-

Uniswap’s recent bullish momentum is underscored by a notable increase in network participation and solid support levels.

-

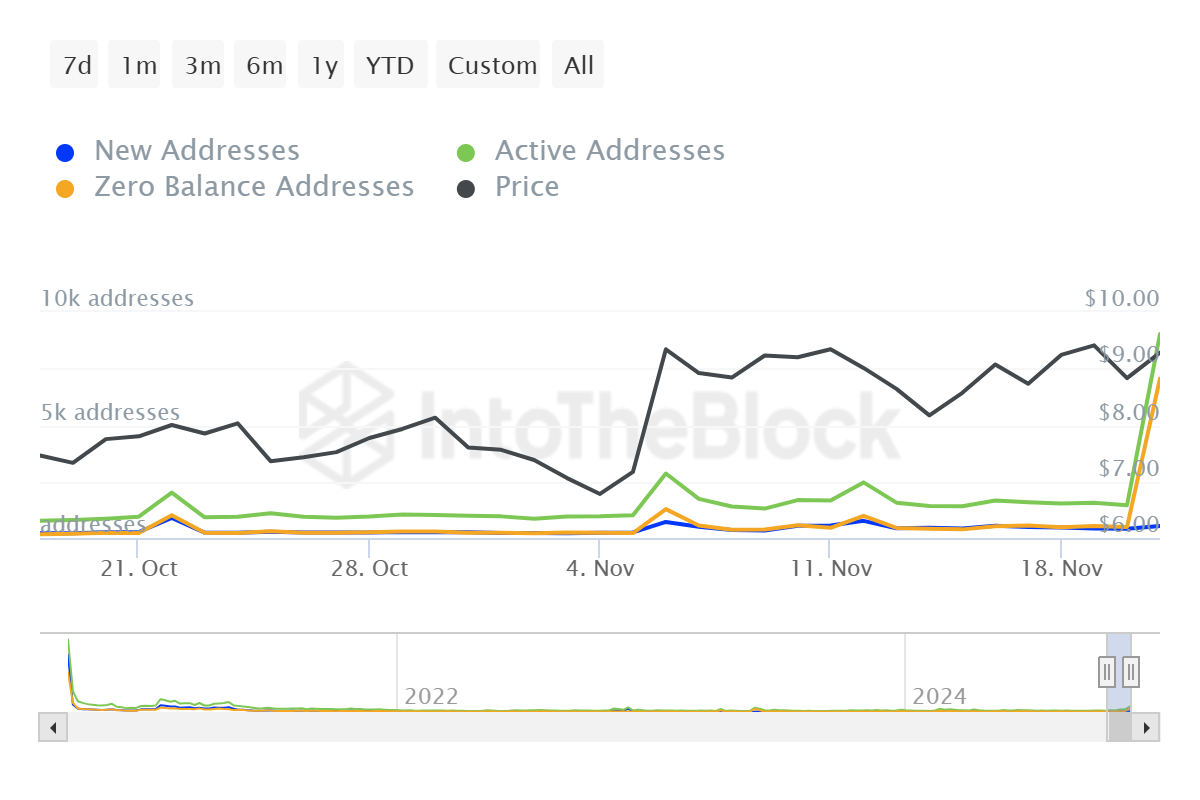

The altcoin has seen active addresses surge by 520%, a clear indicator of heightened user engagement and market interest.

-

“The strong defense of the $8.75 support level suggests a robust buyer presence,” shares a COINOTAG source.

Uniswap is showing strong bullish signs with a key support level holding and surging network activity, suggesting potential for further upside.

Uniswap’s Technical Landscape Signals a Bullish Shift

Uniswap has experienced a notable breakout from an ascending triangle pattern, historically associated with bullish market runs. This pattern signifies that upward price momentum could be building after a period of consolidation.

Over the past week, UNI has retested the $8.75 support level multiple times. The consistent testing of this level not only reinforces its significance as a demand zone but also hints at growing confidence among buyers.

Source: Tradingview

The robust buyer support at this level indicates a potentially sustained upward movement for Uniswap.

Positive Metrics Indicate Growing Market Interest

According to a recent analysis by COINOTAG, on-chain data reveals a significant spike in network activity, with active addresses for Uniswap increasing by an impressive 520% within a 24-hour window. This surge signals that more users are engaging with the platform, translating into enhanced market activity.

