Bitcoin slightly declines while altcoins crash. Is the bull market still on?

The number of liquidations has exceeded the "312 crash."

Author: 1912212.eth, Foresight News

Bitcoin has not stabilized as expected after breaking the $100,000 mark. Around 11 PM yesterday, it briefly surpassed $100,000 before declining sharply, dipping to around $94,150 by 5 AM today, and has since slightly rebounded to around $96,000.

Although Bitcoin has not experienced a significant drop, the outlook for Ethereum is not optimistic. This morning at around 7 AM, it fell from $4,000 to a low of around $3,500 before slightly rebounding to around $3,700, with a daily drop of over 5%. With Ethereum's instability, other altcoins have also shown signs of weakness.

In the 24-hour decline, the public chain sector saw SOL drop over 8%, SUI over 12%, APT over 16%, SEI over 16%, and in the AI sector, WLD dropped over 19%, ARKM over 20%, and IO over 12%. In the L2 sector, OP dropped over 14%, and ARB over 17%.

The contract data is grim. According to Coinglass data, $1.725 billion was liquidated across the network in the past 24 hours, with $1.557 billion in long positions liquidated, affecting approximately 574,168 people, with the largest liquidation occurring on Binance's ETH/USDT, valued at $16.69 million.

If we consider only the number of liquidations, today's figures even exceed the 100,000 people liquidated during the "312 crash."

The market is in turmoil; what is the cause of the sharp decline?

There is a lot of leverage in the market

The market is heavily leveraged. As early as December 6, Galaxy Digital CEO Mike Novogratz, in a recent CNBC interview (commenting on BTC breaking $100,000), stated that a global Bitcoin buying frenzy is underway, marking it as one of the first global assets. He warned that there is a lot of leverage in the system, and he is confident that there will be one or two sharp corrections that will "test your soul," and this leverage will ultimately be cleared out.

Since Trump's election victory on November 5, Bitcoin futures open interest has surged significantly, rising from $39 billion on November 5 to $60 billion in early December, with trading activity and market speculation increasing wildly.

Take South Korea, known for its speculative trading, as an example. Last month, CryptoQuant data showed that the monthly total trading volume of stablecoins on the top five CEXs in South Korea—Upbit, Bithumb, Coinone, Korbit, and GOPAX—was approximately 16.17 trillion KRW ($11.5 billion). This figure includes the total trading volume of stablecoins such as Tether (USDT) and USDC issued by Circle, and it has increased sevenfold compared to about 2 trillion KRW recorded at the beginning of the year. This also marks the first time that South Korea's monthly stablecoin trading volume has exceeded 10 trillion KRW.

