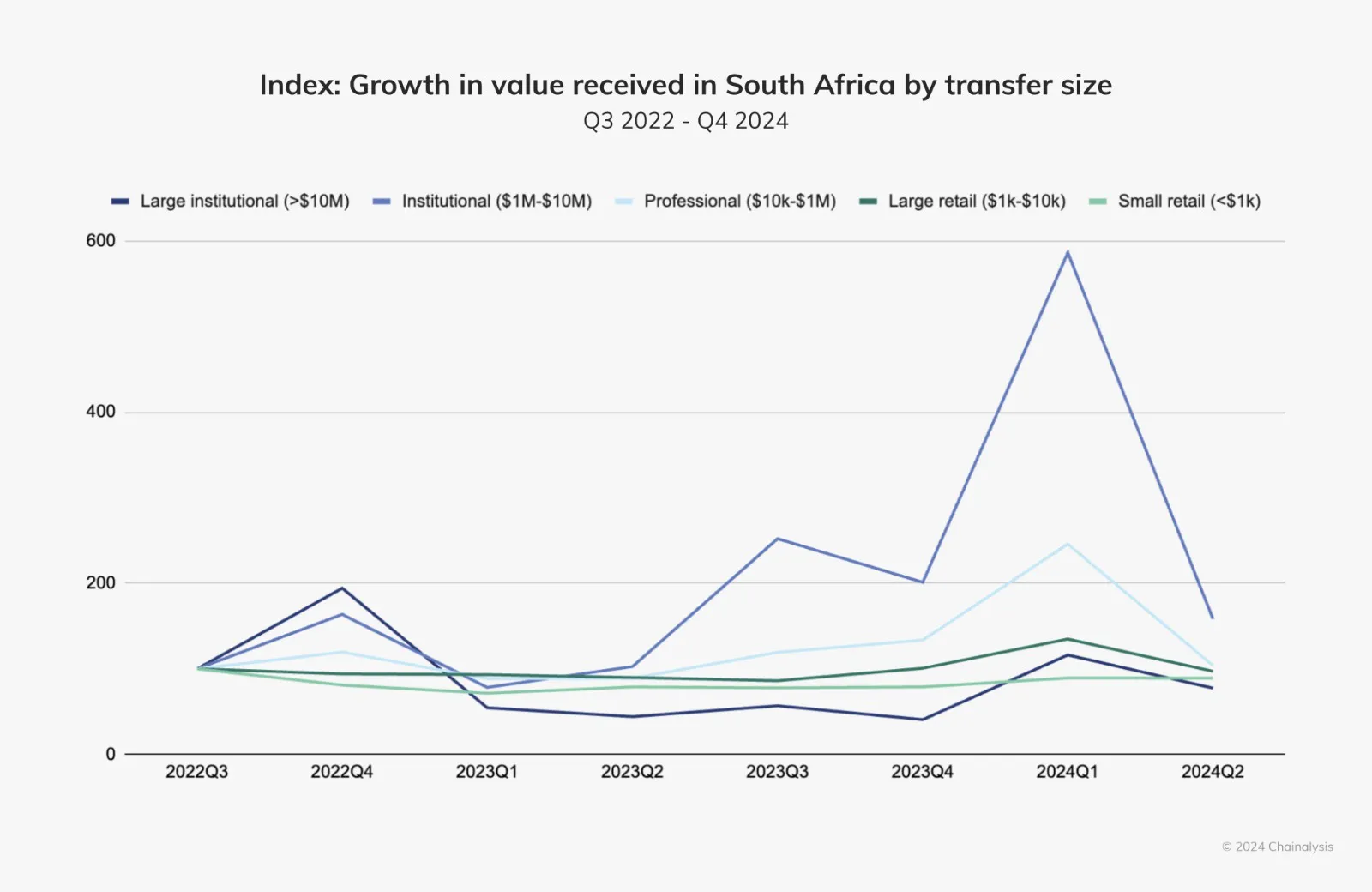

South Africa’s (SA) crypto sector has been on a tear over the past year. That’s according to an excerpt from an upcoming Chainalysis 2024 Geography of Cryptocurrency report. The piece shows that Africa’s largest economy drew roughly $26 billion in crypto values thanks to growing traditional finance (TradFi) adoption and institutional activity.

Absa Group’s Rob Downes has weighed in on the TradFi-crypto connection that’s taken off in the country. He said:

We are seeing growing interest from institutional clients, particularly around custody solutions for digital assets, which will play a crucial role in supporting the crypto ecosystem here.

– Rob Downes

Source: Chainalysis

Source: Chainalysis

Other experts, however, hold that South Africa owes much of its crypto boom to retail involvement. One of them is Carel van Wyk, founder of MoneyBadger, a crypto payments solutions provider. He observed that the nation’s cryptocurrency market, more so its payments space, has been steadily progressing.

Van Wyk recalled how transaction costs had previously hampered on-chain crypto settlements. However, the adoption of layer 2 solutions and advanced payment APIs has increased the viability of small daily crypto transactions. This has, in turn, allowed retailers to accept them and settle in the Rand.

South Africa’s regulations have been a boon for crypto

While regulations have often presented hurdles for crypto usage and growth, that isn’t the case with South Africa. Rob Downes lauded the country’s watchdog, the Financial Sector Conduct Authority (FCSA), for enabling SA’s crypto market. He held that the FCSA’s decision to adopt existing financial laws in overseeing crypto assets has brought clarity to the space.

He added that the favorable regulatory environment had emboldened investors and businesses to develop their crypto-leaning aspects responsibly. That has subsequently encouraged financial institutions to explore providing them with crypto services.

The banker further linked South Africa’s crypto market growth to surging Rand trading pairs. To him, that growth signals a maturing crypto ecosystem, a precursor to increased institutional engagement. He concluded that South Africa exchanges were becoming sophisticated, a critical factor in cultivating trust with all investors.

Banks are helping bridge the TradFi-crypto gap

Downes reiterated the critical role banks are playing in merging traditional finance and cryptocurrencies. He says demand for Absa’s crypto-related services, for instance, has tripled over the past one and a half years. These interests traverse investments, crypto payments, and banking exchanges.

He also acknowledged the newness of financial institutions (FI) in crypto while insisting that demand would push them to adapt quickly. In his view, their expertise and controls prime them to spearhead blockchain-first finance. By integrating this technology into their functions, financial institutions will fan crypto adoption at individual and institutional levels.