- Coinbase and MicroStrategy surge over 18%, ranking among top-traded stocks alongside Tesla and Nvidia.

- Bitcoin hits $84,687, with a 5.92% daily gain and market dominance climbing to 58.31%.

- Crypto trading volumes skyrocket as institutional interest grows and retail investors embrace long-term holding strategies.

ETF analyst Eric Balchunas recently noted an interesting market shift on Twitter (now X). Coinbase (COIN) and MicroStrategy (MSTR) became two of the top-traded stocks, joining Tesla (TSLA) and Nvidia (NVDA) in the top five. Both crypto-related stocks rose over 18%, which may indicate growing interest in digital assets.

Tesla Gains While Other Tech Stocks Fall

Tesla gained 10.99%, generating $30.39 billion in trading volume. Investor enthusiasm for the EV giant remains high. However, major tech players like Apple, Microsoft, and Meta each fell over 1%. This suggests that investors may be selling those stocks after recent highs. Nvidia also fell 1.44%, which may indicate some caution in the chip sector despite the company’s AI leadership.

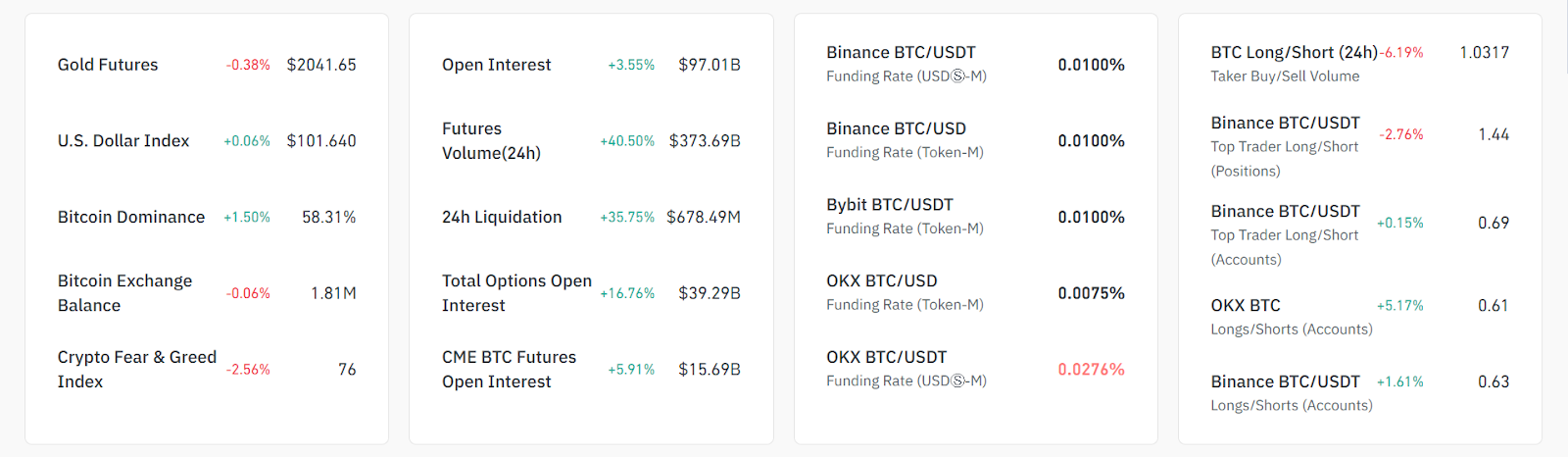

Bitcoin rose to $88,550 , a 6% gain in 24 hours, with trading volume over $97 billion. The leading cryptocurrency’s market cap is $1.67 trillion. Furthermore, Bitcoin’s dominance reached 58.31%, which shows its influence in the crypto space. Futures trading volume increased 40.50%, and liquidations rose 35.75%, suggesting heightened market activity.

Read also: Crypto vs. Stocks: Is Ethereum the Nvidia of the Digital Asset World?

