MicroStrategy to Enter Nasdaq 100 This Month, Claim ETF Analysts

MicroStrategy may join the Nasdaq 100 this month, driven by its Bitcoin investments. Analysts see a clear path unless reclassified as a finance firm.

According to Eric Balchunas and James Seyffart, two respected ETF analysts, MicroStrategy may soon enter the Nasdaq 100. MicroStrategy is still classified as a tech stock, circumventing the restriction that finance companies are ineligible.

If this prediction comes true, it will take place this Friday for a listing on December 23.

MicroStrategy on Nasdaq 100?

Balchunas first declared this prediction via social media post yesterday, claiming that MicroStrategy would replace Moderna, a COVID-19 vaccine manufacturer.

Driven by its consecutive Bitcoin purchases, MicroStrategy’s stock price has been surging, and it has recently become one of the top 100 publicly traded US companies. However, NASDAQ must approve it to put it on the list.

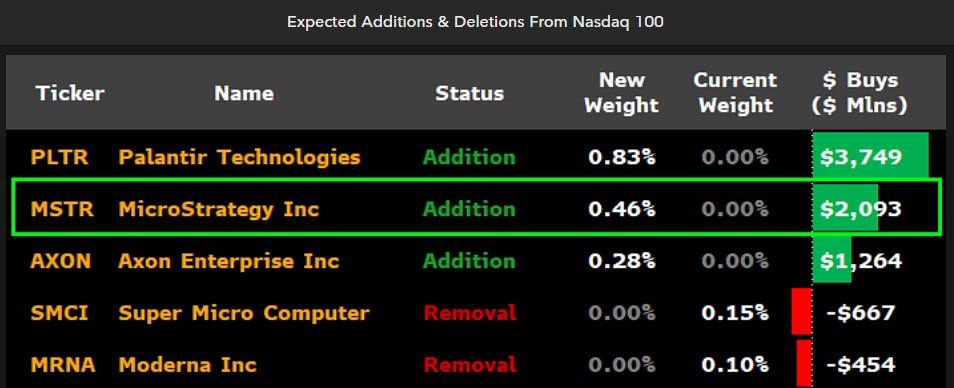

Expected Additions to Nasdaq 100. Source:

Eric Balchunas

Expected Additions to Nasdaq 100. Source:

Eric Balchunas

As a publicly traded company, Nasdaq has made limited entries to the crypto industry in recent years. Last year, the SEC halted its plans to launch a crypto custody business, and the exchange hasn’t publicly discussed restarting them.

In August, it did facilitate BlackRock’s efforts to get options trading on its Ethereum ETF. Beyond that, however, Nasdaq has been quiet on the crypto front.

Meanwhile, James Seyffart concurred with Balchunas’ opinions via another post. He pointed out that Nasdaq does not permit finance companies to be on its list, and MicroStrategy may technically qualify.

The company’s fate is inexorably tied to Bitcoin’s performance, and thus, it is arguably a finance company. However, it’s currently listed as a tech stock, and it can’t be reassessed until March.

“Here are the dates for ICB [Industry Classification Benchmark] reclassification. So unless they’ve already started the process of reclassifying MicroStrategy as a financials stock… we think it should be in. That said — this is the primary risk for not getting included in my opinion,” Seyffart claimed.

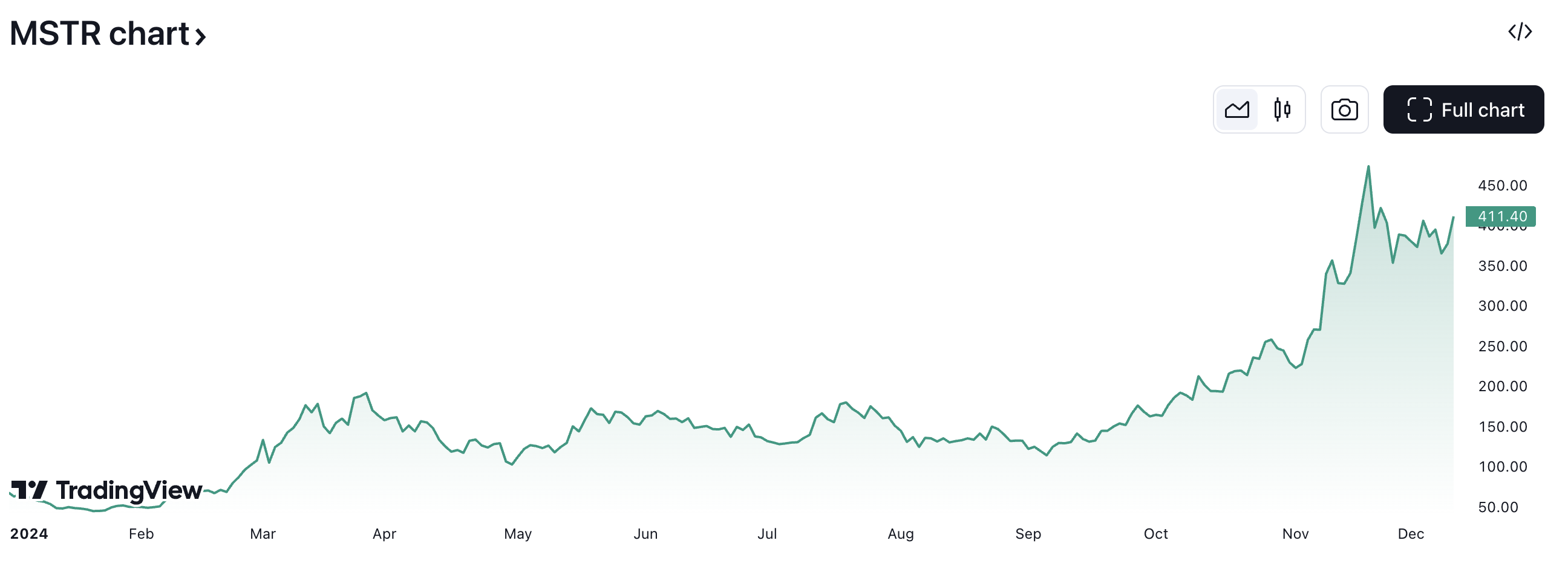

Indeed, MicroStrategy is one of the world’s largest Bitcoin whales, but the firm started as a tech company. Even though it routinely invests huge amounts of capital into Bitcoin, which contributed primarily to its 500% stock market growth this year, MicroStrategy is still a tech stock in Nasdaq’s consideration.

MicroStrategy (MSTR) YTD Stock Performance. Source:

TradingView

MicroStrategy (MSTR) YTD Stock Performance. Source:

TradingView

Ultimately, this is only a prediction, albeit one from two seasoned ETF analysts. In any event, there are important deadlines to consider. If MicroStrategy is entering the Nasdaq 100, the announcement will come by the end of the week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — ERA/USDT!

Launchpool - Unique ERA Event: Stake BTC ETH for a Chance to Win a 10% APR Boost

Bitget to support loan and margin functions for select assets in unified account

ERAUSDT now launched for futures trading and trading bots