Blackrock's Bitcoin ETF draws record $1.1 billion single-day inflow

Key Takeaways

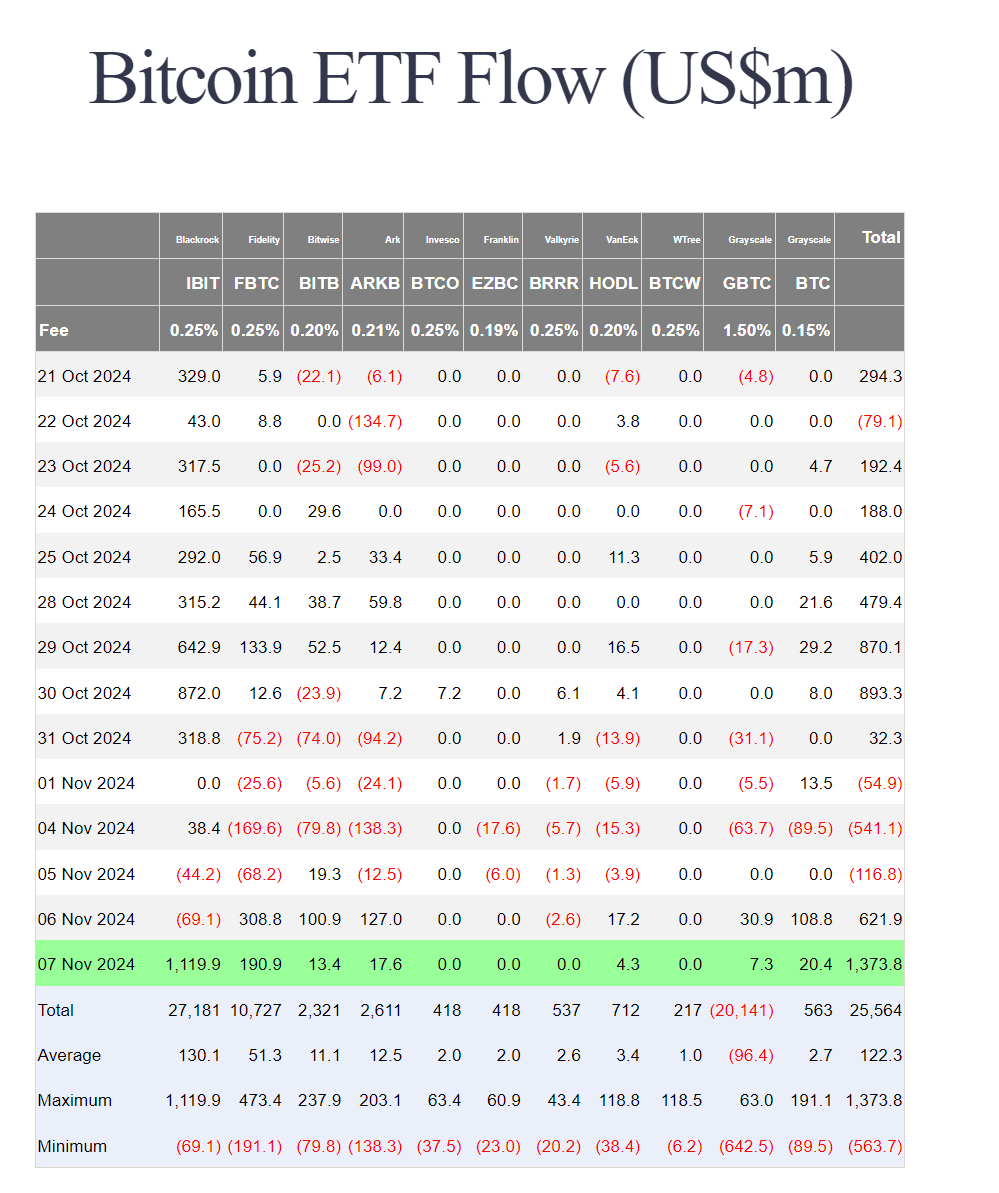

- BlackRock's Bitcoin ETF saw a record single-day inflow of $1.1 billion.

- Total inflows for US spot Bitcoin ETFs reached $1.37 billion during the session.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded $1.1 billion in inflows during a single trading session, marking the largest one-day inflow among US spot Bitcoin ETFs. The total inflows across all Bitcoin ETFs reached $1.37 billion during the session.

source: Farside Investors

source: Farside Investors

BlackRock’s ETF dominated the day’s activity with $1.12 billion in inflows, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) attracted $190.9 million during the same period.

The substantial ETF inflows coincided with Bitcoin’s price movement, which briefly reached $76,500 before settling around $75,700. The reported flows may reflect activity from the previous trading day due to T+1 reporting, explaining why BlackRock’s ETF showed negative flows in the prior session while other funds saw major inflows.

Since their launch in January 2024, US spot Bitcoin ETFs have accumulated billions in assets under management, with BlackRock’s IBIT emerging as the market leader.

Last month, US spot Bitcoin ETFs reached a record asset value over $66.1 billion, thanks to a six-day inflow streak and a Bitcoin price increase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFIUSDT now launched for pre-market futures trading

Bitget pre-market trading: World Liberty Financial (WLFI) is set to launch soon

New spot margin trading pair — SAPIEN/USDT!

Bitget Will Delist MKR on 2025-08-22