Bitcoin Options Traders Hedge Against Potential Declines Following $100,000

Traders turn to Bitcoin options to hedge as prices surpass $100K, with rising demand for puts and cautious signals from market indicators like RSI.

Bitcoin’s surge past $100,000 has prompted some options traders to hedge against potential losses. The demand for put options, which allow holders to sell at a specified price within a set timeframe, has risen.

This signals a cautious sentiment despite the cryptocurrency’s recent rally.

Demand for Hedging Bitcoin Options Has Increased over 24 Hours

Data from Coinglass that put options with strike prices of $95,000 and $100,000 have recorded the highest open interest in the past 24 hours.

Additionally, demand for lower strike prices, including $75,000 and $70,000, has also increased. These positions are largely concentrated around early 2025 expirations.

However, on the Bitcoin options exchange Deibiti, the total open interest on puts remains significantly lower than that of calls expiring within the same period.

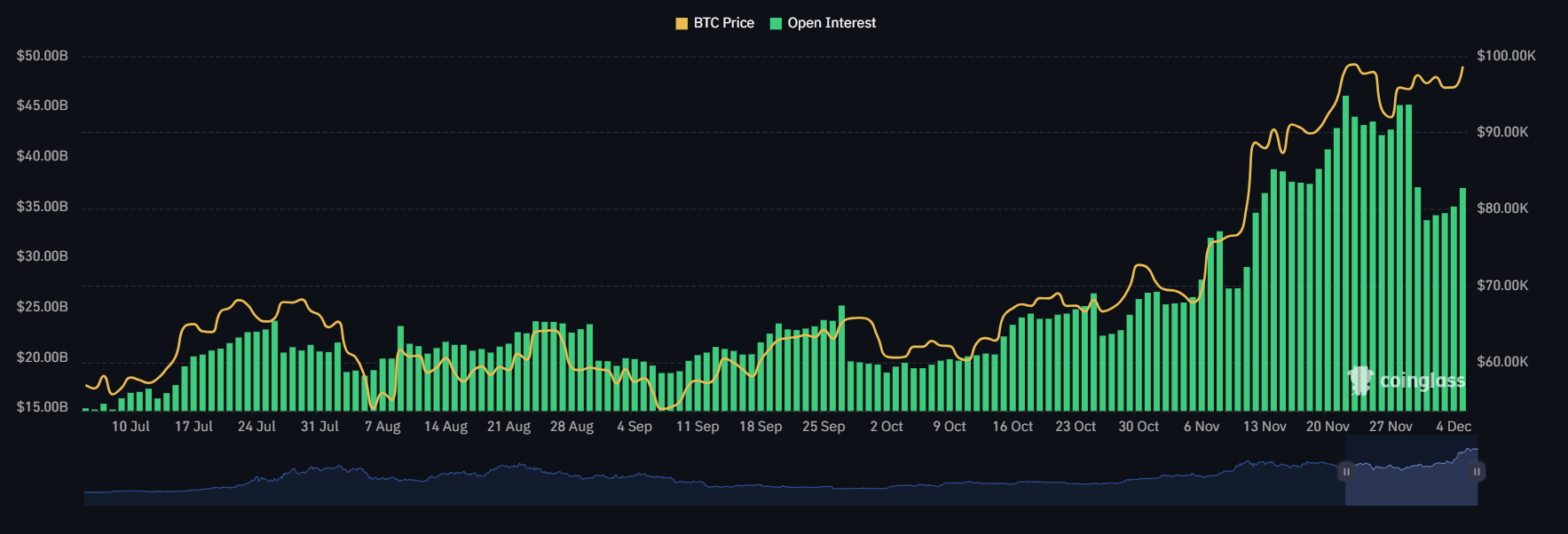

Total Bitcoin Options Open Interest from July to December 2024. Source: Coinglass

Total Bitcoin Options Open Interest from July to December 2024. Source: Coinglass

Bitcoin’s historic surge to $100,000 occurred late Wednesday, fueled by optimism surrounding President-elect Donald Trump’s appointment of a pro-crypto SEC chair and Putin’s endorsement of the cryptocurrency. The rally adds to the nearly 50% surge Bitcoin has experienced since the election, and record inflows in Bitcoin ETFs.