Source: Coinglass

Source: Coinglass

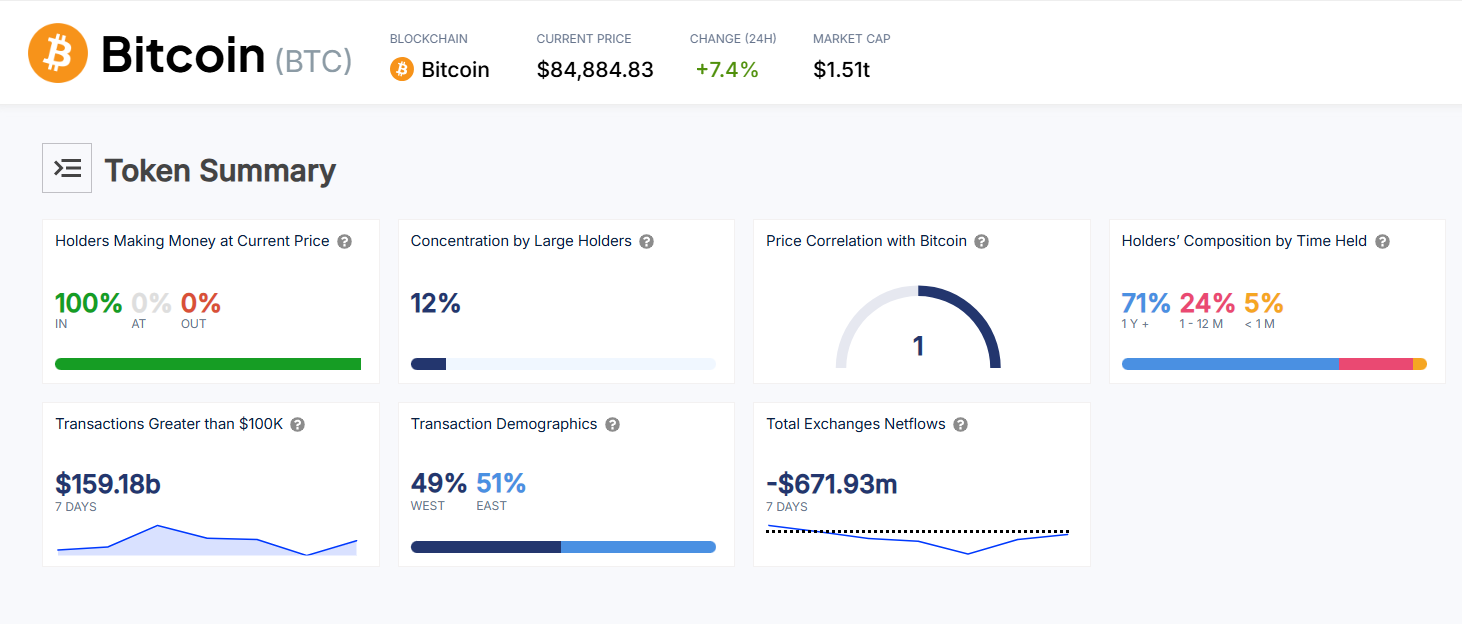

Bitcoin’s fundamentals appeared strong, with all holders holding profitable positions. Investors made over $159 billion in large transactions last week. Additionally, exchanges recorded $671 million in outflows, which may indicate a preference for long-term holding. Institutional investors show growing interest, and retail participation grows rapidly.

Mixed Signals in Market Sentiment

The Crypto Fear & Greed Index is at 76, which shows cautious optimism among investors. Gold, which is traditionally a safe haven, fell 0.38% as risk appetite grew. However, mixed signals in funding rates and long/short ratios indicate that volatility may continue in the near term.

Source: IntoTheBlock

Source: IntoTheBlock

The market sees a clear divide between tech and crypto stocks. While traditional tech shows some consolidation, crypto-related equities use the renewed enthusiasm to their advantage. As Bitcoin maintains its upward trend, market participants watch to see whether the bullish sentiment will expand.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.