ING: Fed may cut rates by 50 bps for the rest of the year

James Knightley, chief international economist at ING, said the Fed could cut rates by 50 basis points for the rest of the year. Knightley explained that the Fed's current approach focuses on risk management. Unlike most central banks whose single goal is to bring inflation down to 2%, the Fed has two main goals: price stability and full employment. If the Fed is confident that it will achieve its inflation target, it may shift its focus to supporting employment. knightley said it would be appropriate for the Fed to cut interest rates by 25 basis points in November, followed by another rate cut in December. He also predicts the Fed could cut rates to around 3%-3.5% by the summer of 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

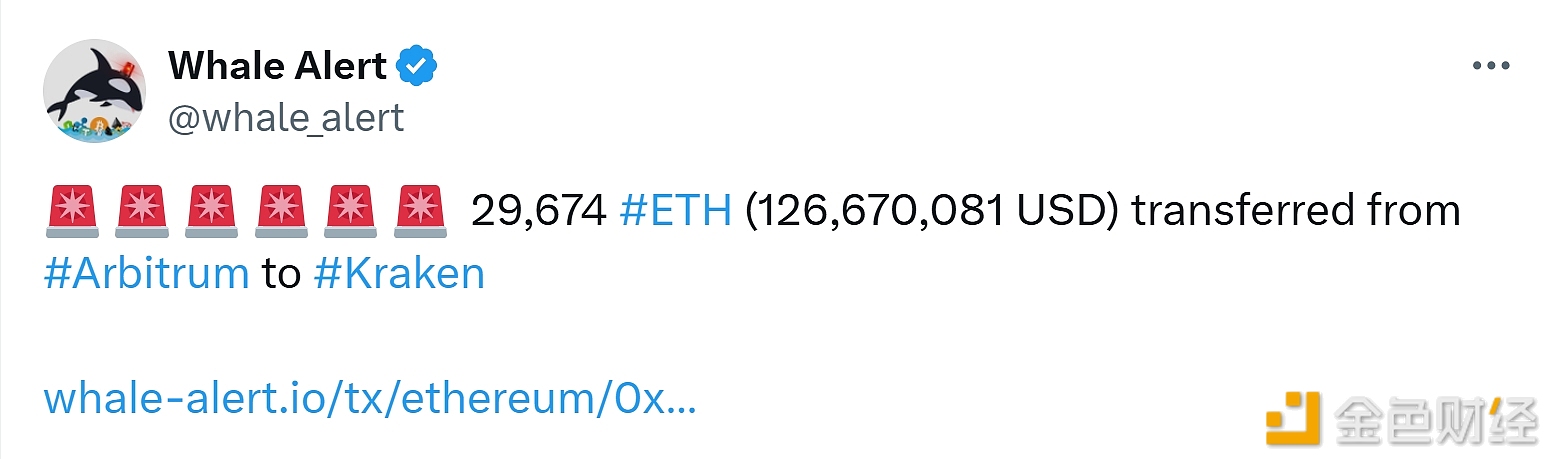

29,674 ETH Transferred from Arbitrum to an Exchange

Crypto Market Under Pressure as Investors Pull Out $1.9 Billion, Focus Shifts to Powell’s Speech

Japanese Nationwide Apparel Chain Mac House Purchases First Batch of 17.51 BTC