-

AAVE’s growth trajectory shows remarkable resilience, with a 53% surge in market capitalization attributed to positive political speculation.

-

The on-chain metrics present a potentially bullish trend, as institutional interest intensifies amidst rising transaction volumes.

-

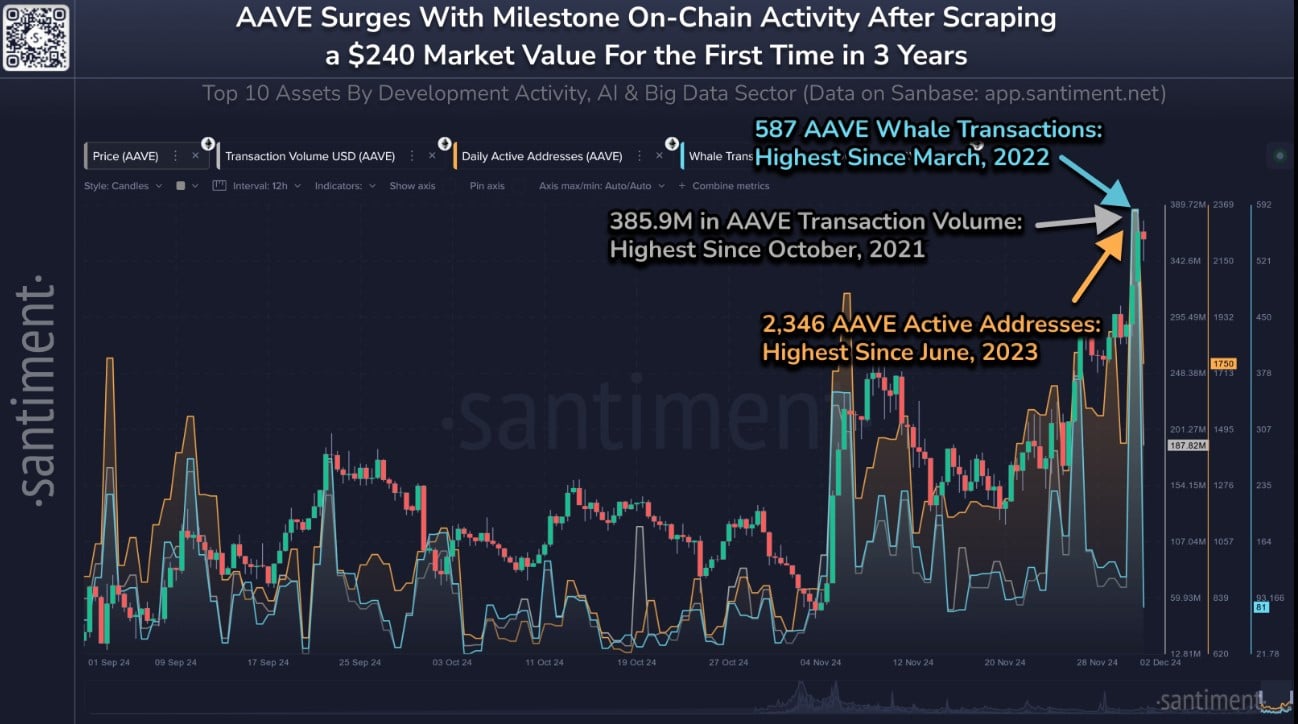

As noted by Santiment, “whale transactions for AAVE have surged into the hundreds, signaling a strong market shift.”

Discover the latest insights on AAVE’s bullish momentum, driven by political sentiment and substantial on-chain activities influencing market dynamics.

Decoding AAVE’s On-Chain Momentum and Market Dynamics

AAVE has recently captured attention in the crypto sphere, showcasing a remarkable uptick in its market capitalization over a short span. The latest data from Santiment reveals that the last 24 hours have been pivotal for AAVE, with indicators suggesting robust market engagement.

Notably, AAVE’s whale transactions have hit a striking 587, marking the highest activity since March 2022. This increase points towards heightened institutional interest, likely contributing to the bullish sentiment surrounding the cryptocurrency.

Furthermore, the total transaction volume for AAVE soared to an impressive 385.9 million, the highest since October 2021, showcasing significant user engagement and a potential precursor to further price movements.

Source: Santiment

Analyzing Technical Indicators for AAVE

From a technical perspective, AAVE exhibits promising bullish signals as it trades just above a crucial weekly resistance level of $244. The recent price action, showing a 21.63% gain, indicates strong buying interest among traders.

This breakout not only reflects optimism in the market but also sets the next resistance level at $252.59. Should the current momentum persist, analysts anticipate AAVE could potentially reach $270, further solidifying its bullish trend.

Source: TradingView

Market Sentiment Shifts Towards AAVE

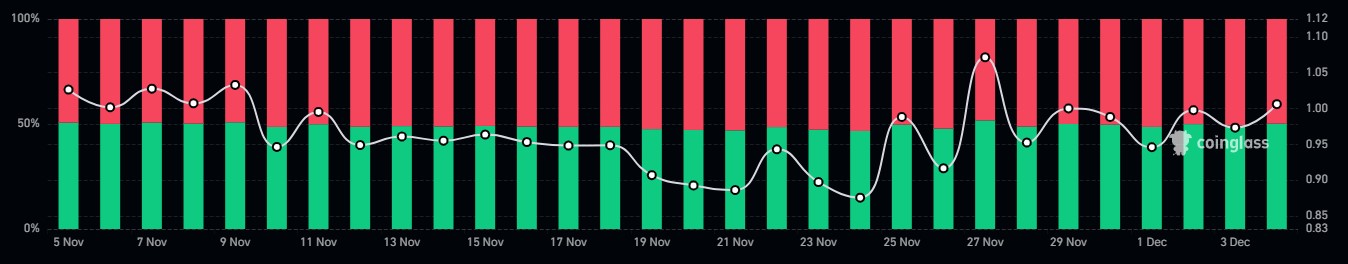

According to COINOTAG’s analysis based on Coinglass data, the Long/Short ratio for AAVE has recently demonstrated a significant inclination towards long positions, with more than 50% of traders opting to go long.

This trend underscores the prevailing optimism in the market and lends credence to the expected bullish rally, particularly as AAVE trades just above a crucial entry price point. A continued dominance of long positions could facilitate further upward movements in price.

Source: Coinglass

To stay updated, read Aave’s [AAVE] Price Prediction 2024-25 for insightful analyses and projections.

Conclusion

AAVE’s recent price movement reveals a convergence of fundamental, on-chain, and technical indicators indicative of an impending bullish rally. If momentum remains strong above the $244 resistance level, there’s potential for the altcoin to test higher resistance levels, setting the stage for further gains in the near future.