-

HBAR experienced an 8% price surge despite a noteworthy 21% drop in trading volume, indicating a potential bearish divergence.

-

The current negative sentiment and declining momentum suggest a significant risk of a further downtrend, with the $0.25 support level being critical.

-

If market sentiment shifts positively, HBAR may reclaim the $0.39 level; however, bearish pressures continue to dominate.

HBAR rises 8% amidst declining trading volume, highlighting bearish risks, low market confidence, and critical support levels as future price keys.

Hedera’s Price Dynamics: A Closer Look at Market Sentiment

Despite a recent 8% uptick, the price movement of the Hedera token (HBAR) has been characterized by significant caution due to concurrent trading volume losses. This divergence is often interpreted as a lack of genuine market support for the price increase.

The recent market behavior indicates that while HBAR’s price recovers, it does so on the heels of speculation rather than robust demand, raising concerns over its sustainability.

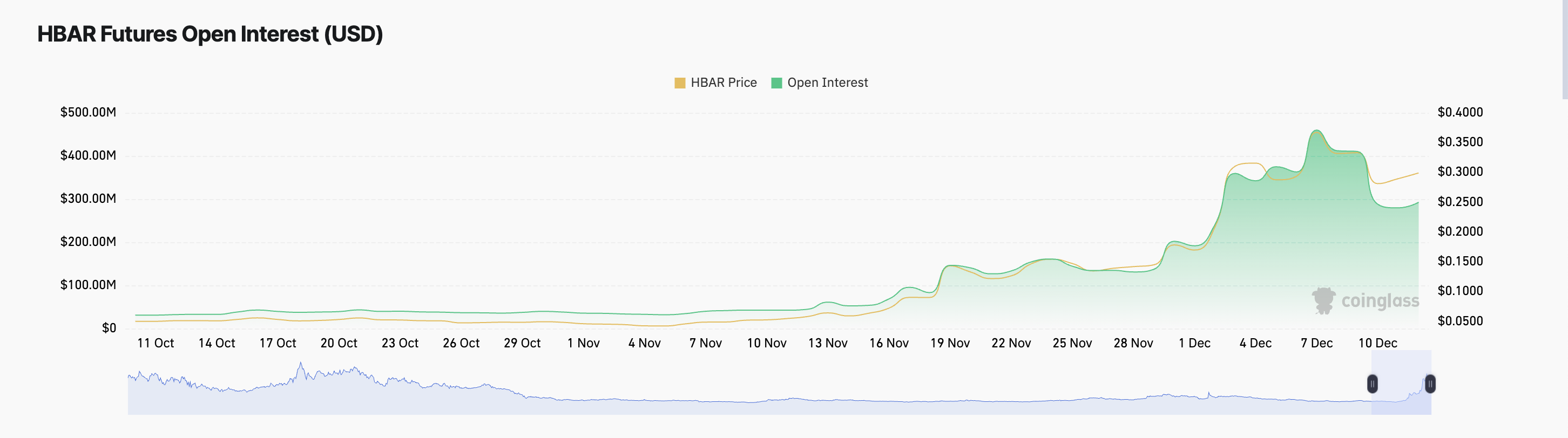

The pronounced drop in open interest within the derivatives market underscores dwindling investor interest, sitting at just $292 million — a drastic 38% drop seen over the past week. This decline in open interest is suggestive of a cautious market atmosphere where investors are either liquidating positions or refraining from new investments.

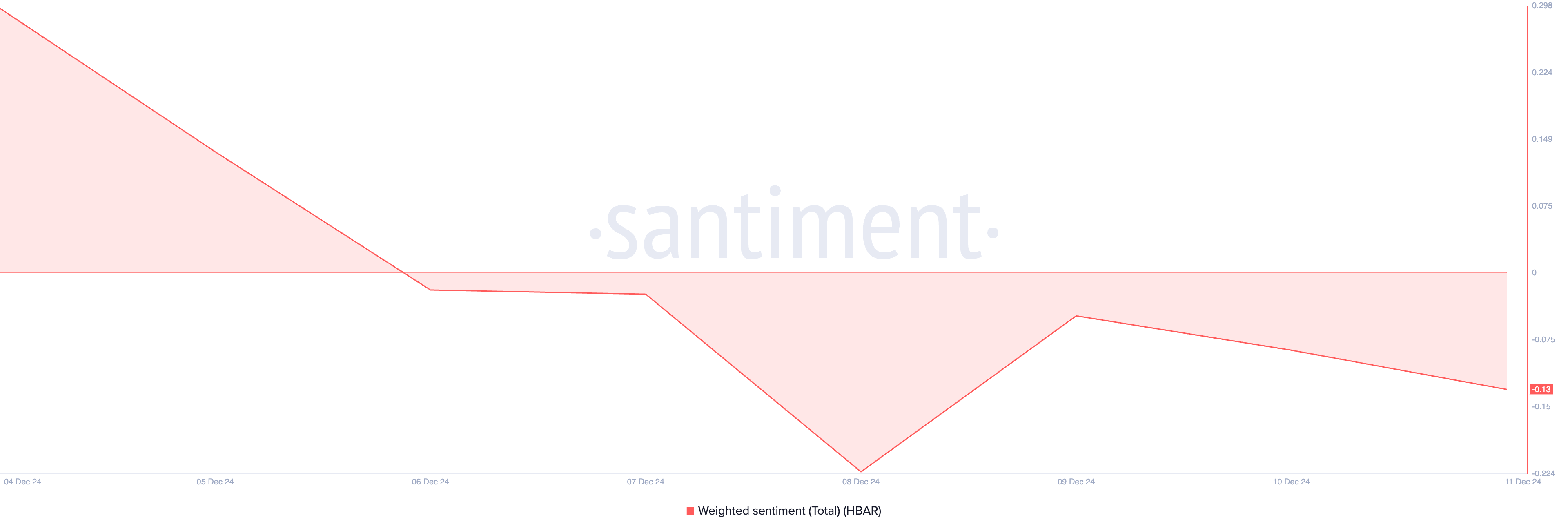

The overall market sentiment towards HBAR remains cautious. The weighted sentiment metric reported by Santiment confirms persistent negative sentiment since the token hit its three-year high on December 4, currently standing at -0.13. This data reflects a largely negative discourse surrounding HBAR across social media platforms, indicating growing skepticism among potential investors.

