Volume 209: Digital Asset Fund Flows Weekly Report

From CoinShares Research Blog by James Butterfill

The US election dividend spurring further inflows of US$2.2bn into digital assets

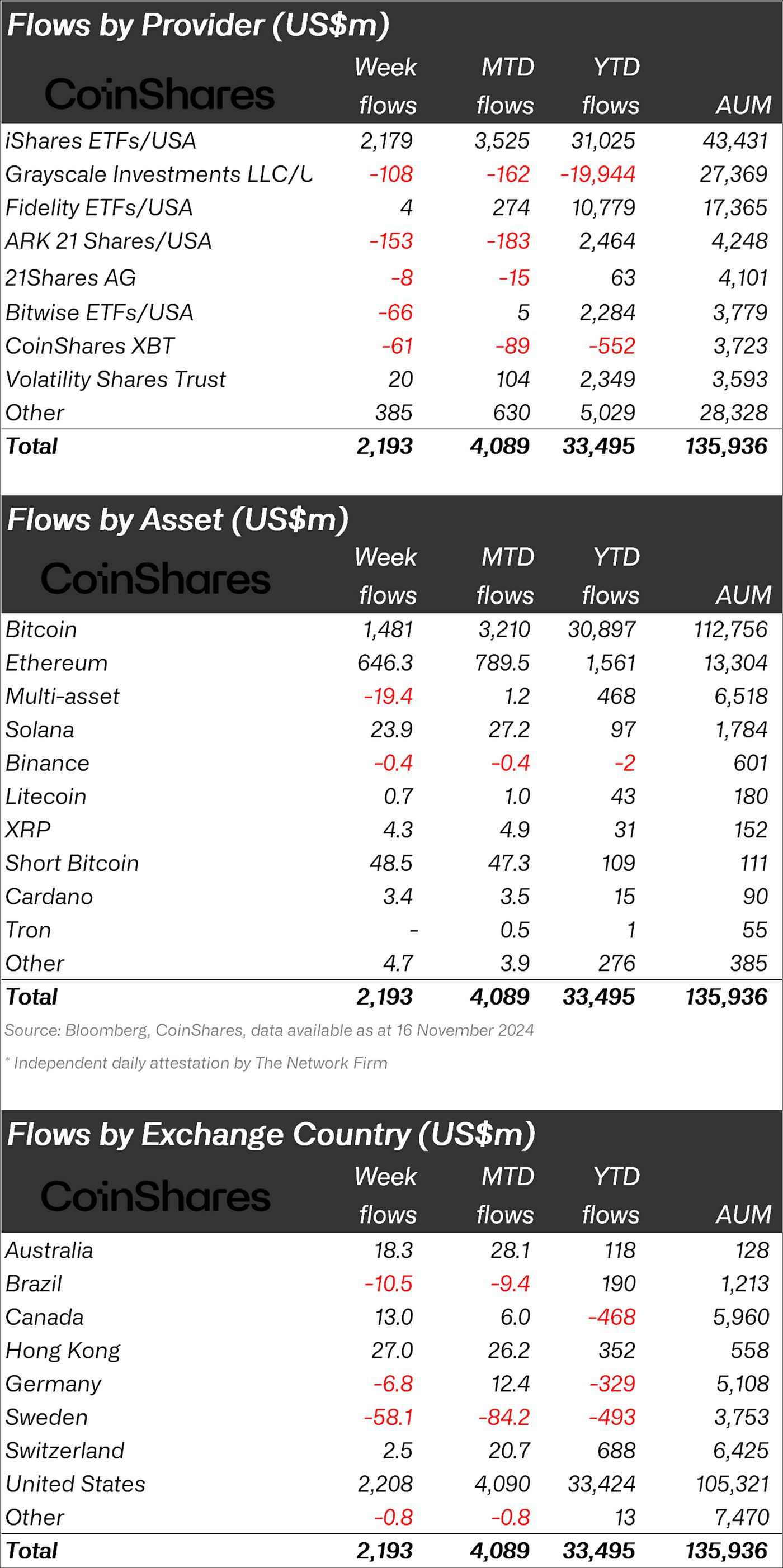

- Digital asset inflows reached US$2.2bn last week, bringing year-to-date inflows to a record US$33.5bn, with AuM hitting a new peak of US$138bn.

- Inflows of US$3bn were seen in the first half of the week, although all-time-hights in the Bitcoin price spurred outflows in the latter half of the week totalling US$866m.

- Bitcoin saw US$1.48bn in inflows, with US$49m into short products, while Ethereum rebounded with US$646m in inflows.

