Crypto Trading on Centralized Exchanges Soars to $10 Trillion in November

Crypto markets saw a record $10.4 trillion in November trading volume, with derivatives leading growth and global exchanges showing remarkable activity.

A new report from CCData claims that total trade volume in the crypto industry hit an all-time high in November, reaching $10 trillion. Donald Trump’s promises of regulatory friendliness helped spur intense growth.

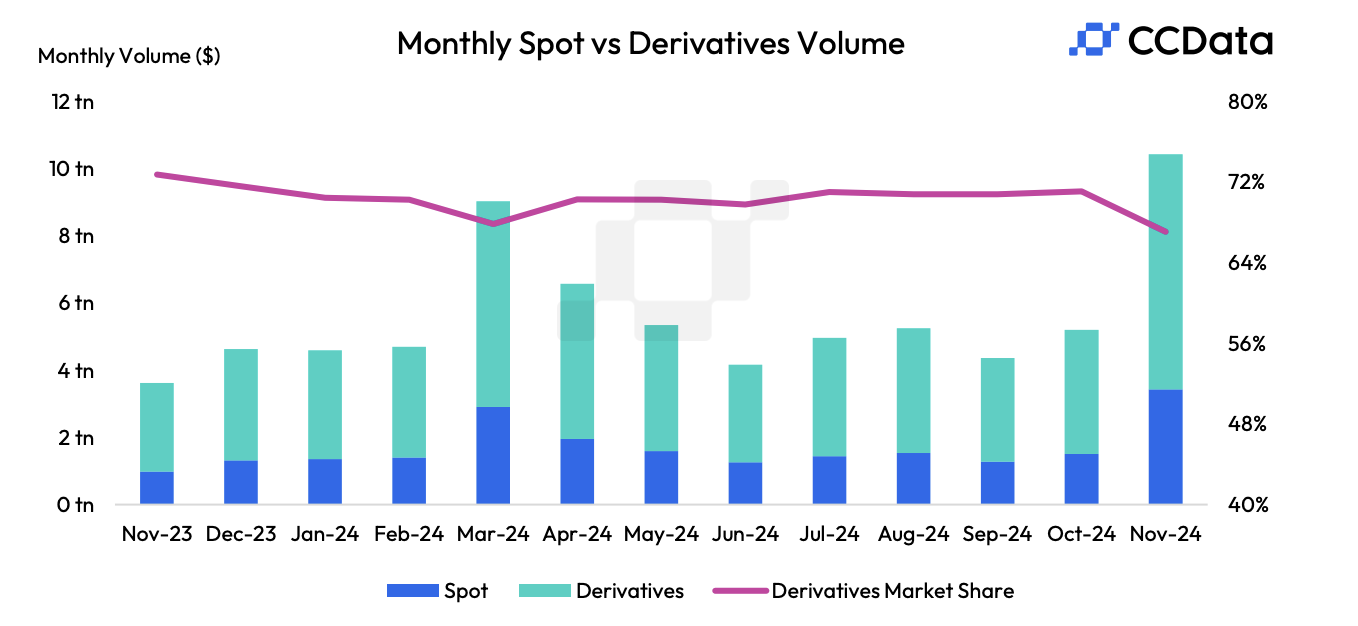

Derivatives trading played a huge role in this increase, representing a majority of centralized exchange traffic.

CCData Exchange Report

The report analyzed trading data on centralized exchanges and identified several intriguing trends in this growth pattern. For one thing, Donald Trump’s electoral victory played a key role as the industry awaits a friendlier regulatory environment. Jacob Joseph, senior research analyst at CCData, spoke with Bloomberg about this trend:

“This sentiment is evident in the increased appetite for assets like Ripple, which has historically faced heightened regulatory scrutiny. Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month, Joseph claimed.

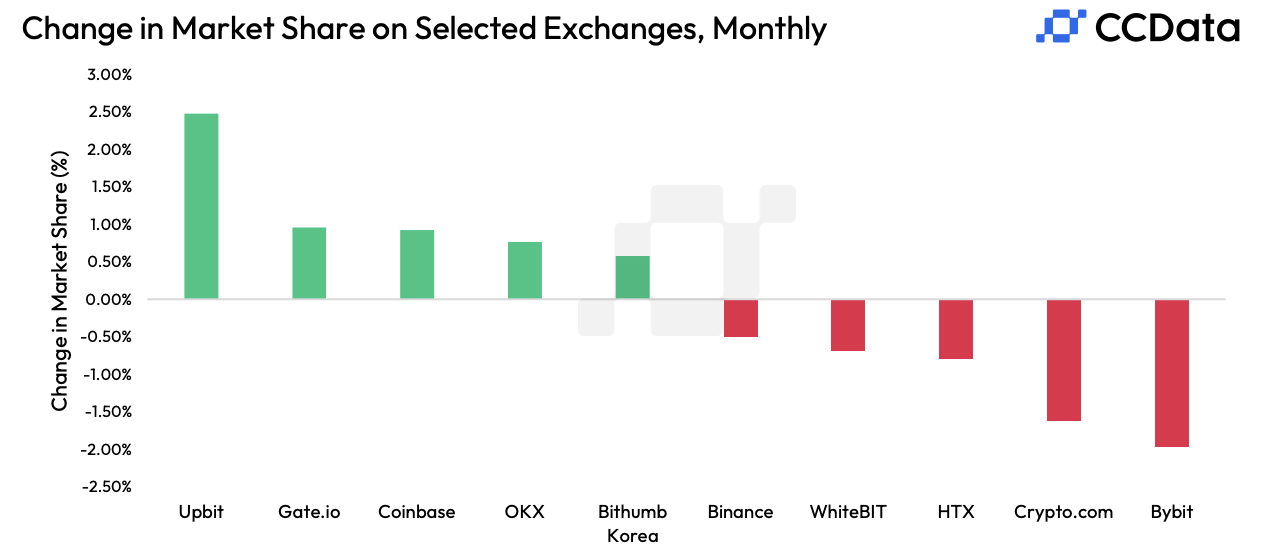

However, the firm was clear that this growth was not localized to US-based companies. In fact, CCData claimed the fastest-growing exchange was Upbit in South Korea, which saw monthly spot trading surge by 358%. Amazingly, these gains took place despite South Korean regulators accusing Upbit of 600,000 KYC violations.

Exchanges’ Market Share in November. Source:

CCData

Exchanges’ Market Share in November. Source:

CCData

Crypto options trading also greatly increased, contributing to these overall gains. CCData claimed that options volumes on the Chicago Mercantile Exchange (CME) hit an all-time high, with $5.54 billion in Bitcoin options alone.

That represents a 152% rise, and other assets showed similar growth. Derivatives trades, in fact, represented the majority of overall volume.

November Derivatives Volume. Source:

CCData

November Derivatives Volume. Source:

CCData

The OCC approved Bitcoin ETF options trading in November, likely encouraging other options trading. CCData only looked at direct crypto traffic through centralized exchanges, so ETF volumes are not included in their data. However, these options nonetheless generated huge volumes, with BlackRock surpassing $425 million on the first day.

Altogether, the combined spot and derivatives trading volume on centralized exchanges rose more than 100% from October to November. The final total, by CCData’s reckoning, was $10.4 trillion. This impressive milestone helps contextualize the massive bull market in the crypto space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Surges Past $200, Signals Major Price Rally

Western Union Explores Stablecoin Integration Potential

Consensys to Lay Off 7% of Workforce Amid Restructuring

ETH Profit-Taking Evident at $2,520, Market Resilient