South Korea’s cryptocurrency sector has been in crisis since President Yoon Suk Yeol declared martial law on December 3, 2024. This unexpected political development has sparked widespread concern among investors, resulting in significant price drops across several cryptocurrencies.

Crypto Market Crash in South Korea, Source: X

Crypto Market Crash in South Korea, Source: X

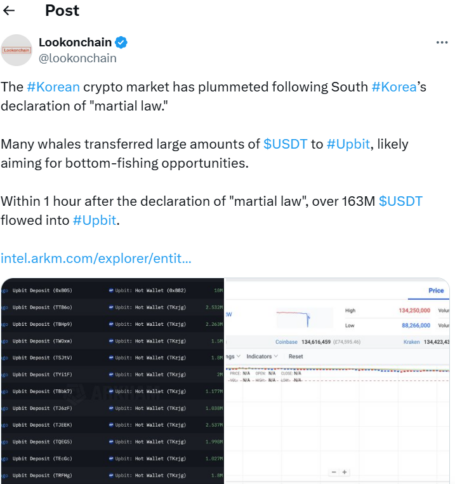

Lookonchain, a blockchain analytics tool, claimed that South Korea’s cryptocurrency market has fallen following President Yoon’s proclamation of martial law.

Bitcoin’s price fell by more than 30% on the Upbit platform, reaching around $62,000 shortly after the martial law announcement. This steep fall created an arbitrage opportunity, as Bitcoin was trading for about $4,000 more on worldwide platforms.

Meanwhile, other coins, like XRP, Dogecoin, and XLM, had price losses of up to 20%. However, some bitcoin whales seem unfazed about this development. According to Lookonchain, a number of whales have transferred large sums of USDT to the Upbit exchange, most likely in an attempt to seek bottom fishing chances.

Since the president announced martial law, more than $163 million has flowed into Upbit as whales seek to accumulate these coins at a bargain.

Because of the war between panic sellers and bottom fishermen, Upbit has announced that its applications and open API services are now halted and experiencing problems due to a temporary increase in traffic.

The political instability in South Korea has caused a drop in both the crypto and traditional financial markets. South Korean stocks have fallen, with ETFs like the iShares MSCI South Korea ETF losing more than 5%, The South Korean won has likewise devalued versus the US dollar.