Coinbase has filed two Freedom of Information Act (FOIA) requests against U.S. regulators, seeking information about cryptocurrency crackdown involving American banks.

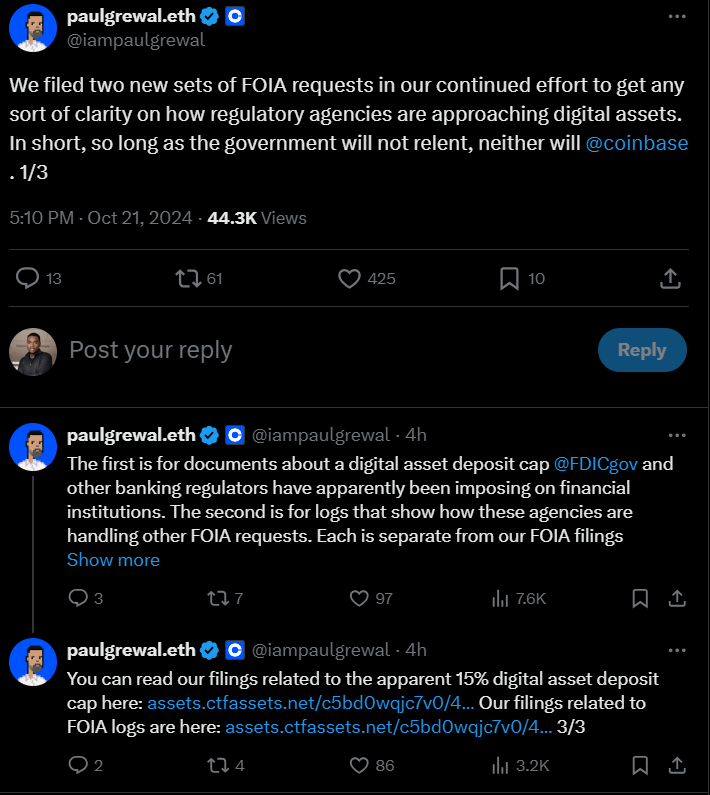

In a tweet from Paul Grewal, the company’s chief legal officer, Conbase is requesting clarity on a 15% limit that the Federal Deposit Insurance Corporation (FDIC) supposedly put on banks for deposits from crypto companies

Coinbase says this rule was made without public input, which is usually required by U.S. law. Grewal explained that they want documents about this cap to understand how it affects the crypto industry.

Source: X

Source: X

The second FOIA is about getting records on how the FDIC and other regulators have responded to earlier FOIA requests related to cryptocurrencies.

These requests come after Coinbase filed lawsuits in 2023 against the FDIC and the U.S. Securities and Exchange Commission (SEC) for not complying with earlier FOIA requests.

In 2023, Coinbase asked the SEC to release documents concerning the agency’s classification of Ethereum (ETH) and its staking pools, which remains unclear.

The company has also raised concerns about “pause letters” the FDIC allegedly sent to banks, urging them to slow down activities related to crypto.

Grewal noted that these new requests are separate from FOIA filings made over a year ago, which are now the subject of federal lawsuits.

Moreover, Coinbase has been getting involved in politics by supporting pro-crypto regulation through its “Stand with Crypto” campaign and creating a political action committee (PAC) in March 2024.

This is part of its effort to shape the future of crypto regulation, especially with the upcoming U.S. presidential election in November.

In previous reports, Donald Trump, the Republican nominee expressed strong support for making the U.S. a leader in crypto, while Democratic candidate Kamala Harris has been less vocal.

Coinbase’s recent FOIA filings show its ongoing push for more transparency and fair regulation in the crypto space.

Grewal emphasized that Coinbase is determined to get clarity, stating, “So long as the government will not relent, neither will Coinbase.”