Anticipating HBAR Price Movements: Key Levels to Monitor

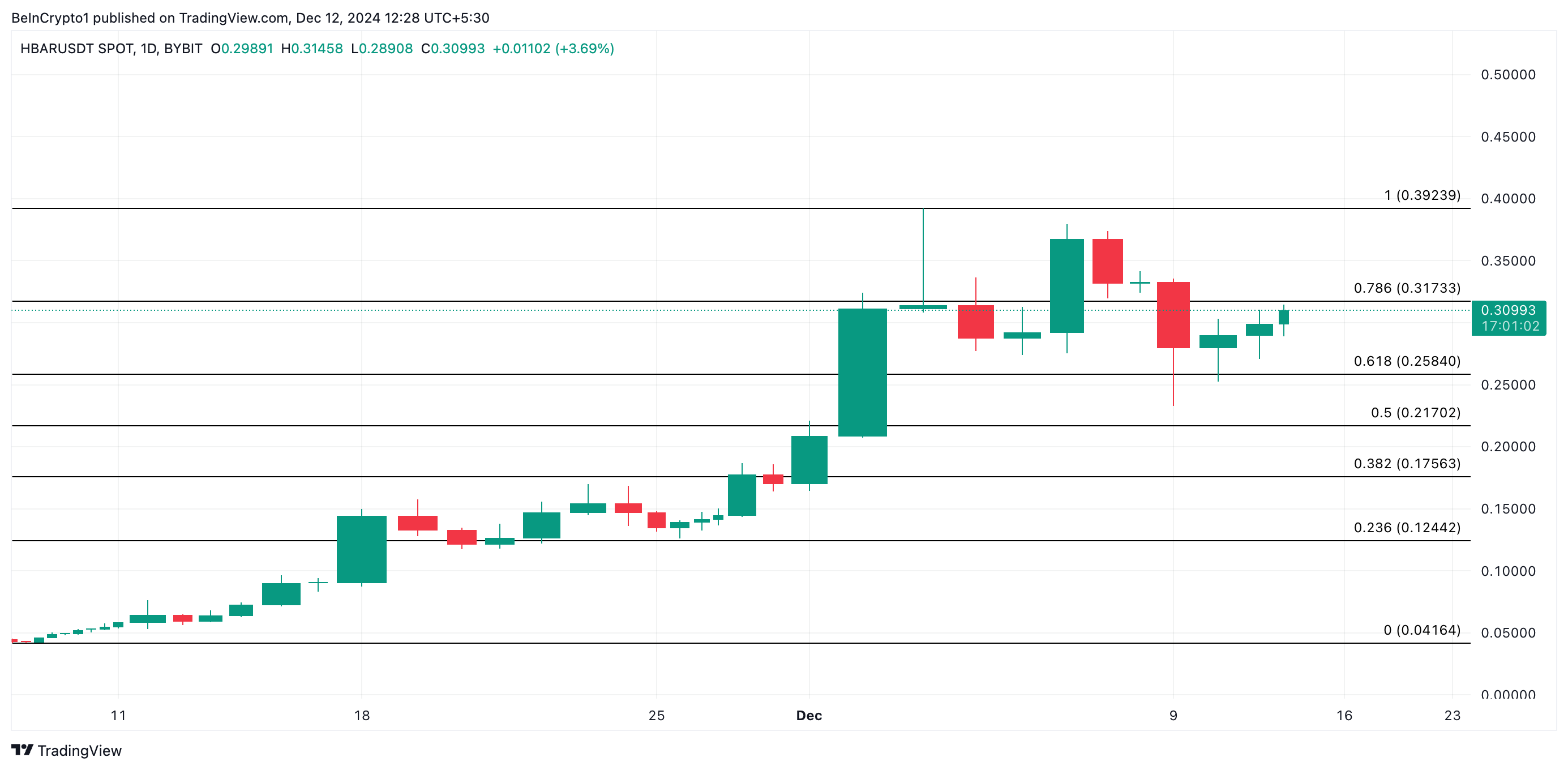

Technical indicators from the HBAR/USD one-day chart provide a bearish outlook, with the Awesome Oscillator displaying consistent red bars for the past five days. This technical indicator is widely used to analyze momentum, and red histogram bars signify dwindling bullish momentum, indicating increasing bearish pressures.

At $0.30, HBAR risks sliding down to the critical support level of $0.25 if the downtrend persists.

Conversely, should market sentiment shift, there’s potential for HBAR to breach the $0.31 resistance level, paving the way for a possible return to its previous three-year high of $0.39. Market watchers will need to stay vigilant to gauge changes in investor sentiment and trading activity that could influence future price trends.

Conclusion

The recent 8% price increase in HBAR comes amid significant trading volume reductions and negative market sentiment, which casts a shadow on its sustainability. Investors are advised to monitor the $0.25 support level closely and watch for signs of a shift in market attitude. The dynamics of the cryptocurrency market are volatile, and with a detailed understanding of these factors, stakeholders can make informed decisions moving forward.