In September 2024, the crypto market rose by 8%, thanks to global economic decisions. A key factor was the US Federal Reserve’s decision to cut interest rates by 0.5%, which boosted investor confidence.

While DeFi markets flourished with increased activity, the NFT market continued to struggle in the quarter. Despite a relatively muted Q3, crypto outperformed traditional assets like gold and stocks.

Crypto markets grew in September

The latest Binance Research finds that the crypto market grew 8% in September, largely driven by favorable macroeconomic conditions. The Federal Reserve’s 0.5% rate cut and China’s economic stimulus were reported to be the major factors behind the growth.

The US central bank decided to loosen its monetary policy and slash crucial interest rates by 0.5% in September. While it was the first reduction since 2020, there is expected to be another rate cut in November.

The Fed’s aggressive stance led to crypto and stock markets clocking in some gains. Meanwhile, the People’s Bank of China (PBOC) injected around $33 billion through open market operations during the month. The attempt to ease deflationary pressure led to increased liquidity in the market, benefiting the crypto market.

Over the month, DeFi Total Value Locked (TVL) grew by 9.6% on the back of increased market activity. The top performers in September include Sui, which saw 60% TVL growth, Base, which reported 45% growth, and Sei, reporting a 102% rise. Contrarily, the NFT market continued its 2024 decline, with trading volumes reportedly dropping by 21.2%.

Q3 was muted but crypto outperformed traditional assets

While September saw market movement due to macro conditions, the Q3 2024 report from Bitwise Investments finds a period of stagnation over the quarter. Bitwise 10 Large Cap Crypto Index declined by 3.5% in the period, marking one of the smallest quarterly movements ever. Despite this, some crypto advancements are reportedly worth noting.

With the US Elections 2024 just a month away, crypto entered the political conversation with Donald Trump and Kamala Harris. In Q3, Ethereum ETFs were approved by the SEC after the January debut of spot Bitcoin ETFs. The Bitwise report also notes major institution interest in the quarter.

It underlines that Morgan Stanley became the first major wirehouse to allow wealth managers to purchase Bitcoin exchange-traded products (ETPs). The stablecoin market also witnessed growth in the quarter. Tether, the largest stablecoin issuer, reported profits exceeding those of BlackRock in the quarter.

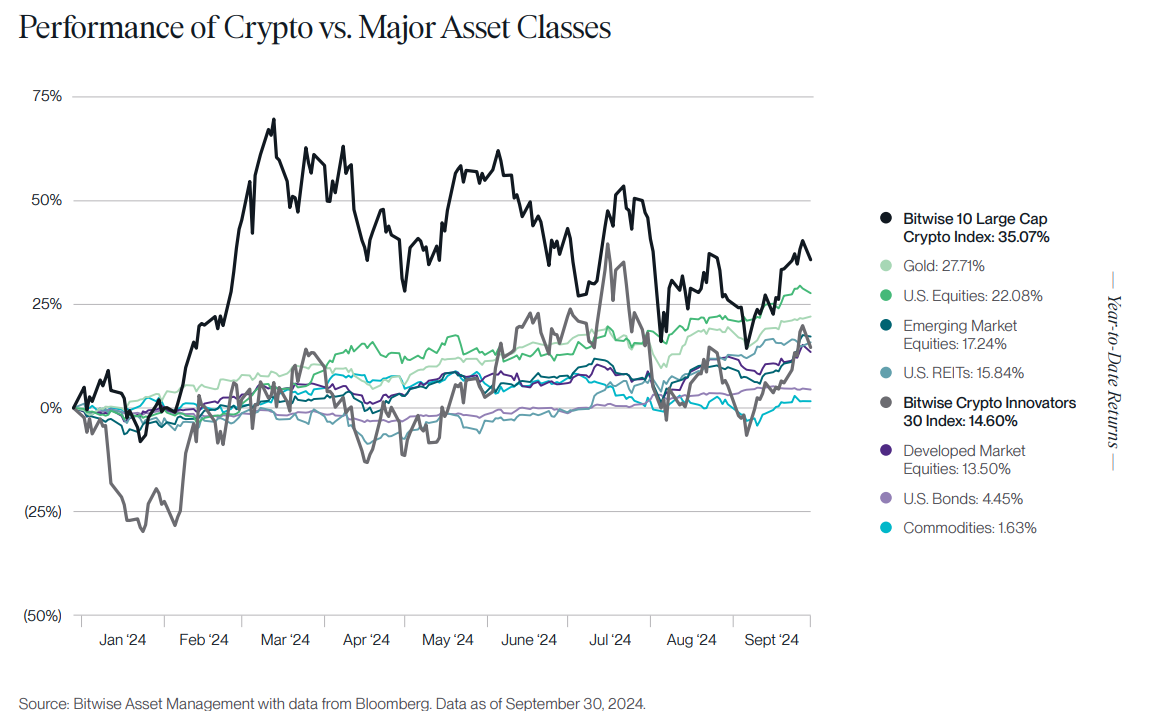

Crypto vs. traditional assets | Source: Bitwise Investment Report for 2024

Crypto vs. traditional assets | Source: Bitwise Investment Report for 2024

Meanwhile, crypto also outperformed some of the traditional assets. The Bitwise 10 Large Cap Crypto Index reports a year-to-date return of 35.07%, with Bitcoin leading the performance among major assets, returning 49.21% in 2024. The YTD for gold was at 27.71%, and US equities returned around 22%. US bonds and commodities returned 4.45% and 1.63%, respectively, until Q3.

However, the report notes a major drop in net revenue for leading blockchains. They fell 61.61% quarter-over-quarter, indicating the largest potential weaknesses since Q1 2023. But, pro-crypto legislation as an election outcome, global monetary easing, and investor interest in crypto ETFs could be crypto catalysts in Q4.