SOL Solana price crosses $214.47 per coin, up 2.00% intraday

Solana SOL latest price news, SOL Solana real time price rose 2.00% to $214.47, trading volume $10.976 billion Based on the analysis of the k-chart, it is now in a downtrend. It rose more sharply compared to 18:00, recovered from 15:00 and broke above the 14:00 high. When prices rise and volume falls, it usually means that the market's upward momentum is weakening and the number of buyers is decreasing. This volume-price divergence is usually due to a lack of selling. In this case, prices may retrace or move sideways in the future. Due to the lack of volume support, price rises are unsustainable and one needs to be wary of the risk of a pullback from higher levels. Investors should keep an eye on the trading volume to see if it can match the price rise and if there is new buying coming into the market. Market activity is low and momentum is weakening. The Williams Indicator states that there is no overbought or oversold condition. There has been a recent decrease in trading volume, the volume of trades is lower than in the previous hours, the price is rising and the volume of trades is falling: the upward momentum is weakening. As the market's upward momentum is weakening, it is advisable to remain cautious, pay attention to changes in trading volume and wait for the market to stabilise. The above content is for reference only and does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE surpasses 320 dollars

James Wynn: Missed the Shorting Opportunity, Will Wait Until the PUMP Fully Bottoms Out Before Considering Entry

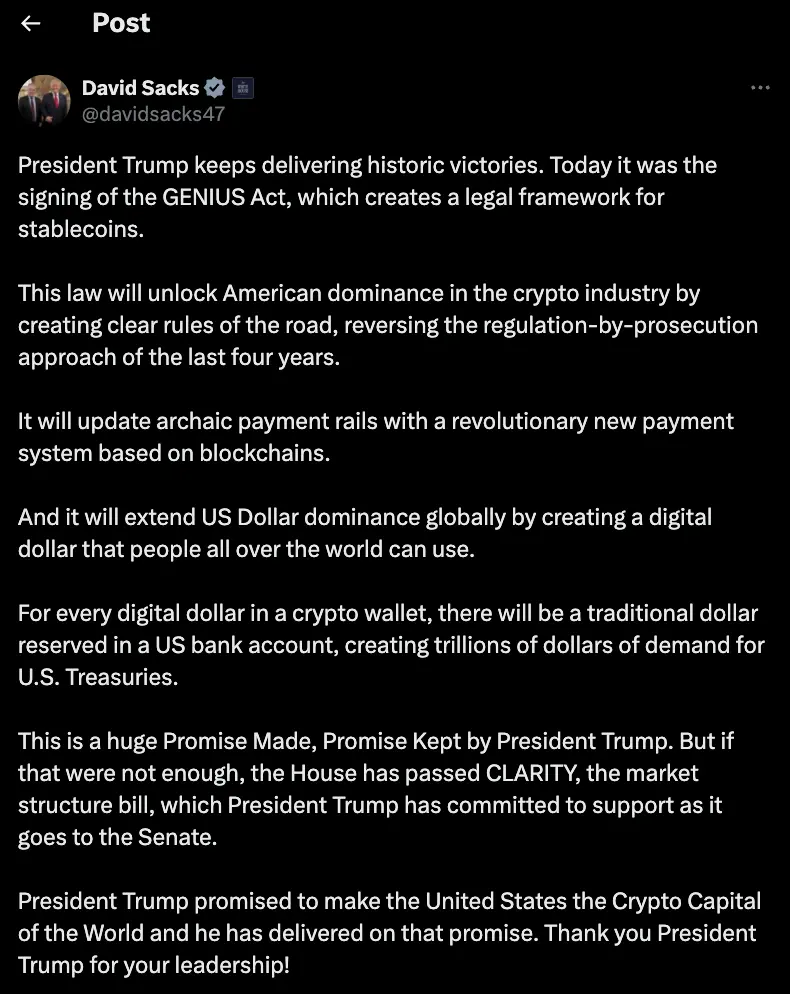

Crypto Czar David Sacks: The GENIUS Act Advances Digital Dollar and Stablecoin Legislation