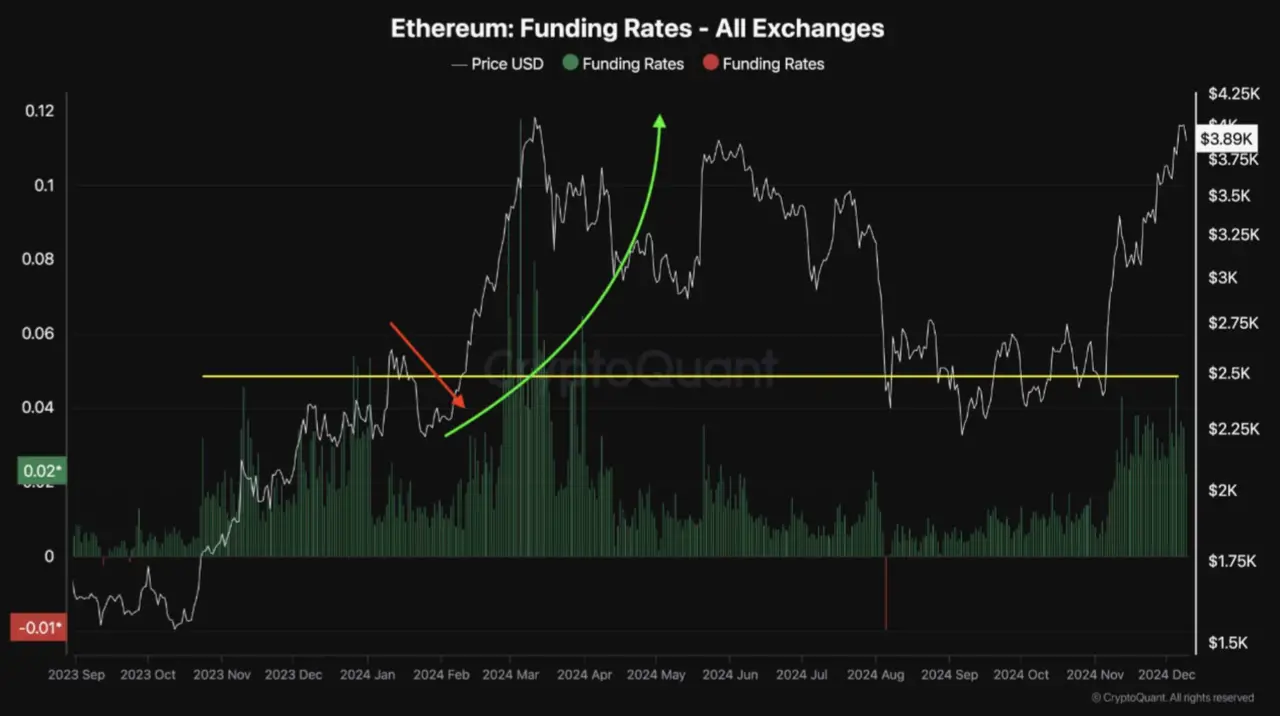

Yesterday, charts from CryptoQuant analyst ShayanBTC also indicated that the Ethereum funding rate indicator in the futures market has surged to its highest level in months, with traders generally expecting a historical high. However, the market may need to adjust to maintain this momentum.

Recently, various centralized exchanges such as Binance and Bybit have seen annualized rates for borrowing USDT exceed 50% during the altcoin frenzy, indicating that a considerable number of users are leveraging by borrowing USDT through staking. The on-chain lending leader AAVE has seen its USDC deposit annualized rate on the Ethereum network reach as high as 46%, while the USDT deposit rate reached 34%.

As of the time of writing, the annualized rates for stablecoins on exchanges and on-chain lending have returned to normal levels.

