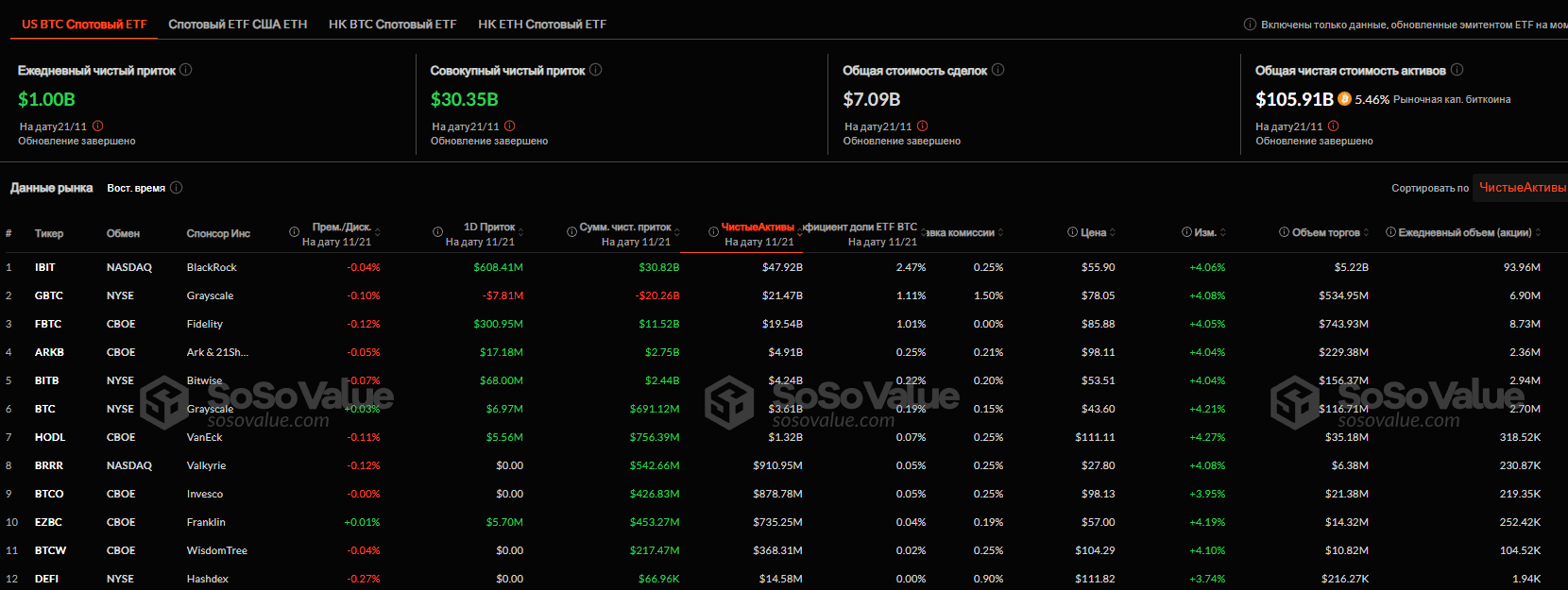

On Thursday, November 21, US spot bitcoin ETF recorded an inflow of $1 billion. This is the second-highest figure since the beginning of the month, the maximum was on November 11 with $1,11 billion. In just four days, exchange-traded funds based on the leading cryptocurrency received more than $2,8 billion.

The leader in daily inflow of funds was IBIT from BlackRock, which received about $608,41 million. FBTC from Fidelity and BITB from Bitwise received $300,95 million and $68 million from investors, respectively. The capitalization of the ARKB fund from ARK and 21Shares increased by $17,18 million, Grayscale Bitcoin Mini Trust - for $6,97 million, EZBC from Franklin Templeton - for $5,7 million and HODL from VanEck - for $5,56 million.

Inflow into US spot bitcoin ETF

Grayscale's GBTC was the only fund to see outflows, at $7,81 million. The rest of the U.S. spot bitcoin ETF recorded zero indicators.

Total trading volume for BTC- ETF amounted to $7,1 billion, which is significantly higher than the $5,09 billion recorded the day before.

Thursday's significant influx of funds came after Bitcoin surpassed the $99,000 mark, setting an all-time high of $99,260. Analysts predict that the flagship kriptovalyuta will reach the important $100,000 mark before the end of the week, which will attract even more investor attention to Bitcoin - funds.

Bitcoin ETF are already enjoying great popularity, and it is likely to grow even more, especially after Bitcoin will exceed $100,000. This will attract additional attention from both the media and traders, said TYMIO founder Georgy Verbitsky.