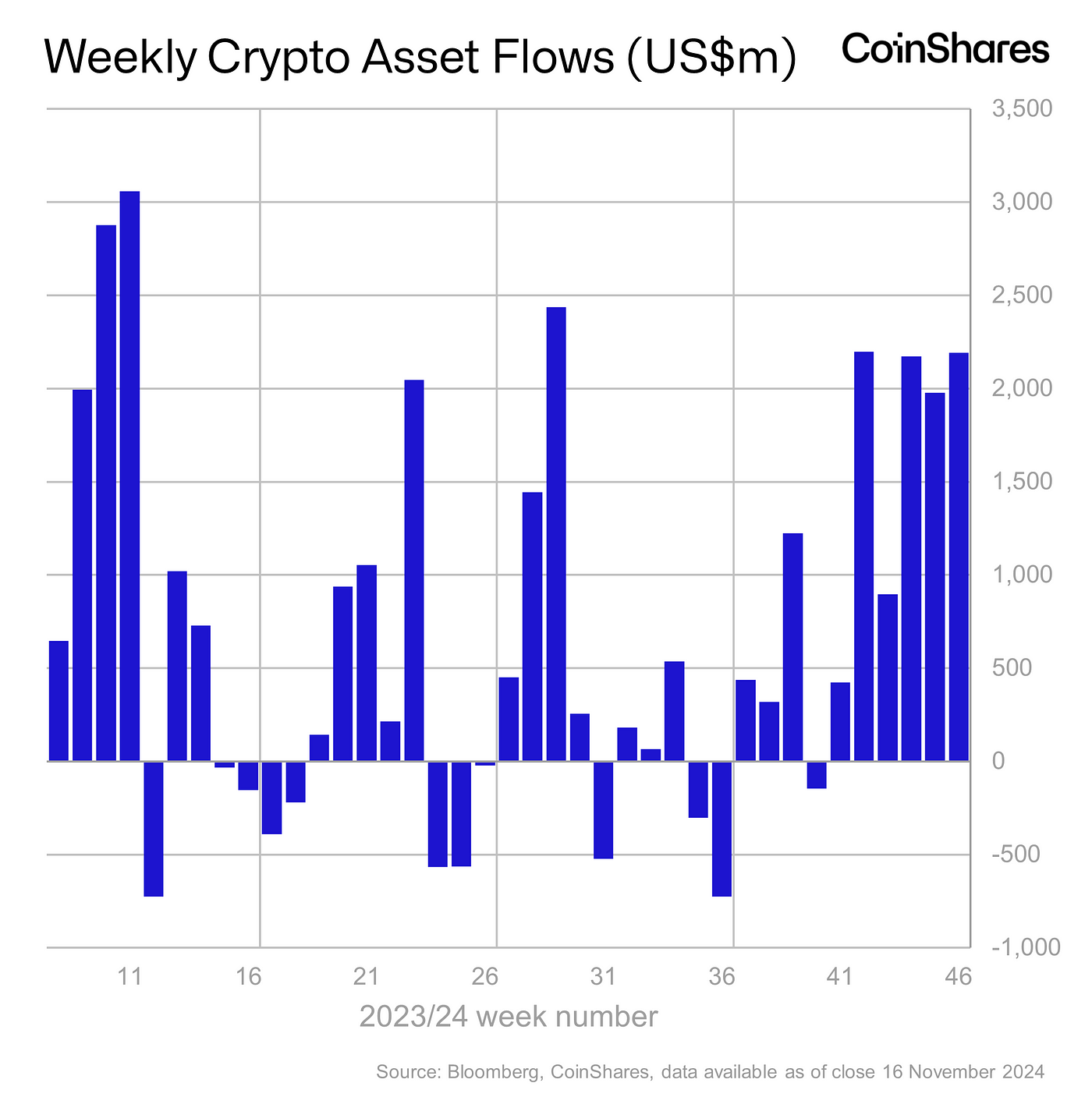

Digital asset investment products saw further inflows of US$2.2bn last week, raising the total inflows since interest rates were first cut in September to US$11.7bn, while year-to-date inflows at a record US$33.5bn. Inflows of US$3bn were seen in the first half of the week, although all-time-hights in the Bitcoin price spurred outflows in the latter half of the week totalling US$866m. Recent market activity, particularly Bitcoin surpassing its all-time highs, propelled total assets under management (AuM) to a new peak of US$138bn earlier in the week. This recent surge in activity appears to be driven by a combination of looser monetary policy and the Republican party’s clean sweep in the recent US elections.

Regional sentiment was mixed, with the US seeing US$2.2bn of inflows, followed by Hong Kong, Australia and Canada with inflows of US$27m, US$18m and US$13m respectively. While investors in Sweden and Germany took profit, seeing outflows of US$58m and US$6.8m respectively.

Bitcoin saw inflows of US$1.48bn but this recent all-time-highs in price spurred investors to add US$49m into short bitcoin investment products.

Ethereum seems to have broken its negative funk, seeing inflows of US$646m (5% of AuM), likely due to a combination of Justin Drake’s Beam Chain network upgrade proposal and recent US elections. Solana also saw inflows of US$24m.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.