Meanwhile, leveraged bullish positions have also surged as traders capitalize on Bitcoin’s momentum. The funding rate, a critical metric for measuring leverage in the crypto market, is nearing an all-time high.

This rate reflects the premiums traders are willing to pay for perpetual futures contracts, a popular mechanism for amplifying directional bets on Bitcoin prices.

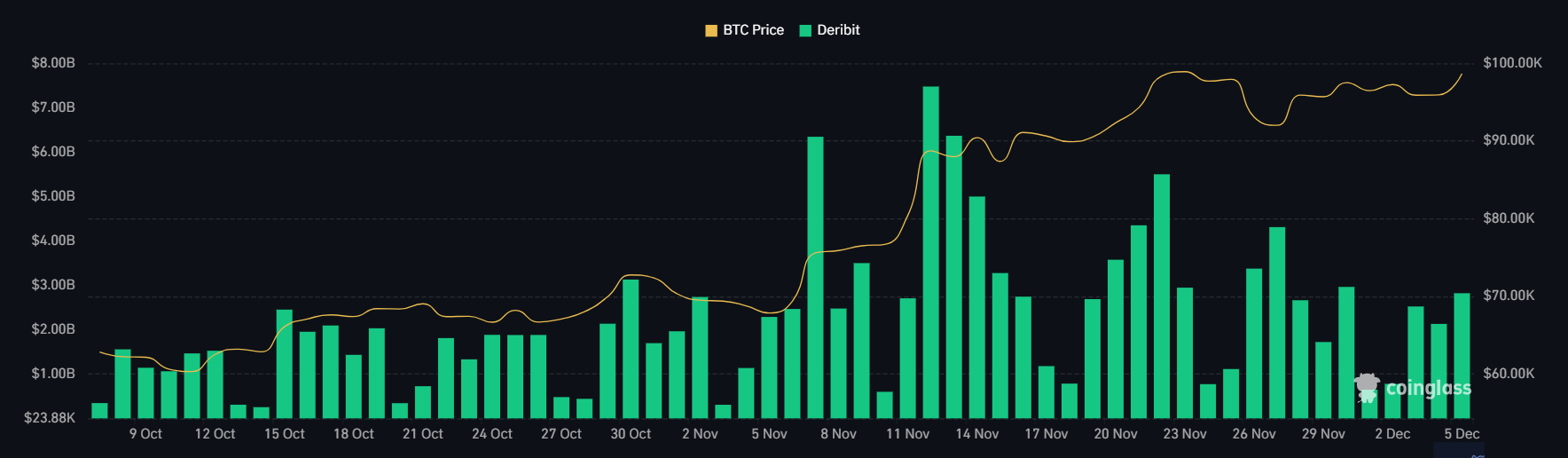

Bitcoin Options Trading Volume on Deribit. Source:

Coinglass

Bitcoin Options Trading Volume on Deribit. Source:

Coinglass

A Short-Term Pullback?

Historically, increased funding rates have often preceded market corrections. Bitcoin has already shown signs of softening. Prices have dipped 3% over the past hour to trade above $98,000. This pattern mirrors previous bull cycles, where sharp gains were followed by periods of consolidation or pullbacks.

At the same time, Bitcoin’s Relative Strength Index (RSI) has dropped to 53. RSI is a momentum indicator that measures the speed and magnitude of price movements.

Bitcoin Price and RSI Chart. Source:

TradingView

Bitcoin Price and RSI Chart. Source:

TradingView

A reading of 53 indicates a neutral position, suggesting that Bitcoin is neither overbought (above 70) nor oversold (below 30) at the moment. This level reflects balanced market sentiment, with no strong bias toward buying or selling pressure.

Depending on other market factors, traders might interpret this as a pause in momentum, signaling potential sideways movement or an uncertain direction in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — ERA/USDT!

Launchpool - Unique ERA Event: Stake BTC ETH for a Chance to Win a 10% APR Boost

Bitget to support loan and margin functions for select assets in unified account

ERAUSDT now launched for futures trading and trading bots