-

As 2024 unfolds, the crypto market exhibits notable shifts, with altcoins like Stellar (XLM), Yield Guild Game (YGG), and Banana Gun (BANANA) showing distinct price movements and potential future developments.

-

Amidst the backdrop of anticipated Bitcoin price surges, these altcoins are positioned uniquely based on their recent performance and upcoming events.

-

According to a recent article by COINOTAG, “The overall sentiment in the altcoin market is becoming increasingly optimistic as key resistance levels are tested.”

Explore the latest on Stellar, Yield Guild Game, and Banana Gun as they navigate critical market conditions and performance trends in the crypto space.

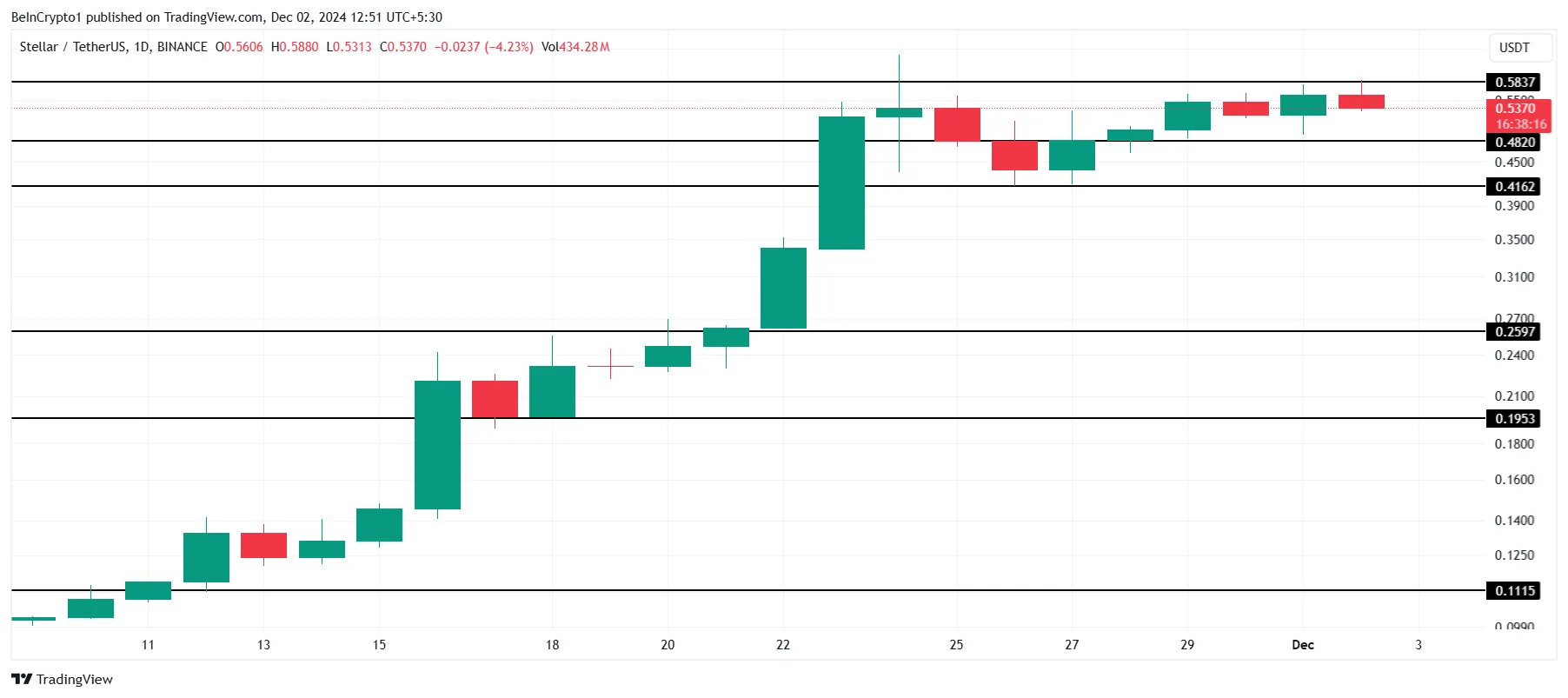

Stellar (XLM) Remains Resilient Amid Positive Market Trends

The price of Stellar (XLM) has maintained a detailed position above the crucial support level of <$0.41>, driven by recent bullish trends in the overall market. While it may not attract as much attention as Bitcoin or Ethereum, its consistent price movement signals a growing confidence among investors in its potential.

This week, Stellar validators are set to vote on the mainnet upgrade of Protocol 22. After thorough testing on the testnet, this enhancement could catalyze an upward price movement for XLM. The market generally responds positively to successful upgrades, increasing investor outlook and possibly enhancing the token’s value further.

Currently, XLM’s position above the significant support at <$0.41> indicates its stability and potential for growth. Falling below this threshold, however, could reverse this bullish perspective and trigger a decline towards $0.25.

Yield Guild Game (YGG) Eyes Breakthrough Above $0.70

Despite YGG’s challenges with price resistance at $0.70, its path to growth appears plausible if it can overcome this critical barrier. Only by breaking through this level can YGG set its sights on a further increase to $0.80.

The upcoming conclusion of The Purging Event may significantly influence this token’s momentum. Such events have historically correlated with positive price movements, thereby eliciting interest from investors and promising a possible revival of YGG’s price trajectory.

If YGG manages to flip the $0.70 resistance into reliable support, it could establish a stronger foundation for continued growth. Conversely, any decline past $0.57 might discourage investment and undermine its bullish outlook.

Banana Gun (BANANA) Faces Volatility After Drop

Banana Gun (BANANA) has recently seen a 9% drop, currently trading around $60. This volatility reflects ongoing market sentiments but also underscores the altcoin’s resilience above key support levels.

As the token approaches its monthly unlock of 250,000 BANANA tokens—equivalent to a $15 million increase in circulation—market participants are keenly observing potential reactions. Such adjustments may induce notable price movements depending on overall market attitudes.

Should market conditions become bearish, a decline towards the next support level at $55 may materialize, complicating the current bullish expectation. Maintaining support is crucial for BANANA to foster recovery momentum amidst fluctuating market scenarios.

Conclusion

In summary, as we navigate the final month of 2024, the crypto landscape is rife with potential, especially for altcoins like Stellar, Yield Guild Game, and Banana Gun. Traders and investors should remain vigilant, as key events and resistance levels could dictate price movements in the near term. Understanding these dynamics can aid in making informed investment decisions as the market evolves.