Global liquidity is continuously decreasing

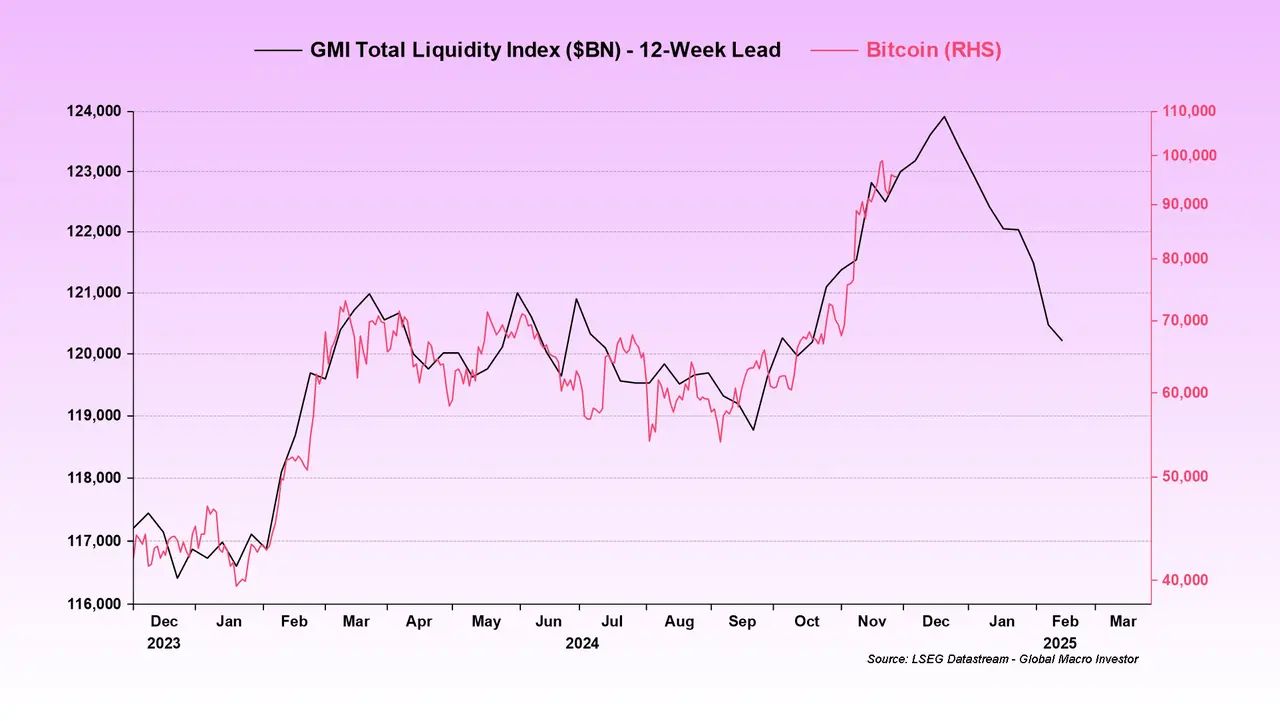

Cryptocurrency assets are increasingly influenced by macroeconomic factors, while the global liquidity that supports their prices is decreasing.

Moreover, many investors believe that the Federal Reserve will continue to cut interest rates, but many institutions predict that the number of rate cuts by the Fed may be limited. Economists at Morgan Stanley expect the Fed to cut rates by 25 basis points in December and January, totaling only two cuts.

The liquidity fuel available in the market is dwindling, making price increases increasingly weak. The chart above shows that the decline has become quite steep, prompting some liquidity analysts to warn of an impending correction.

- In the 2017 cycle, this situation occurred in December 2017, and the bull market ended a month later.

- In the 2021 cycle, this situation occurred again in April 2021, and a month later, altcoins plummeted by 50%.

Weiss Crypto analyst Juan M Villaverde stated in his analysis of this downturn that it may not necessarily be the time to sell, but it serves as a warning that the market is unhealthy, and the final outcome is always a collapse of altcoins. The $100,000 level for Bitcoin is critical; if Bitcoin can break through and stabilize again, the current altcoin rebound will not end prematurely. However, if Bitcoin fails to hold above $100,000, the fate of altcoins is likely to revert to their starting point.