Source: IntoTheBlock

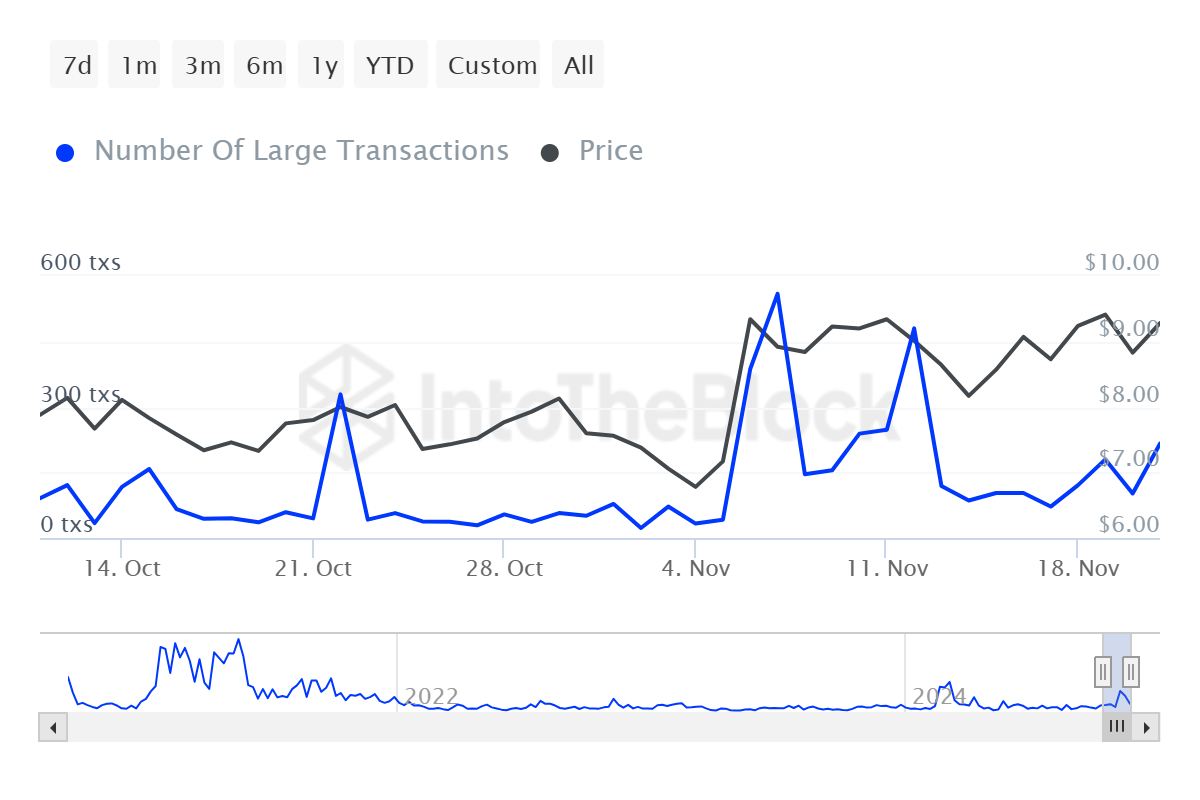

This rapid influx of active addresses coincides with a remarkable 143% increase in large transactions, a strong indicator that larger market players, or ‘whales,’ are taking an interest in UNI.

Source: IntoTheBlock

The uptick in both active addresses and large transaction volumes reflects a growing interest from institutional investors, a trend that often precedes notable price movements as trading volumes increase.

Approaching Critical Liquidation Levels

Analyzing Coinglass’s liquidation heat map, it becomes evident that there is a concentrated cluster of liquidations around the $9.73 price point, with approximately 430,000 UNI at stake. This concentration could serve as a price magnet, driving prices up as long-position holders seek to capitalize on bullish signals.

Source: Coinglass

Despite the optimistic outlook, traders must remain cautious of potential volatility around this critical resistance level. A decisive break above $9.73 could lead to rapid liquidations, amplifying upward momentum and presenting new trading opportunities.

Conclusion

Uniswap’s technical indicators and on-chain metrics collectively suggest a robust buying sentiment, particularly with strong support at $8.75 and active address growth. However, attention to the $9.73 resistance level is crucial, as a breakthrough could trigger substantial bullish momentum, marking a significant opportunity for investors.