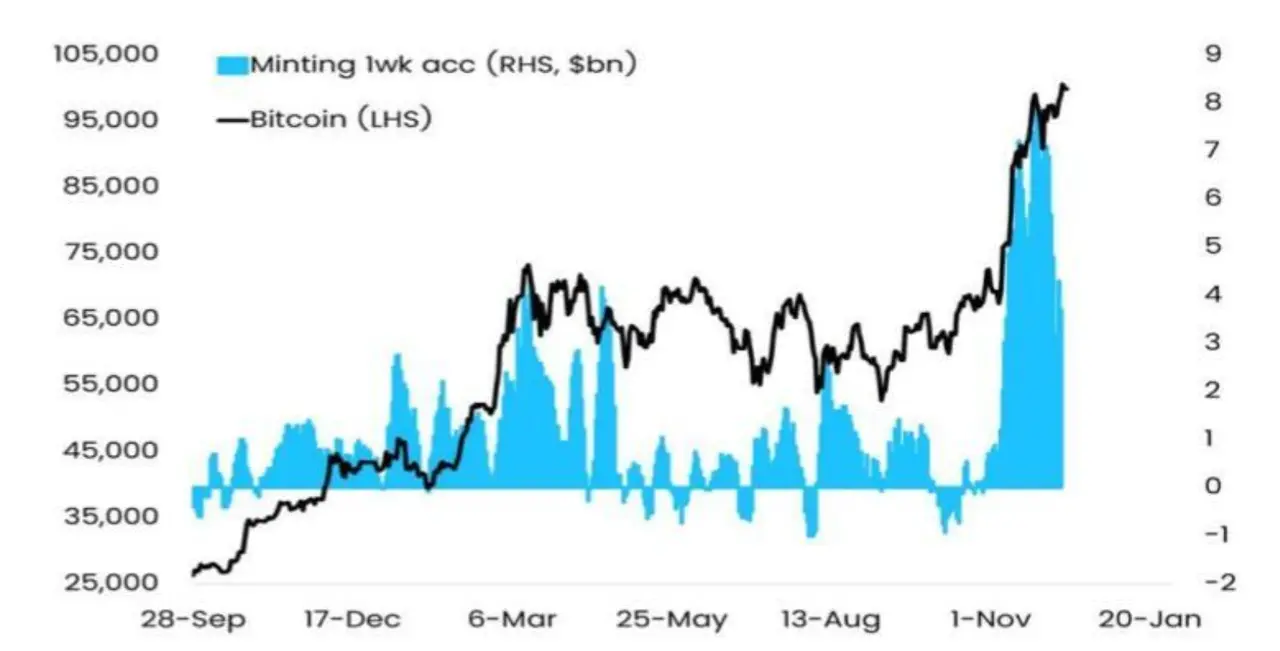

Matrixport's analysis indicates that while stablecoin-related indicators remain at relatively high levels over the past 12 months, the weekly inflow has significantly decreased, dropping from a peak of $8 billion to $4 billion.

This indicator needs to be monitored closely; if inflows continue to decrease, it may indicate that the market will enter a prolonged consolidation period, especially during the typically quiet year-end holiday season. Even if the trend of slowing inflows persists, the outlook for the market in 2025 remains optimistic. Bitcoin prices are expected to rise steadily, but short-term gains may become moderate.

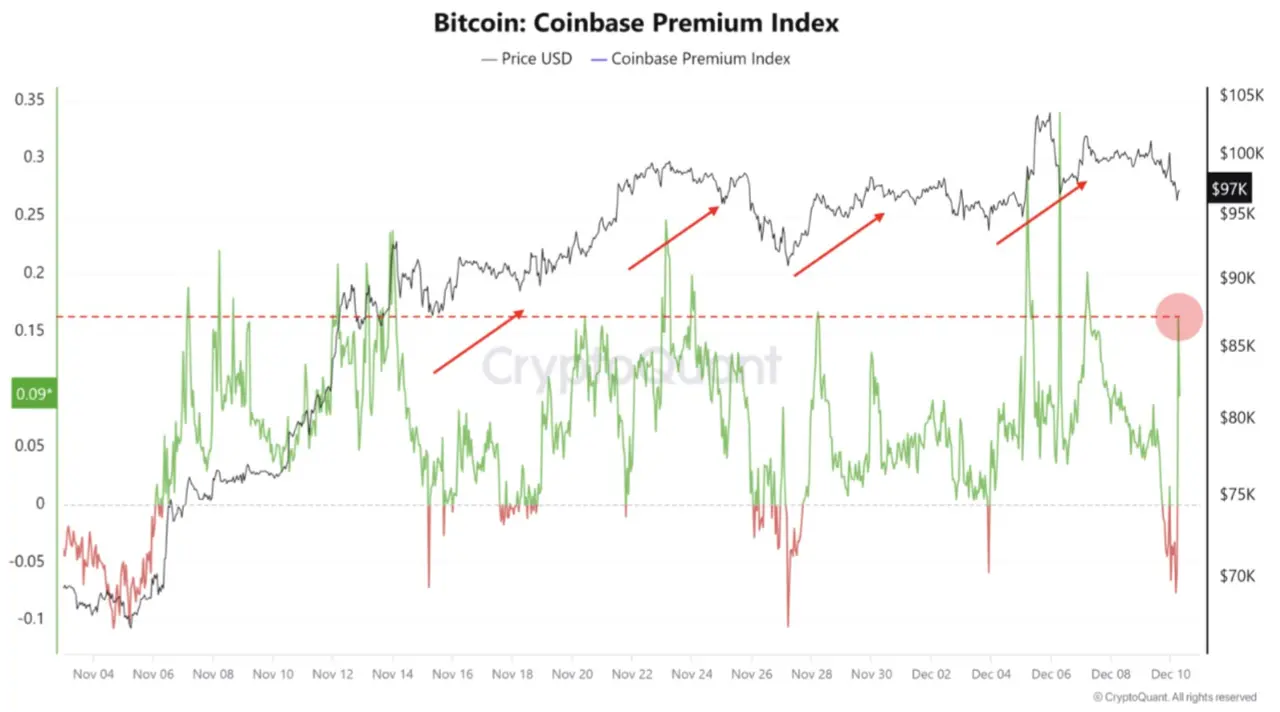

Additionally, according to CryptoQuant data, during the Bitcoin decline, the premium on Coinbase surged.

This rebound typically indicates that when a significant number of small retail investors engage in panic selling, U.S. institutional investors are aggressively buying.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!